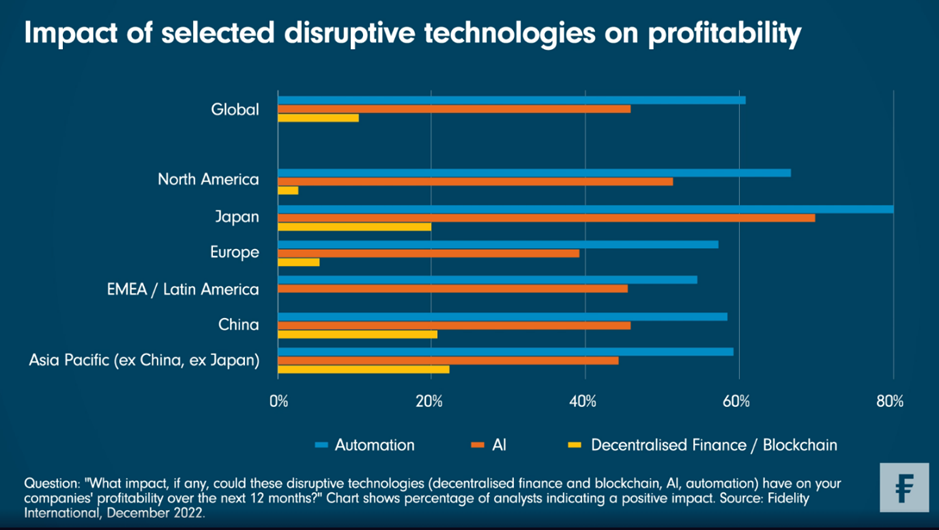

Automation is the disruptive technology likely to have the biggest impact on profitability this year, according to Fidelity International’s 2023 Analyst Survey, which features responses from 152 sector analysts around the world.

Globally, 61 per cent of analysts say automation will have a positive impact on profitability over the next 12 months, while around 3 per cent of them see a negative impact. In Japan, some 80 per cent of our analysts find automation a profit booster, the highest among regions.

“IT (information technology) service companies are actively increasing investment for cutting edge solutions in automation and artificial intelligence,” says an equity analyst covering information technology in Japan.

About 46 per cent of our analysts globally think artificial intelligence will help increase profits at the companies they cover, while about 4 per cent of them see a negative impact.

“AI (artificial intelligence) will continue to be deployed incrementally, whether it is to improve underwriting, service customers more effectively, and so on,” says an equity analyst covering financials in China.

On the other hand, blockchain and decentralised finance (DeFi) have failed to impress our analysts as major profit drivers, at least in the near term. Globally, only one tenth of our analysts expect a positive impact on profitability from blockchain and DeFi, while some 4 per cent of them see a negative impact.