|

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way, so wrote Charles Dickens in 1859 (A Tale of Two Cities) but these words ring true now more than ever. Day 83 of 366 in the leap year that is 2020, yet it already feels like we have lived through a decade in the past three weeks with enough statistics on volatility and capital lost to make the financial history record books overshadowed only by the human tragedy unfolding as Covid-19 speeds across the globe - 300,000 affected so far, over 10,000 mortalities and a near certainty of many more to come in the days ahead. With the real economy likely to come to a sudden stop to protect life over the next few days, record high levels of debt and near certainty of a recession, Q2 unemployment in the US expected by the Federal Reserve to soar to 30%, compounded by a global pandemic and an oil shock, is it any wonder that we have not had two consecutive days of stability in the markets1. There are just too many trade-offs and too many decision trees to compute between the bad and the less bad - the machines lack the data and the humans lack the compute power making for a powerful volatile cocktail. This overload led to quite a few market participants clamouring for market closure last week - a problem of too many questions and too few answers. Everyone has been seeking a parallel to this period. The Marriot International CEO Arne Sorenson (link to his heartfelt message to employees) sees a parallel to his business to a combination of the period post 9/11 and 2008 great financial crisis2. Some have looked at the pandemic as the Spanish flu epidemic of 1918, whilst others have compared this period to 1987 (Black Monday), LTCM (algorithms failing - read Ray Dalio’s Linked-in note Our Performance) or 1929 (onset of the great depression)3. As Howard Marks eloquently put it - Nobody Knows in his recent memo to clients, investing today is a bit like (to paraphrase the tag line from my favourite television series of all time - Star Trek) - going boldly, where no one has gone before! This is how investing through 1929 would have felt like where there were no parallels to go back to or what investing during the great wars must have felt like (incidentally in my view the great wars possibly offer the best parallel - more on this below). However, I believe that what we lack in compute power, we more than make up with the power that is imagination (machines don’t yet have that!). What do we know, what do we not know? Covid-19 Related

Interest rates, Government and Central bank response:

In the near to medium term it is important to remember that if you are getting unduly bearish, you are fighting the Fed and nearly every central bank and government in the world along with the single-minded dedication of various health care professional and scientists to find a cure/vaccine. Think hard and rationally about your odds! Country Selection & Politics & The Long Term - the 1945 Crossroad

The 1945 Crossroads & The Marshall Plan

The open questions for the path ahead:

From the macro to the micro - comments on equity valuations & things to focus on:

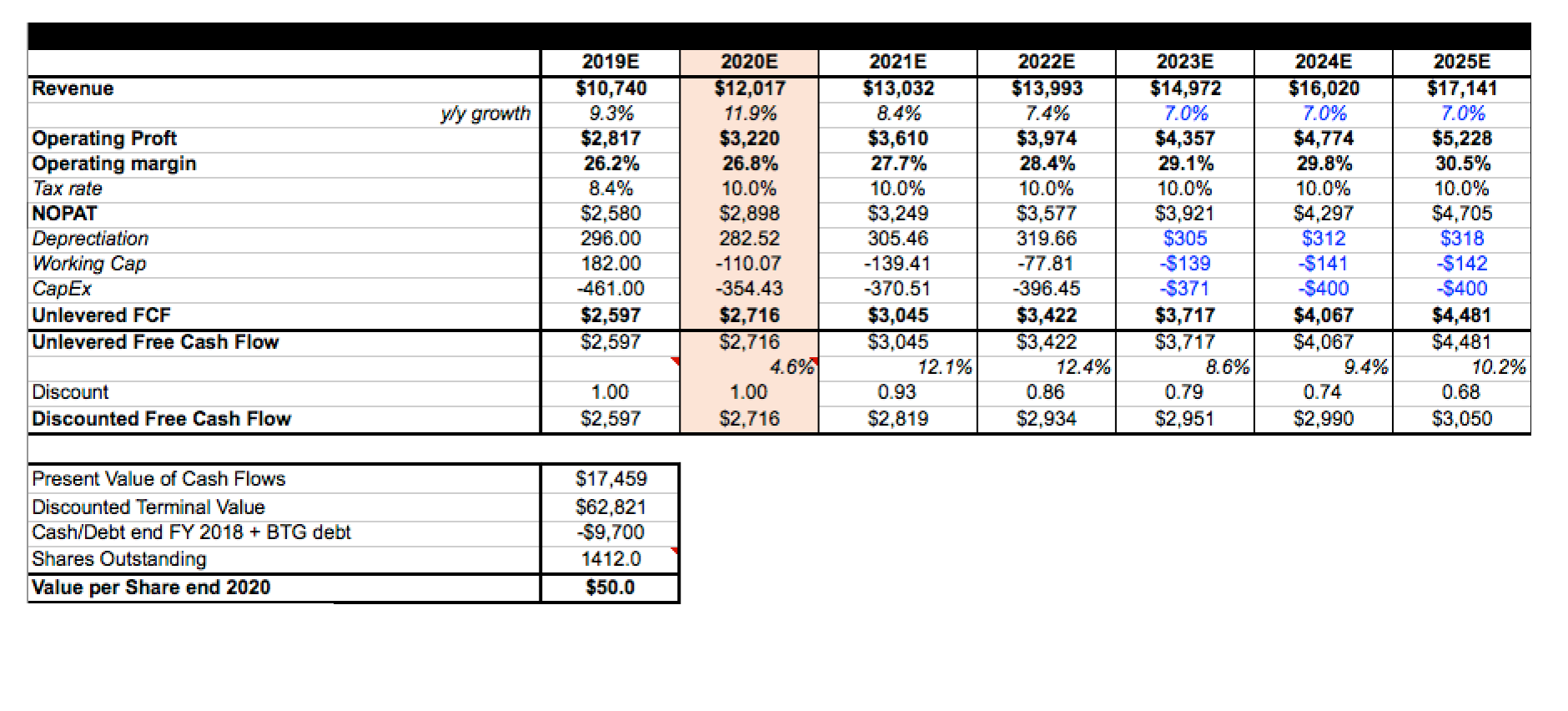

Forecast pre-Covid-19

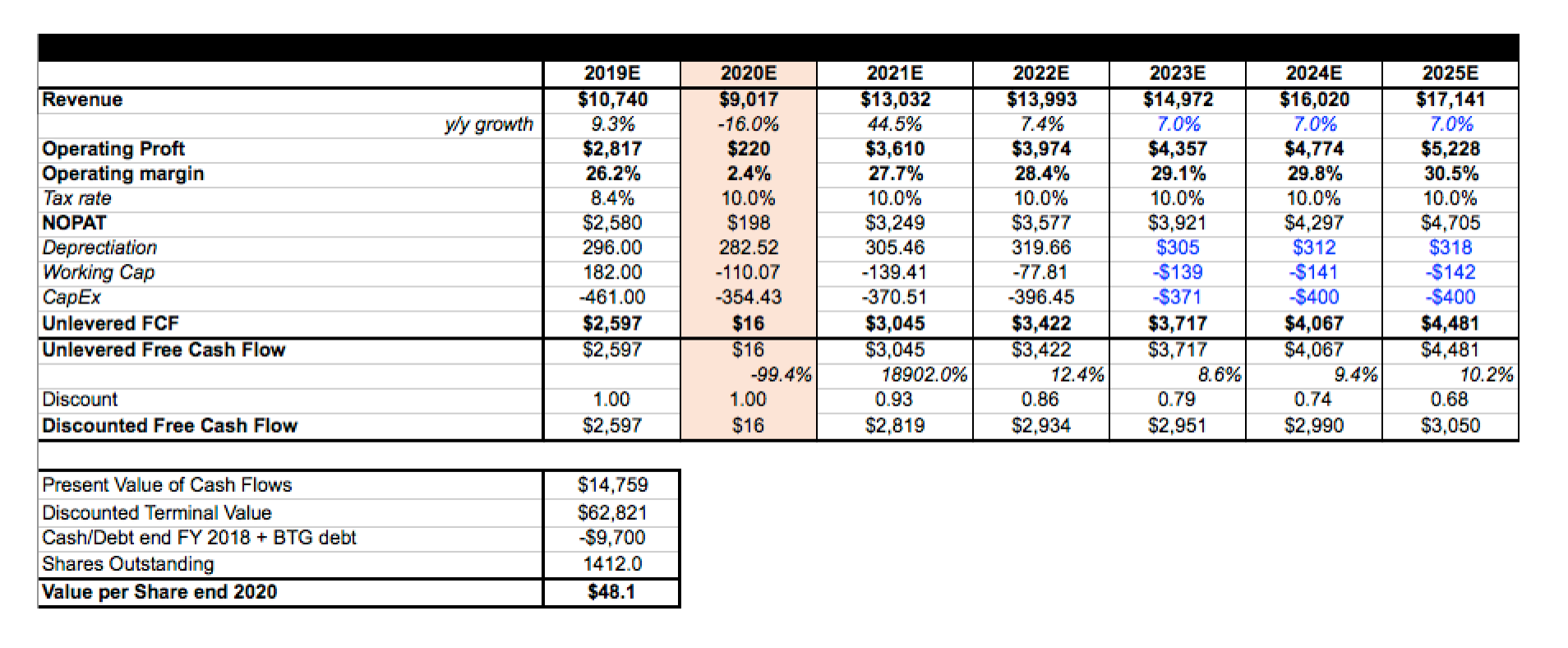

This is the draconian forecast assuming that for about 3 months revenues are down to zero while costs stay constant (i.e. no job losses or production cuts and for simplicity sake no changes to any other assumptions like capex or working capital)

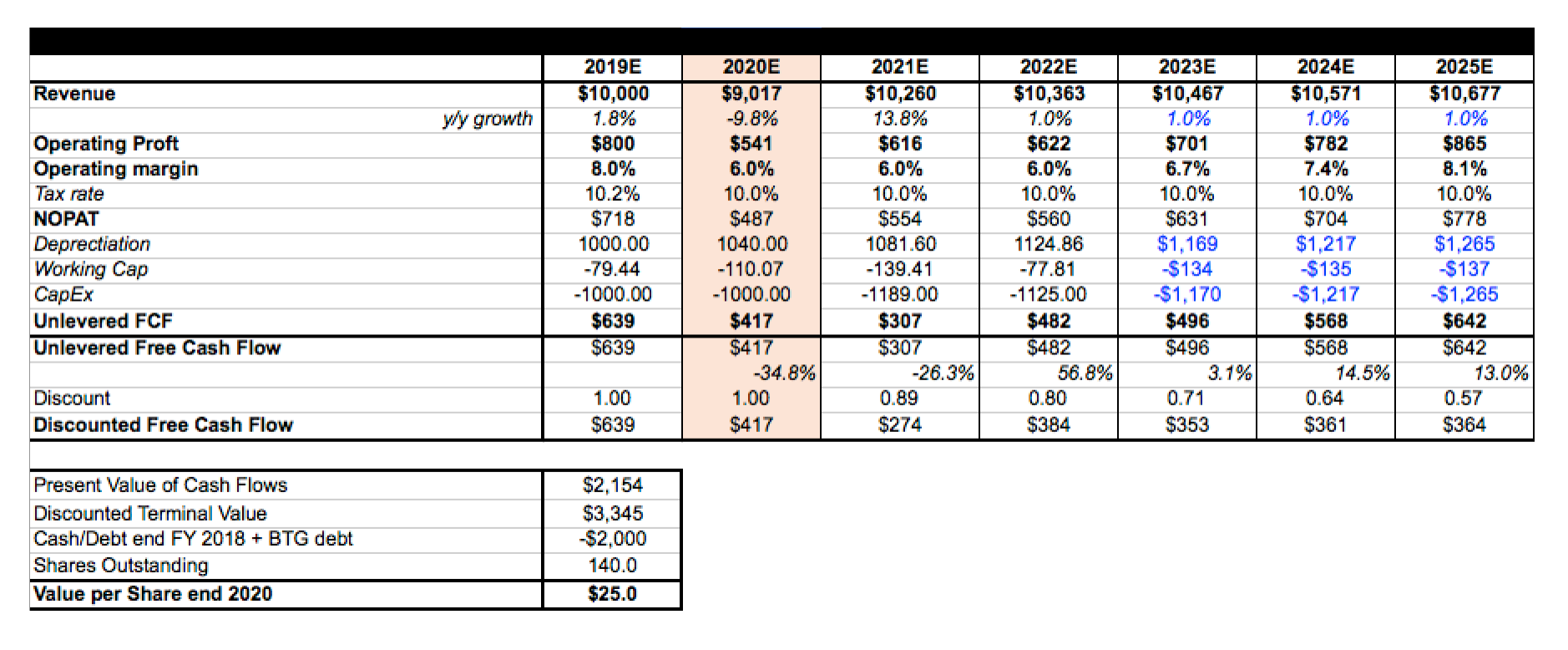

For a draconian 93% negative change in a year’s operating profitability, the change in the franchise value is $2 or less than 5%. This is because this is a business with pricing power where a disproportionate chunk of the value in the business lies over the long term. Business managers who are focussed on long term value creation will intuitively know this trade-off. However, recessions don’t treat all businesses equally. Here is the same exercise for a cyclical business which trades at much lower multiples with lower margins (hence high operational gearing) and more importantly is unfortunately highly levered going into this recession. Forecast pre-Covid-19

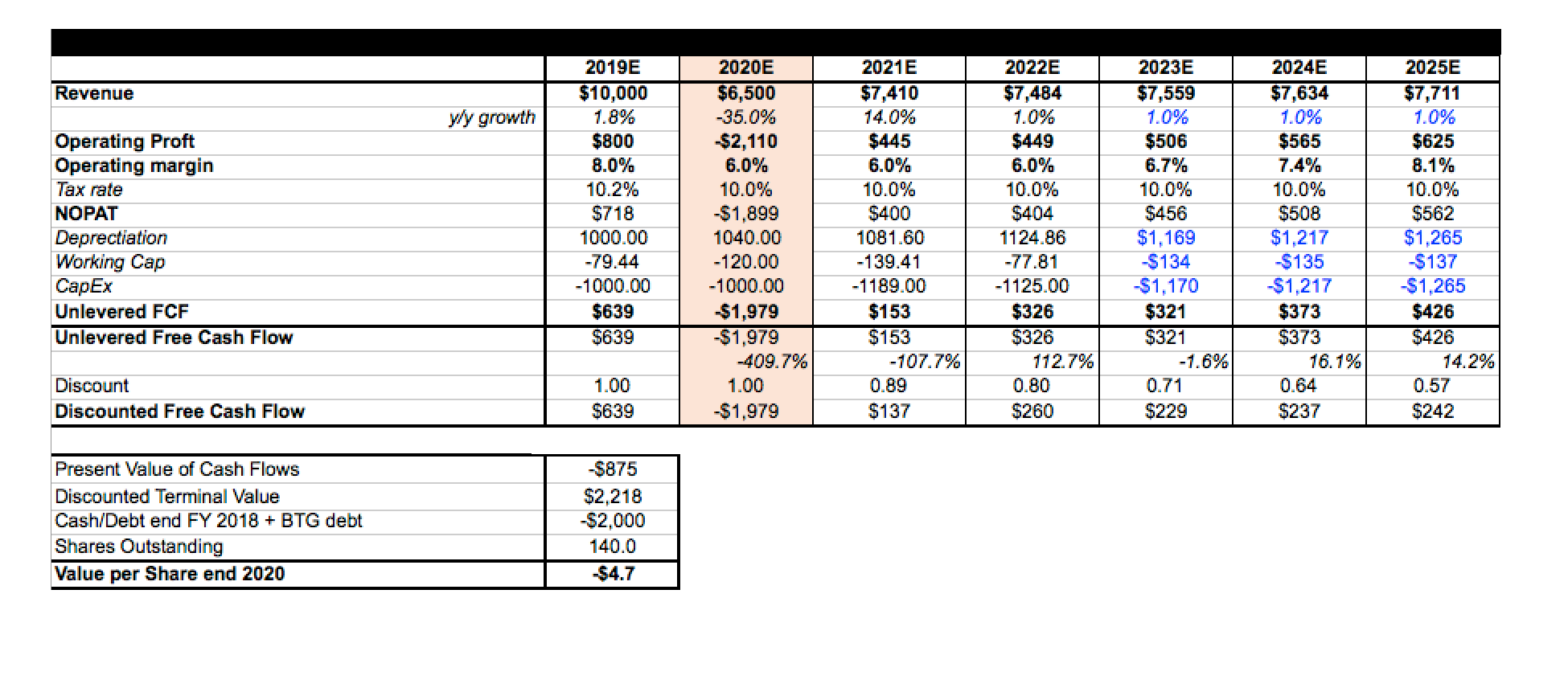

Forecast post Covid-19 (3 month hard stop with no cost support and 100% drop down on leverage- no other changes to assumptions)

As is apparent the combination of high financial and operating leverage is a toxic cocktail which together can destroy significant amount of capital in a downturn. In this example, three months loss of revenue and without any attendant management action would see the company’s equity becoming worthless (is it any wonder the high yield market is in such a stake of funk?) Having said that, this is not to suggest investing in one versus the other. On the contrary, this is where evaluating the difference between market price and your view of franchise value becomes so important. During dislocations, all businesses trade at significant discount or premium to market valuations and it should not surprise you if you have over 50-100% upside on your price targets. Further the correct investment strategy in the 2009 recovery was to sell everything that had been defensive in 2008 (good quality, low leverage & had protected capital) and buy everything cyclical that had survived (generally had great management teams who had navigated the cycle with often lower than peer group leverage). In fact, in 2009 the defensive high-quality businesses were not good areas for capital preservation, given the weight of capital which flowed in the other direction. As soon as governments announce the all-clear on the pandemic, or a cure is found, or restrictions go, expect 2009 like investment environment to repeat. So, the message is really to be flexible and continue to look through the wreckage in cyclical areas where the market has thrown out the baby with the bath water (for e.g. if 9/11 did not make us stop flying, it is doubtful that Covid-19 will). To repeat what could be described as one of the core tenets of Anthony Bolton’s investment philosophy ‘The most money in equity markets is made when things go from bad to less bad’.

Closing thoughts:

On a more personal note, everyone has a guiding philosophy - mine is ‘Whatever happens, happens for the best’ - it has kept me steady through both good times and bad and is one which I cling to as I grapple with both the uncertainty in economies and financial markets and the worry around the health of my loved ones especially my grandparents (one octogenarian and two nonagenarians). In that spirit, I wish you and yours the best of health.

You can find previous editions of Amit's 'From the desk of' on the Fidelity Global Equities Fund page

Footnotes & References: 1. Source: Bloomberg News Article Link, U.S. Jobless Rate May Soar to 30%, Fed’s Bullard Says, 23 March 2020. 2. Source: YouTube Video Link, COVID-19: A message to Marriott International associates from President and CEO Arne Sorenson, 20 March 2020. 3. Source: Linked-In, Article by Ray Dalio, Co-Chief Investment Officer & Co-Chairman of Bridgewater Associates, L.P. Article Link, March 2020. 4. Source: James Aitken - Systematic Risk in Crisis Podcast Link

|

All information is current as at its published date unless otherwise stated. Not for use by or distribution to retail investors. Only available to a person who is a "wholesale client" under section 761G of the Corporations Act 2001 (Commonwealth of Australia) ("Corporations Act“).

This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL No. 409340 (‘Fidelity Australia’). Fidelity Australia is a member of the FIL Limited group of companies commonly known as Fidelity International. Prior to making any investment decision, investors should consider seeking independent legal, taxation, financial or other relevant professional advice. This document is intended as general information only and has been prepared without taking into account any person’s objectives, financial situation or needs. You should also consider the relevant Product Disclosure Statements (‘PDS’) for any Fidelity Australia product mentioned in this document before making any decision about whether to acquire the product. The PDS can be obtained by contacting Fidelity Australia on 1800 044 922 or by downloading it from our website at www.fidelity.com.au. The relevant Target Market Determination (TMD) is available via www.fidelity.com.au. This document may include general commentary on market activity, sector trends or other broad-based economic or political conditions that should not be taken as investment advice. Information stated about specific securities may change. Any reference to specific securities should not be taken as a recommendation to buy, sell or hold these securities. You should consider these matters and seeking professional advice before acting on any information. Any forward-looking statements, opinions, projections and estimates in this document may be based on market conditions, beliefs, expectations, assumptions, interpretations, circumstances and contingencies which can change without notice, and may not be correct. Any forward-looking statements are provided as a general guide only and there can be no assurance that actual results or outcomes will not be unfavourable, worse than or materially different to those indicated by these forward-looking statements. Any graphs, examples or case studies included are for illustrative purposes only and may be specific to the context and circumstances and based on specific factual and other assumptions. They are not and do not represent forecasts or guides regarding future returns or any other future matters and are not intended to be considered in a broader context. While the information contained in this document has been prepared with reasonable care, to the maximum extent permitted by law, no responsibility or liability is accepted for any errors or omissions or misstatements however caused. Past performance information provided in this document is not a reliable indicator of future performance. The document may not be reproduced, transmitted or otherwise made available without the prior written permission of Fidelity Australia. The issuer of Fidelity’s managed investment schemes is Fidelity Australia.

© 2024 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited.