As the world’s largest economy, the United States is an important catalyst for the global business cycle. More recently, concerns have risen that the global economy, led by the US, has entered into the last stage of the economic growth cycle.

This is reflected in the shape of the US Treasury yield curve, which investors have historically viewed as a signal of future economic growth. It is typically the steepest after recessions, as the US Federal Reserve lowers interest rates to stimulate economic activity, and flattens over the course of the business cycle as the US Federal Reserve raises rates to contain inflation. If a recession looms, the yield curve typically becomes “inverted,” when two-year yields are higher than 10-year yields. In the post WWII era, the US treasury yield curve has inverted before every recession.

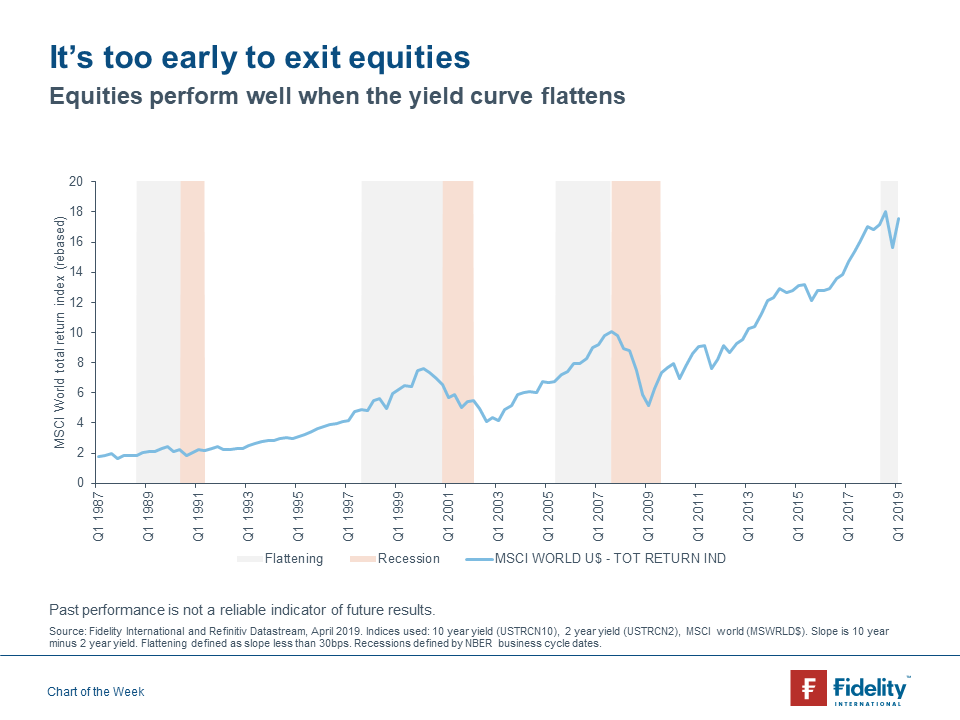

While late-stage expansions are typically characterised by heightened volatility and greater uncertainty, it can be a rewarding time for investors. An analysis of global equity market performance during periods of US Treasury yield curve flattening shows that global equities have historically performed well during the latter stages of economic expansion. Those investors that can maintain their discipline during periods of heightened market nervousness can often find that it pays to remain invested over the long run.