As we start to think about summer holidays and Christmas shopping we can look back on another strong year for equity markets. At the end of November, the ASX 200 accumulation index had returned 15% for the 12 months which is ahead of average annual returns assuming there’s no major issues in December. This result has been delivered despite considerable headwinds such as political instability, macroeconomic volatility, increasing government intervention and subdued economic and company earnings growth.

Australian market performance has been driven by an attractive dividend yield (around 4%), low single digit earnings growth and valuation multiple expansion. While market returns are most sustainable when they are coming from earnings growth, I believe there may still be further opportunity for valuation multiple expansion due to low interest rates, strong corporate balance sheets and high quality earnings.

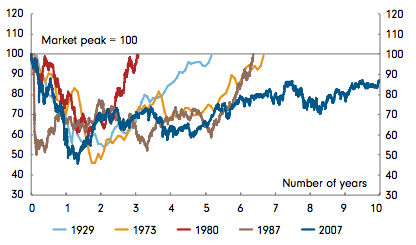

An interesting point to note is that we are only just now starting to get back to where we were in 2007 for the equity capital indices. The chart below highlights all the major market downturns in Australia’s history. The first point to note is that the 2007 downturn with a decline of around 50% was the second largest downturn in Australia’s history, only slightly exceeded by the downturn of 1973. Secondly the current market downturn’s recovery has been the longest, slowest recovery of all the major market downturns. It has normally taken between three to seven years for the capital indices to recover to their previous peak from a market downturn. We’re 10 years in and are only now starting to get close to those levels.

The 2007 downturn was a balance sheet downturn which tends to take longer to recover as balance sheets are repaired but the current cycle really stands out as it is by far the longest and slowest recovery. While it’s been a difficult road, I think this has also helped build a stronger foundation for the current market and it’s important to understand this perspective when looking at the current valuation and attractiveness of the equity market.

The largest declines of the All Ordinaries Index since 1929

Source: IRESS. Thomson Reuters Datastream. Citi Research as at October 2017.

Looking ahead to 2018 many of the headwinds will likely remain but pockets of strengthening economic activity will provide opportunities.

Government intervention in markets such as banks and energy, political instability, macroeconomic volatility and disruptive technologies are all potential areas of concerns. Amazon’s entry into the Australia market for example will likely have a significantly negative impact of on Australian retail companies either through loss of market share or price pressure and lower margins. To date Australian retailers and supermarkets are some of the most profitable in the world but there are some challenges ahead.

On the positive side we’re seeing some good signs coming through for the manufacturing, mining services and infrastructure sectors. Other areas for optimism include technology which we remain overweight and food delivery which is tipped to be one of the strongest long-term growth trends. Australia’s tourism and agriculture sectors should also benefit from China’s move towards domestic consumption.

Overall the Australian equity market remains well positioned as we head into the New Year with attractive dividend yields, good earnings growth and some room for further valuation multiple expansion.

Finally, I’d also like to take this opportunity to wish everyone a very happy and healthy Christmas and holiday season and a prosperous 2018!

Best wishes,

Paul Taylor

Country Head - Equity Investments

Fidelity International