Investors can implement Environmental, Social and Governance (ESG) considerations into their portfolios in a host of ways, stretching from active ownership to impact investing.

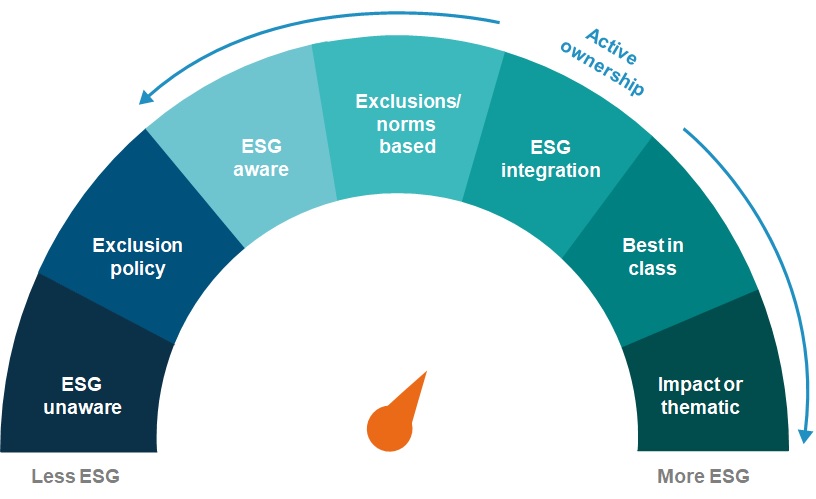

One way to think about the different approaches is as a dial, from ‘less ESG’ to ‘more ESG’.

This is a rough guide and there are gradations within, and overlaps between, categories.

For illustration purposes only. Source: Fidelity International

An overview of ESG terminology

ESG unaware: This is a stage where investors place no positive value on ESG-related issues. They may consider certain risk management or regulatory factors somewhat relevant to ESG, such as the potential for environmental litigation, however this is based on avoiding loss, rather than the positive shareholder benefits of incorporating ESG into investment decisions.

Exclusion policy: This excludes investment sectors that are contrary to the investor’s ESG specific criteria, such as avoiding weapons or tobacco stocks, or investments in countries with poor human rights records. Outside of these excluded categories, investors apply a standard investment approach.

Active ownership: Investors seek to influence companies on many different levels, so this includes a broad spectrum of interaction with company boards and straddles many categories.

- Investors can take an engagement approach, where they monitor the ESG performance of companies and engage in constructive shareholder dialogues to ensure progress.

- A consulting approach is a form of engagement where larger institutional investors and shareholders are able to pursue ‘quiet diplomacy’, attempting to influence the company through regular meetings with top management, exchanging information and developing a trusted adviser relationship.

- Activism is the most aggressive form of engagement. It is a pressure-based technique, involving strategic voting in support of an issue or to bring about governance changes. This approach can be pursued publicly to apply more force. Increasingly, we are seeing investors use activist methods for environmental and social-related issues, rather than purely governance.

ESG aware: Investors recognise the positive contribution that ESG considerations can make to investment outcomes. This is a broad category and there are varying degrees of the incorporation of ESG elements into investment decisions.

Exclusion / norms based: This is a more comprehensive type of negative screening that excludes investments in companies that do not meet widely-accepted norms, such as the United Nations (UN) Global Impact principles, Kyoto Protocol, or the UN Declaration of Human Rights.

ESG integration: The consistent fundamental analysis of environmental and social issues, in order to identify additional sources of risk and opportunity, and deliver better overall investment decision-making. Statistical methods can also be used to establish a predictive correlation between the sustainability aspects of a company’s performance and financial factors.

Best-in-class: Investors actively select companies to invest in based on a set of ESG criteria or choosing from a sub-set of the best practitioners in a sector. In practice, this can involve ranking the potential investment population by the criteria, then selecting the best performers from each characteristic, or picking several investments that feature in the top group of the ranking.

Impact or thematic: This refers to investments made with the intention to generate measurable and beneficial social or environmental impacts alongside a financial return. This differs from traditional philanthropy, as it intends to earn a financial return. It often follows themes such as renewable energy, water treatment or education provision.

Integrating ESG into your investing

These approaches to ESG demonstrate what a broad church it is.

One element that binds all these forms together is the careful consideration, by investors, of environmental, social and governance effects on stakeholders. This requires investors to integrate, to some degree, ESG factors into the investment process.

Such integration could take the shape of a separate ESG advisory group informing the investment decision makers, or an ESG function embedded in the investment process.

Either way, ESG investing requires investors to conduct an assessment of relevant risks and opportunities as part of their financial analysis, to allocate capital in a society-conscious way.