This article first appeared in Ensombl on 10 April 2024

The transfer of wealth between generations is an important topic for many older Australians, who are increasingly seeking guidance on how their assets should be divided while still alive. This often involves difficult questions around how much wealth should be transferred, who the recipients will be and what sorts of activities should be funded.

Demographic factors are pushing many Australians to consider living legacies. The last of the baby boomers are now entering retirement and many are holding record amounts of wealth as property prices have soared. As a result, many older Australians are keen to transfer their wealth during their lifetimes to other family members who may be not so fortunate or well-off.

Simple desires often involve wanting to help children or grandchildren buy their first home, fund their secondary or tertiary education, pay for weddings, or help out in other ways with smaller monetary gifts. The cost-of-living crisis in Australia has added to the impetus for the transfer of wealth to younger Australians – so much so that Australia is now experiencing one of the biggest generational wealth transfers it has ever experienced. It is estimated that Australians aged 60 or over will be transferring an average of $175 billion per year in wealth for the next decade at least, according to a 2021 Productivity Commission report.

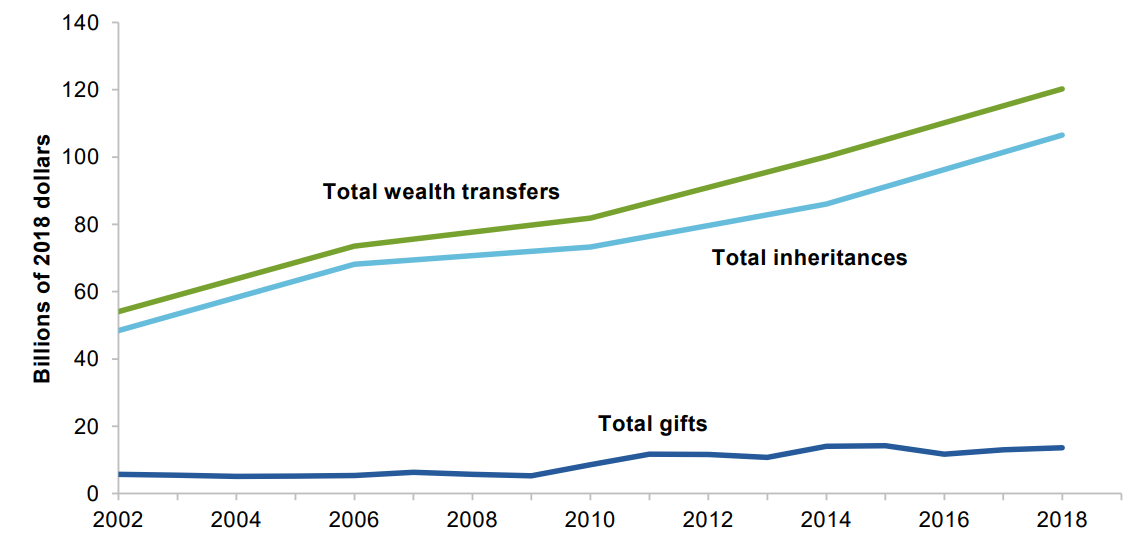

That report found that the aggregate annual value of wealth transfers has more than doubled in real terms since 2002. Between 2002 and 2018, the aggregate value of wealth transfers was approximately $1.5 trillion, of which $1.3 trillion was inheritances and $155 billion was gifts, as the chart below shows.

The annual value of wealth transfers has more than doubled since 2002

Source: Productivity Commission, Wealth transfers and their economic effects

Fidelity’s own research highlights the trend towards living legacies and the desire for it. A recent study undertaken for Fidelity by research firm MYMAVINS found that almost four in five Australians aged 26 years or older believed sharing their wealth with the next generation was important. The research involved an online survey of 1,500 Australian consumers over 26, with fieldwork undertaken in September 2023.

The Fidelity International survey found that two in five people prefer to share their wealth as a living legacy compared to one in five who prefer to just share their wealth as a bequest. The remaining two in five have an equal preference, meaning that four in five want to leave a living legacy.

Canvassing the options an important discussion

Fidelity’s own conversations with clients shows that many Australians do not want to wait until they have passed on their wealth and would prefer to leave a financial legacy while alive.

What has often helped to prompt this discussion is an annual review of clients’ finances. One of the things advisers tell us they talk about with clients at every review is whether any estate planning is in place or, if they don’t have anything in place, they have a conversation about the importance of it. That has been very effective in getting clients to plan estates and consider living legacies.

Typically, wealth advisers investigate different options with clients before final decisions are made to explore different ways of making wealth transfers. This can involve anything from simple monetary gifts to a grandchild to multiple gifts spread across children and grandchildren, or perhaps larger transfer to enable to purchase of shares or property.

Educating clients on their options is important. Sometimes the education involves starting with the basics on who the recipients of the transfer will be. Sometimes, the best approach is to start with their children and do some work with them to better understand their spending or savings habits. That may involve helping to teach good wealth-making habits. This is important to give the benefactor the confidence that the transferred funds will be used for a good purpose such as wealth creation or debt reduction.

Once the type and method of transfer is decided with clients, communicating the living legacy and its purpose to the beneficiaries is very important. This is an opportunity for older Australians to engage recipients on the wealth transfer, its significance and its management.

Gen Y, or millennials, are the generation that will be receiving the most wealth and are more likely to take a collaborative approach with their financial advisers. They have also grown up with more technology than their parents and are happy to complement or verify any advice with their own research. Wealth advisers and other professional can also guide Australians through these decisions.

Those in the Fidelity International Survey who said they would seek out professional help were most likely to trust a solicitor or family lawyer on estate planning matters at 49 per cent, followed by a professional financial planner at 37 per cent.

Our survey also found that from a Gen Y perspective, many said that if they were to receive significant financial help, or inheritance from their family, they would rely on a professional financial planner for advice for what’s best to do with it.

Governance of transfer matters

A framework governing the intergenerational wealth transfer can help families better manage, preserve, and maintain control of the transfer and, importantly, avoid conflict. Important factors to consider in a living legacy plan include clearly identifying who the beneficiaries will be, determining the most appropriate investment vehicles to hold and transfer assets and rules for resolving disagreements. While not all wealthy retirees believe they have an obligation to transfer wealth, among those that do, avoiding disputes and conflicts is often a key concern.

With so much wealth at stake, professional advice is important. While wealth holders and managers have concentrated primarily on wealth creation and its protection in the past, this is changing as living legacies become more important. As older Australians accumulate record levels of wealth, wealth transfers must be carefully planned to keep relationships between generations harmonious and to ensure the effectiveness of living legacies.