Download PDF

When investors talk about environmental, social and governance (ESG), which they’re doing with ever-greater frequency, they often focus on a company’s environmental and social records. However, to overlook governance is to risk missing the point entirely. I have found that most companies with good ‘E’ and ‘S’ practices have strong governance structures. Meanwhile, it’s relatively rare to see firms with poor governance uphold high environmental or social standards.

Good governance is the bedrock upon which everything else rests; it determines the actions of managements, employees and shareholders, guides a company’s approach to environmental and social issues, and drives financial returns. If you get the ‘G’ right, the ‘E’ and the ‘S’ usually follow as a robust corporate structure and decision-making process creates the optimal framework for ESG-aware policies.

It is crucial to understand a company’s ownership in the first instance who are we investing alongside and what do they want the business to achieve? The answer to this will go a long way to determining how the company allocates its capital. When a government is a major shareholder, for example, investors should not be surprised if the company makes decisions that prioritise national interests over those of other shareholders.

It also helps to know exactly what management teams are paid to achieve, which is why clarity around targets and incentives is so important. Through fundamental research and analysis we can build a comprehensive picture of a company’s opportunity set for creating long-term value. However, this is purely theoretical unless management is motivated to put it into practice.

As asset managers, we like companies that allocate their excess capital at an accretive rate of return, creating intrinsic value for investors over time – in other words, firms investing in projects which return more than their cost of capital. When managements are incentivised to think about the sustainability of cash flows, and when the shareholder structure supports that behaviour, it tends to lead to sustainable outcomes for the business. This can manifest in low staff turnover, or better investment in research and developmentleading to more efficient, cleaner manufacturing processes. If a company cuts environmental corners to maximise short-term returns, for instance, at some point this will become a financial liability. In this way, ESG and financial success are one and the same.

Different governance systems in practice

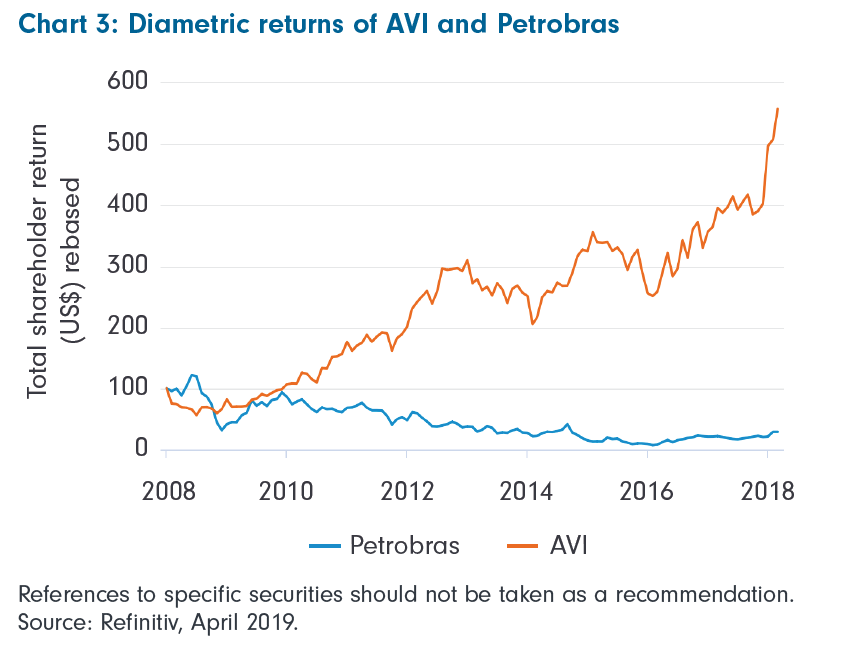

Companies with robust governance structures can create huge amounts of value, while those with poor governance can destroy it. AVI, a South African food and beverage firm, and Petrobras, a Brazilian oil and gas company, both operate in emerging markets and suffered currency devaluations of more than 50% in the decade following 2008’s financial crisis. But the companies, driven by their different governance systems, responded in very different ways to the pressures and had very different results.

AVI’s costs for raw materials such as coffee, tea and wheat are in US dollars, while its products are priced in South African rand, which meant the weakening currency dramatically increased its cost base. However, AVI’s management felt they could not raise prices to offset the higher costs when their customers’ spending power was also deteriorating. Instead, they recognised that conditions were not ripe for growth and stopped investing in the business.

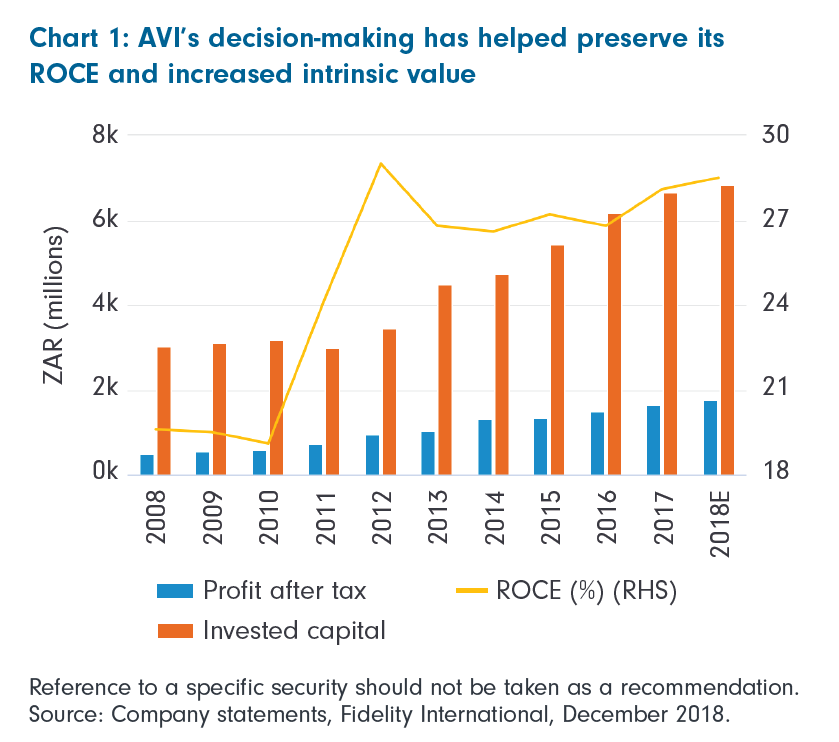

For almost five years, AVI added no net new capacity, choosing to focus on sweating the asset base and increasing return on invested capital through cost cutting, price optimisation and branding. While invested capital stayed flat, absolute profits began to increase and return on capital employed (ROCE) jumped from just over 20% to 30%.

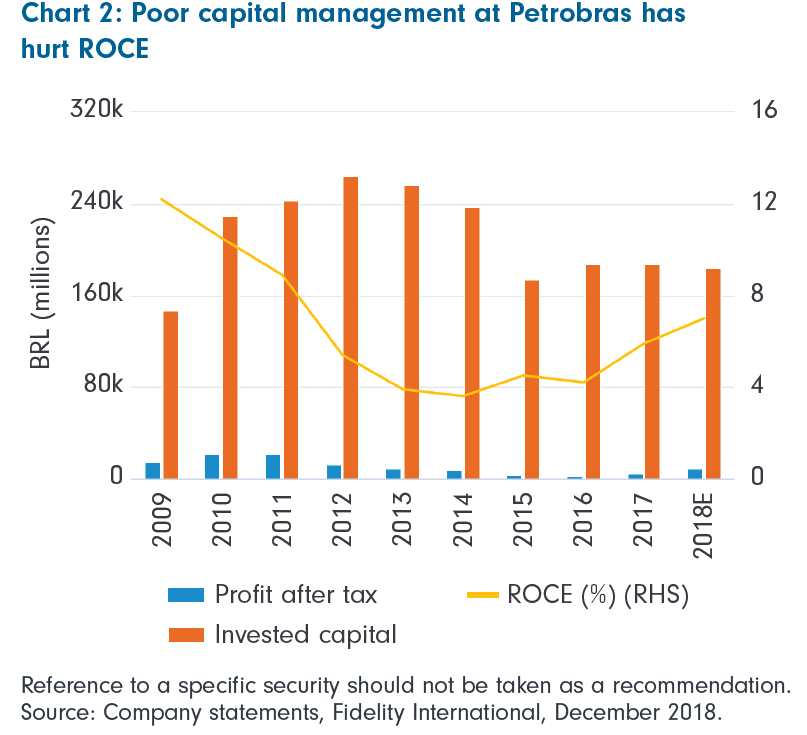

On the other hand, Petrobras’ major shareholder was the Brazilian government, which recognised that by 2009 the economy was under pressure and it needed to create jobs. Petrobras ramped up capital expenditure by around US$50 billion a year, with little regard for the returns such projects were generating. Invested capital rose from just under BRL150 billion to more than BRL250 billion in under four years, while ROCE plummeted and absolute profits fell sharply.

Because of its capital management decisions, AVI was able to triple its dividend between 2008 and 2018. Meanwhile, Petrobras eventually had to scrap its dividend after over-investing in projects that did not generate any cash flow, ultimately undertaking a massive capital raise to support its stressed balance sheet.

Petrobras, at one point one of the largest companies in the world and included in almost every emerging market portfolio at its peak, saw its share price fall almost 80% over ten years. In contrast AVI, a lesser-known mid-cap in South Africa’s well-penetrated consumer goods sector, delivered a 340% share price return over the same period.

These case studies help illustrate why, to me, good governance is not just a bonus or even one-third of a broader ESG strategy, but the starting point and foundation of all fundamental research. A company’s governance framework drives its capital allocation decisions, which determine the sustainability of both returns and broader business practices. In turn, this creates long-term intrinsic value, and that is music to investors’ ears.