China’s leading industrial machinery firms are making new inroads abroad, seeking profitability that’s built to last as demand falls and competition intensifies at home.

Rising costs, slowing growth, and geopolitical jitters are a few of the forces driving foreign companies to diversify their supply chains beyond just China - a backup business strategy dubbed “China plus one”. Now, an increasing number of China’s leading industrial machinery companies are pursuing the strategy, too.

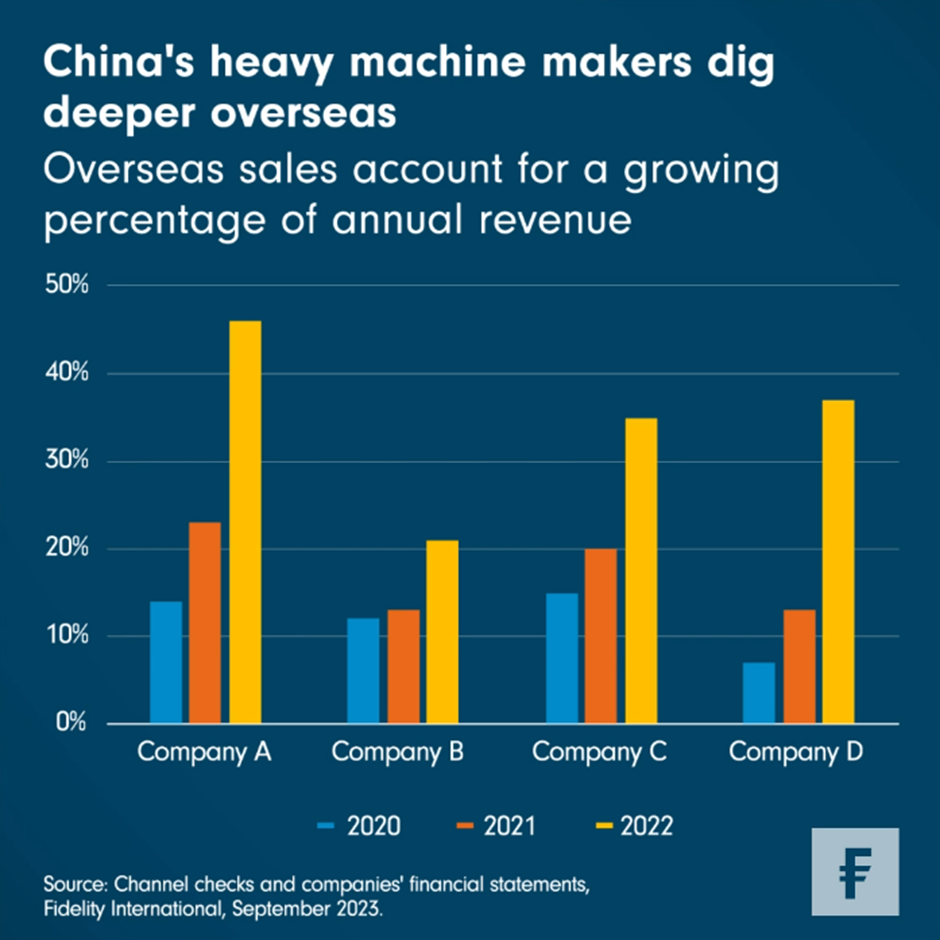

This week’s Chart Room looks at how those firms are increasingly finding overseas markets to be not just a source of top-line growth but better bottom-line profitability. That includes companies like a major manufacturer of dump trucks, excavators, and cement mixers that we’ll refer to as company A; or company B, which makes hydraulic pumps and valves; company C, a forklift maker; and company D, which produces heavy duty trucks and semi-trailers. All of these leading industrial machinery firms have built factories or established sales operations in markets including the US, Europe, Africa or Southeast Asia. They have also managed to quickly gain market shares. As the chart shows, the four firms all saw meaningful increases in their overseas sales, especially last year.

What’s more, their overseas units normally have a better return profile, as it’s often the case away from home that competition is less intensive and demand is stronger. Take the forklift market as an example, where we estimate the earnings before interest and tax (EBIT) per vehicle in overseas markets is more than twice the number in China. With economics like this, we believe the go-abroad trend for machinery firms could be built to last over the medium-to-long term. This is especially true while the Chinese property sector stays stuck in a slump, dragging on demand for heavy trucks and machinery amid the slowdown in the broader economy.

Of course, for Chinese firms venturing abroad, the journey to the West is not without its challenges. In addition to extra costs in localising supply chains and sales networks, they also face potential regulatory risks. Those could take the form of anything from higher entry barriers to outright sanctions if foreign governments feel the need to protect local players.

None of this is to suggest that China’s status as a factory floor to the world is in jeopardy. Particularly for homegrown industrial machinery makers, we think China will remain their core production base and biggest market for the foreseeable future. They just don’t want to put all their eggs in one basket.