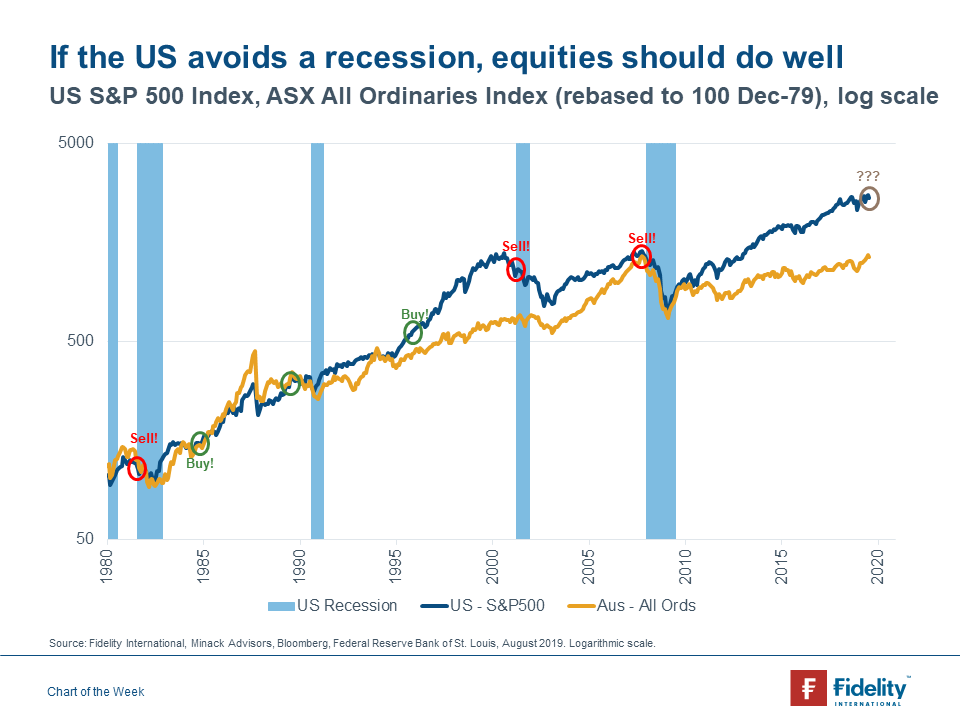

The US Federal Reserve has a pretty good track record of cutting interest rates when the US economy needs it most. Since the mid-1950s there have been twelve completed interest rate easing cycles, and nine have been associated with recessions. Because of this, investors usually see the first Fed interest rate cut as a good signal to sell equities. This is relevant for other stock markets - like Australia - which normally enter a period of negative performance when the US enters into recession.

However, there are three occasions when the US avoided a recession, and the economy experienced a “soft landing”. On these occasions, equity markets performed well until the next recession. The question for investors today is: how likely is it that the US enters a recession in the next twelve months? If we are to believe Federal Reserve Chairman Jerome Powell, and July’s interest rate cut is indeed a “mid-cycle adjustment to policy”, then it appears that equity markets can continue to perform well. However, if concerns continue to intensify over global growth, tariffs, and low inflation, then a more defensive approach to the stock market may be warranted.