Significant investment is required to deliver on global climate ambitions. However, a growing funding gap highlights the need for further developments in transition finance. Fidelity International’s Chief Sustainability Officer Jenn-Hui Tan and Associate Director for Sustainable Investing Tina Chang discuss Asia’s transition landscape and potential opportunities.

Key points

- High-emitting industries require additional investment to develop and deploy low-carbon technologies.

- The need for transition investment is particularly acute in Asia, given the region produces 85 per cent of its energy from fossil fuels and accounts for more than half of global carbon emissions.

- The global transition finance gap stands at around US$4 trillion per year.

- To plug that gap, it is vital to have transparent frameworks that ensure funds are being channelled in a way that supports broader net-zero objectives.

- Asia’s regulators are defining transition finance principles that should induce greater transparency.

- Japan, the world’s largest issuer of sovereign transition bonds, has already developed a clear investment framework.

- Fidelity is pursuing a four-pronged engagement strategy to encourage change and stimulate investment.

- Notable progress is being made with companies in high-impact sectors, including palm oil producers and nickel miners.

Until recently, efforts to marshal global capital in the pursuit of a cleaner, fairer world have focused primarily on companies that fall neatly inside the parameters of environmental, social, and governance (ESG) investment.

As a result of those efforts, ESG investing has moved firmly into the mainstream. In the process, it has tended to exclude high-emitting industries like steel, cement, chemicals, or shipping. Increasingly, though, it is acknowledged that these industries need assistance in the form of transition finance to adapt to a low-carbon and low-pollution future.

In Asia, the need for transition finance is particularly acute. Currently, the region is off course in delivering its 2030 climate targets. Asia still produces 85 per cent of its energy from fossil fuels1, accounts for more than half of global carbon emissions2, and produces 65 per cent of the world's plastic waste3. “It is in Asia's long-term interest to invest in a transition that contributes to a more sustainable business model,” says Tan.

Transition aims and structural concerns

Broadly, transition finance refers to investment in industries that meet three essential criteria:

- They are emissions intensive.

- They may lack a low- or zero-emission substitute that is economically viable or credible.

- They are important for future socio-economic development.

“Transition finance aims to invest in sectors that require capital to decarbonise their current operations and support the next generation of low-carbon technologies,” notes Tan. “These sectors are often hard to abate due to insufficient technology or a lack of finance to change existing business models.”

Transition bonds have not been successful in delivering this finance in developed markets. Investors building low-carbon portfolios often see “dirty” assets as an inherently challenging concept, and many asset managers are unsettled by the reputational risks associated with them.

There are widespread concerns, too, that in the absence of clear frameworks, some heavy polluters are using transition finance to “greenwash” their operations without driving any real change.

“Transition planning also involves significant uncertainties because you are forecasting future events, particularly technological innovations that do not exist,” explains Tan.

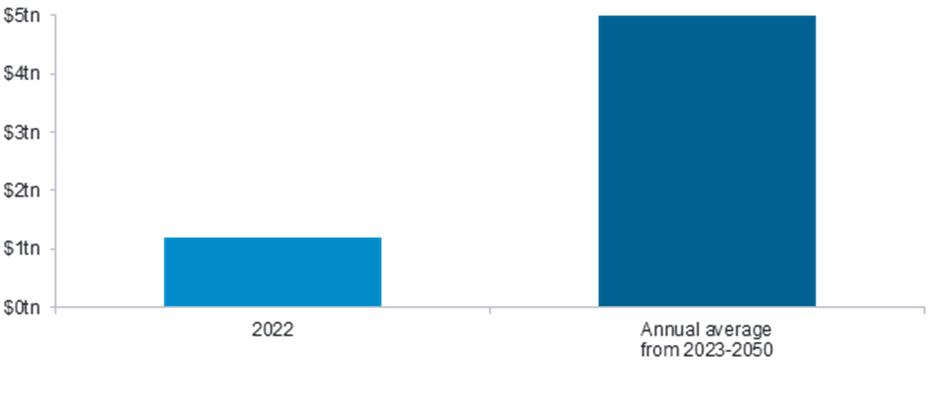

The transition financing gap stands at almost US$4 trillion a year. To reach net-zero targets globally by 2050, a total of about US$5 trillion annually is required4.

To plug that gap, “it is vital to have clear and transparent frameworks to give both issuers and investors confidence that capital is being channelled in a way that supports broader net-zero objectives,” adds Tan.

Significant investment is required to deliver on climate ambitions (US$ trillions)

Note: A cumulative US$150 trillion is required to realise the 1.5 degrees Celsius target by 2050.

Source: IRENA

Asia’s leading role is creating investor opportunities

Frameworks that will standardise the landscape are beginning to emerge. In Asia, regulators are taking the lead in defining transition finance principles, which will lead to greater transparency and, it is hoped, a surge of new investment.

The 2023 Singapore-Asia Taxonomy, for example, is the first in the world to define the transition directly. Elsewhere, frameworks such as the European Union’s pioneering Sustainable Finance Disclosure Regulation (SFDR) and the United Kingdom’s Sustainability Disclosure Requirements (SDR) exist.

These are already driving fresh financial sector flows by creating new opportunities for investors to move into segments that are not necessarily green or aligned with the Paris Agreement’s climate-change goals but could contribute to significant emissions reductions.

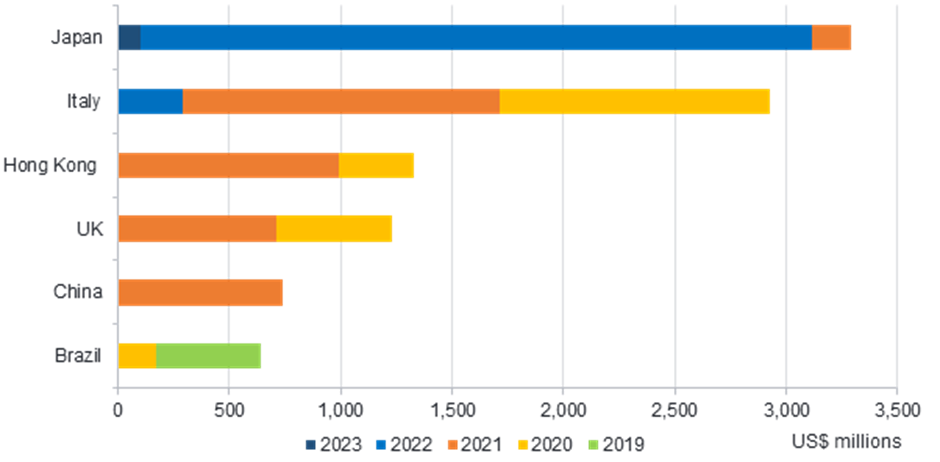

The most notable example is Japan, which now leads the world in transition bond issuance. Over the next 10 years, the Japanese government plans to issue about 20 trillion yen (US$13.3 billion) in sovereign transition bonds, which will unlock 150 trillion yen of transition investment5.

“Japan has been able to provide an overall framework for transition bonds,” says Tan. “These bonds are now being used for a wide variety of purposes that fund emissions reduction.”

“That, in turn, provides opportunities for Japan’s corporations to follow. Ultimately, governments don't have trillions of dollars to fund the financing gap, so that needs to come from the private sector.”

Transition bond issuance in main issuance countries from 2019 to Q1 2023 (US$ millions)

Source: Fidelity International, Sustainable Fitch, Environmental Finance Data.

A four-pronged strategy

Investment managers like Fidelity International can also play a key role in creating a credible landscape for transition finance.

Fidelity follows a four-pronged transition strategy as part of its commitment to aligning investment portfolios to net zero by 2050. The first two entail bottom-up assessments of companies using Fidelity’s proprietary tools, including ESG and Climate Ratings systems.

“The other two are top-down stewardship activities,” notes Chang. “We do this by reviewing our whole portfolio and identifying high-risk companies for in-depth engagement.

“We understand that transition doesn't necessarily happen at a linear pace and that not all transitions look the same. This means utilising different escalation strategies to promote timely progress and encouraging entities to effectively communicate transition plans to the market.”

This holistic approach has registered notable successes with companies in high-impact sectors across Asia, including palm oil producers and nickel miners in Indonesia, an auto manufacturer in Japan, and a utility provider in Southeast Asia.

Simultaneously, they help investors understand the opportunities inherent in companies that can deploy a well-managed transition plan.

“Transition finance is important in meeting global climate ambitions,” concludes Tan.

“Our view is that all finance needs to be aligned on a 1.5-degree trajectory, but we will not be on that pathway without transition finance.”

Sources

1 International Renewable Energy Agency (IRENA)

2 OurWorldInData, Ritchie et al. (2020)

3 OurWorldInData, Meijer et al. (2021)

4 IRENA

5 Ministry of Economy, Trade and Industry.