Give us a sense of how China has changed - and the challenges it now faces.

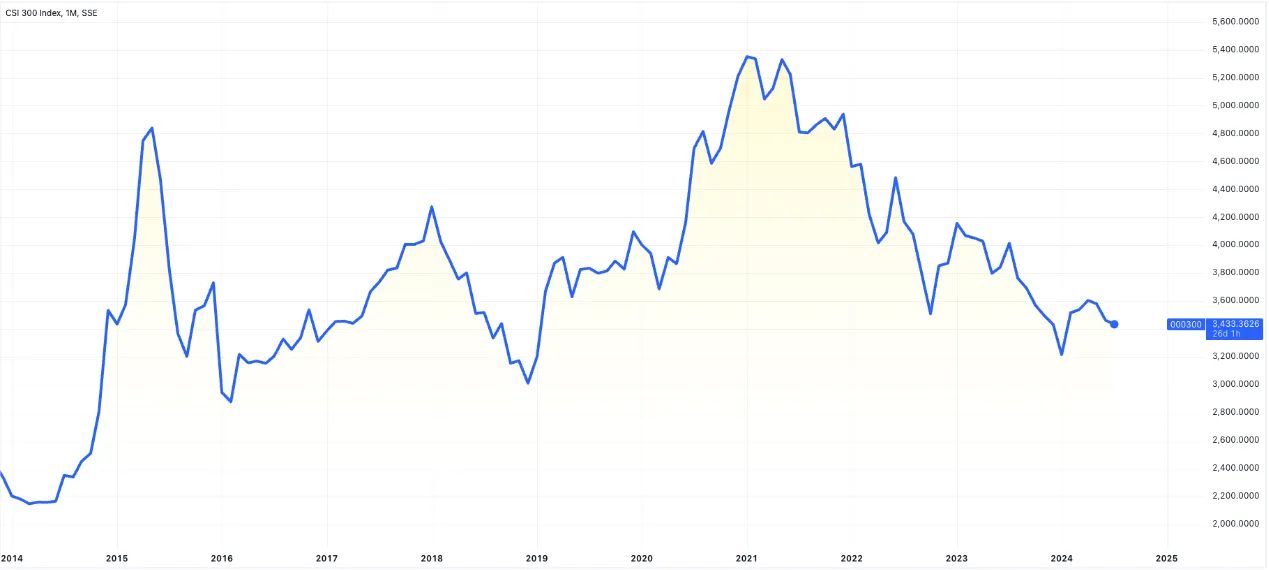

Srom: There are a fair few structural challenges they face. I think if we were to sum it up into why Chinese GDP growth was so strong before that period that you are mentioning. They very much had a machine in place that generated very strong credit growth in China. So foreign direct investment [meant] positive money [was] coming in, trade surplus [meant] money coming into its capital account. So investors like myself who are managing portfolios, money coming in [meant the] PBOC takes that money in US dollars and sterilises it. So basically giving Renminbi to the local companies and then buying US treasuries with those dollars so that the local money supply of Renminbi keeps growing and growing and circulates in what is a relatively closed economy or closed capital account. So you had fantastic price growth in assets in, for example, property, the stock market from time to time, and solid GDP growth. But that machine by and large ceased about eight years ago.

So if you look at the EPS for the Chinese market in Renminbi terms, it's basically been flat for the last eight years. Companies nowadays, it's flat to negative FDI, so money coming out of China, trade surplus is still there. The capital account, I would say is deteriorating. So that machine that was generating a lot of credit growth and GDP growth as a result in China has gone into reverse. And I think that's one of the largest structural challenges they have to deal with besides things like demographics, the debt within the economy, lack of productivity, growth, et cetera.

Are the best days for Chinese stocks behind us?

Srom: Well, I think it's a really interesting question in the sense that stock market returns don't necessarily correlate with GDP growth or returns. No matter how much investors want to focus on that, they're two distinct things. So that's the first thing to bear in mind for the market in China about whether the best days are behind it.

I think what you'll see is a lot of, let's call it, cyclical swings and roundabouts that the business cycle could be sentiment. So there's good money to be made at the individual security selection level in such a market. Do I think it's going to power ahead like India? No, I don't. Are the best days behind it? We'll see. [That's an] open question.

Some investors we speak to say China presents a great "deep value" opportunity while others call it "too hard" or even "uninvestable". Which camp are you in?

Srom: The former, and the reason I say that is it's hard to characterise any market as un-investable. It's always a question of risk versus reward. So from my perspective, what has changed in how you assess China and the companies you're looking at in China. My hurdle rate of return for the fund to invest in a company has gone up. It's not to say it's un-investable, you're not looking, the fund will never buy. No, it's just a question of risk versus reward.

Are there any individual stocks that can stand out from the pack?

Srom: For sure, if you look at one interesting facet of the Chinese market that has emerged in the last quarter, again, just sitting at my desk scouring for ideas, you're seeing stocks and sectors starting to chalk up at valuation multiples that are cheaper than the first quarter of 2020.

If you recall what happened in the first quarter of 2020, COVID hit and markets were crashing. Most people thought the world was going to end, border controls were coming into place not soon after we had the lockdowns. But you've got companies like for example, Galaxy (HK: 0027) casino operator in Macau. Yum China (NYSE: YUMC), which operates the KFC franchise in China. Why are they priced below first quarter 2020 levels? Margins are healthy, growth is there. And there are some slightly different nuances, but from my perspective, it's a question of whether there is something fundamentally wrong. That is, has the industry structure changed, has the company gone off the rails or is it more too much negative sentiment? It's too hard, I don't want to deal with it. I want the baby without the pain. So from where I sit, there's a lot of ideas starting to filter through like that. But again, from a portfolio-level risk management perspective, how much of that do you want?