Equities have had a challenging year, but we believe that neither central bank tightening nor recession risk is fully priced in yet. The tightening seen in monetary policy suggests equity market valuations should still be significantly lower. A such, we remain cautious on the outlook for global equities.

Equities are not yet cheap and valuations could fall further

Source: Bloomberg, Fidelity International, November 2022

Central banks have increased interest rates at a fast pace to tame inflation this year. Yields have skyrocketed to levels not reached since before the Global Financial Crisis and bond prices have crashed. As interest rates are rising, the economy is starting to slow, evidenced by the property market and Purchasing Managers’ Index’s (PMI) showing weakness.

October’s lower-than-expected US Consumer Price Index (CPI) reading has brought hope (again) to markets that the US Federal Reserve (Fed) may change course. We think the Fed will maintain its hawkishness for now as it will want to see a more sustained pattern before acting on rates. We continue to expect a US recession in mid-2023 given the tightening of financial conditions.

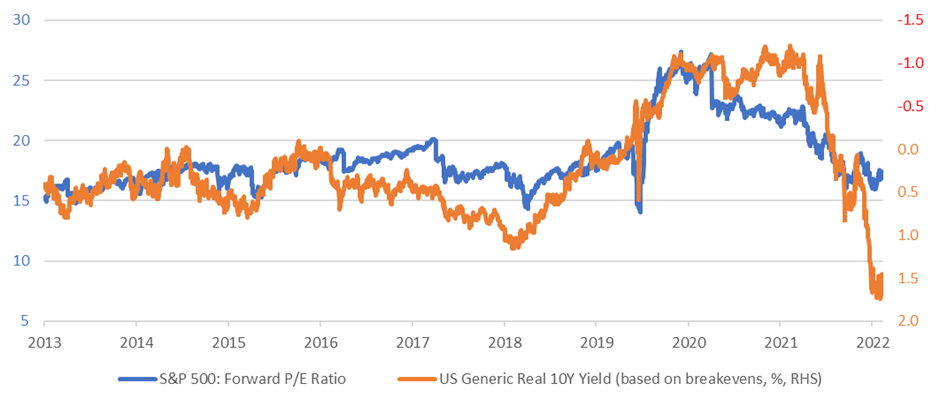

The chart above shows that the S&P 500 forward Price-to-Earnings (P/E) ratio and inverted US 10-year real yields (adjusted for inflation) have moved in tandem over the past decade. This makes sense as stock prices should reflect the future stream of earnings discounted by the cost of capital. But the two have become disconnected over the last few months as real yields have risen further but valuations have not followed. The provision of ’free money’ from central banks to stock markets seems to be over, but equity markets may not yet fully believe it, meaning potential further downside risk to equities.

We also believe that the worsening economic conditions have not fed through to earnings yet. As the Q3 earnings season continues, we expect the market to price in the economic downturn more significantly. As such, we remain risk-off with a cautious view on equities.