A multi-faceted region offering exposure to innovation and growth

In the last two decades, Asia has become a powerhouse of global growth. Demographics and digitalisation are fuelling a boom economy that’s expected to continue for decades to come. However, this complex and dynamic collection of markets also brings the challenges and opportunities of volatility. An active allocation to Asian equities offers the potential to harness this growth and seek resilient, risk-adjusted returns as the growth story of this region unfolds.

How demographics and technology are driving growth

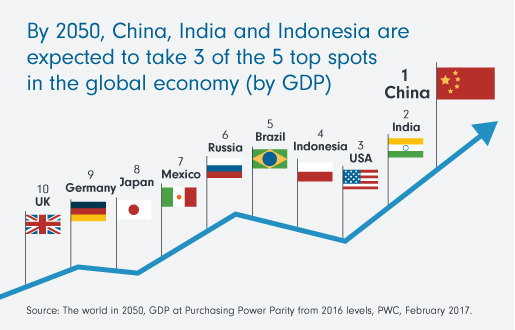

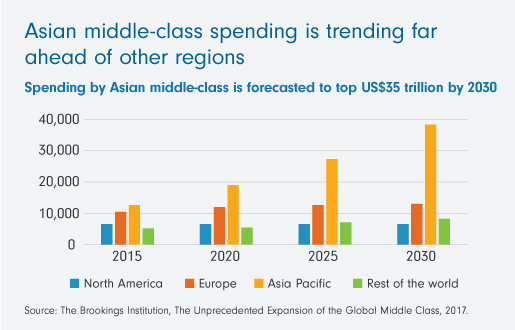

With more and more people being lifted out of poverty, income levels across Asia are also increasing. This rise in the middle-class population is expected drive significant demand for goods and services in the region during the next three decades.

As a region at the forefront of the technology industry, the digital revolution has brought even greater momentum to Asian economies. In the last 20 years, technology innovation has accounted for nearly a third of Asia’s per capita growth1. For investors, the Asian technology sector can be an excellent way to capture returns coming from growth in consumption. It can also work well as a defensive portfolio allocation at a time when wider global equities markets appear to be reaching their peak.

Are investors missing out on Asia?

In spite of the strong economic and demographic trends we’re seeing in this region, Asian companies are underrepresented in global equity indices. In the MSCI AW Index, for example, Asian stocks make up just 10.2% of the index4. When you consider that indices like this are used as benchmarks, many investors can expect to be underweight in their allocation to Asian equities.

The Asian investment universe

In the last twenty years, we’ve seen a dramatic shift towards emerging economies in the Asian region. China and South Korea have taken over the top two slots in the MSCI AC Asia ex Japan index. These two countries now make up more than half the index, compared with a modest 5% share back in 19985.

An ever-changing economic landscape

At the stock and sector level, we’ve also seen the rise of emerging economies, with Chinese internet giants Baidu, Alibaba and Tencent snapping at the heels of their FAANG (Facebook, Apple, Alphabet, Netflix, Google) counterparts in the US. But these large cap players are just a part of the tech enterprise movement in Asia. There has been a recent surge in new digital businesses that don’t yet feature in broad market indices. Investors looking to capitalise on tech innovation and growth in the region need to look beyond established stocks and indices.

Four of the MSCI AC Asia ex Japan top ten holdings come from the financial sector, which speaks to the importance of this industry in the Asia growth story. With only one developed country (Hong Kong) currently represented in the top ten, we see a region continuing to evolve as a diverse collection of economies and industries with much to offer investors.

While this view may present investors with potential for higher growth, volatility in the region can be expected to continue. Greater diversification and strong fundamentals in selected stocks are essential to positioning portfolios to ride out ups and downs in the region, and the global economy overall.

The active advantage for risk and return

The Fidelity Asia Fund holds a concentrated high conviction portfolio of 20-35 companies across Asia. Portfolio Manager Anthony Srom is backed by a 400 strong team of investment professionals worldwide. Together they explore the whole Asian equities universe to find the best ideas to include in the Fund.

As well as applying disciplined analysis to picking these best ideas, the portfolio is carefully weighted for diversification across countries, sectors and companies. This further supports our goal of delivering sustained returns and managing downside risk for investors.

Recommended as a long-term holding, we aim to outperform the benchmark over a five to seven-year timeframe.

1 IMF Data, The Digital Revolution in Asia, April 2019. 2 The Brookings Institution, The Unprecedented Expansion of the Global Middle Class, 2017. 3 Fidelity International/MSCI All Worlds Index, 30 June 2019. 4 MSCI, Bloomberg, Fidelity International, June 2019. MCSI AC Asia ex Japan Index (MXASJ Index) geographical composition. 1998 data as of 30 June 1998, 2018 data MSCI fact sheets for June 2019.