August 2016

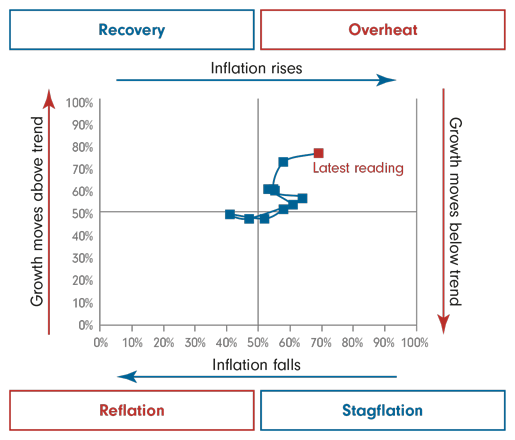

The investment clock has recorded a fifth consecutive reading in the overheat quadrant, where equities do well, as rising business confidence in Europe and good jobs numbers in the US have boosted growth readings while our inflation leading indicator is rising on sniffs of inflation in the eurozone and Japan.

As the UK vote to quit the EU is showing little disruption outside the UK, steady readings on global growth and low government bond yields are already boosting equities towards record highs.

But we have sold equities into the rally because we think the latest spurt in prices is driven by an unsustainable mix of better growth reading and excessively low bond yields, which leaves the asset class vulnerable to a correction. We are now underweight the asset class.

The better economic backdrop and improved supply-demand dynamics support commodities and it is our largest overweight position at the asset-class level. We are roughly neutral bonds although we are slightly underweight global bonds because the Federal Reserve is likely to resume rate increases later this year.

Within equities, our largest sector position is an overweight to energy because supply is falling. The sector is particularly attractive relative to materials, which have similar economic drivers but face headwinds from excess capacity in metal production.

Latest investment clock readings

Past months can be subject to revisions.

The investment clock approach generates growth and inflation readings based on past trends and current momentum of lead indicators, to help forecast how the global economy may perform in the coming three to six months. The growth reading sets the relative weighting of cyclical and defensive assets (north-south on the clock diagram). The inflation reading sets the weighting of financial assets versus real assets (east-west).

For advisers only