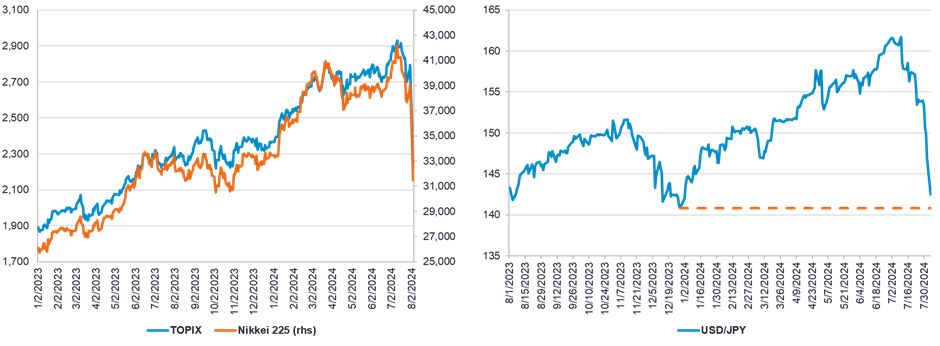

Japanese stocks have corrected by more than 20% since their recent peak on in mid-July, with key indices suffering historic losses recently. There are several factors behind this sharp downturn, namely rising concerns about a recession in the US, unexpected hawkishness from the Bank of Japan (BoJ) and continued yen strength leading to an unwinding of the carry trade.

Japanese equities suffered an historic correction as yen largely reverses year-to-date (YTD) losses

Source: Fidelity International, Bloomberg as of 5 August 2024.

There have been distinct phases within the current selloff: the immediate aftermath of the BoJ rate hike when banks rallied but exporters lost ground amid a strengthening of the yen; The selling of some YTD winners (financials and global cyclicals, especially tech); and this week’s sharp correction in financials and commodity-related sectors. On the other hand, defensive and domestic-oriented segments of the market have held up relatively well in comparison. In terms of style, there has been a clear rotation from value to low-vol and oversold quality.

Market rotating from financials and exporters to domestics/defensives

Overseas investors were net sellers of Japanese stocks through the last two weeks of July and the unwinding of speculative positions has accelerated. It seems that the weakness is primarily coming from systematic and commodity trading advisor (CTA) selling rather than long only.

In the near term, markets are likely to remain volatile and could test further downside. The US July employment data has elevated concerns that an economic slowdown could be more severe than expected and the pace of yen appreciation is raising questions about the impact on corporate earnings in Japan (though most companies’ estimates for fiscal 2024 are based on ¥140 - ¥145 to the US dollar). In terms of the BoJ, the July policy meeting made it clear that the central bank aims to hike rates further, but it is uncertain how rapidly it will act and the emergence of global recessionary fears point towards a gradual pace.

The absence of any material shift in domestic fundamentals suggests that the Japanese market will remain susceptible to concerns over the US. However, once the selling has run its course, fundamentals and valuations will come back into focus. Moreover, we believe that Japan’s economic shift to moderate inflation and its impact on spending and investment decisions by households and corporates, combined with steady progress in governance reforms, represent multi-year structural trends that are supportive of Japanese stocks over the longer term.