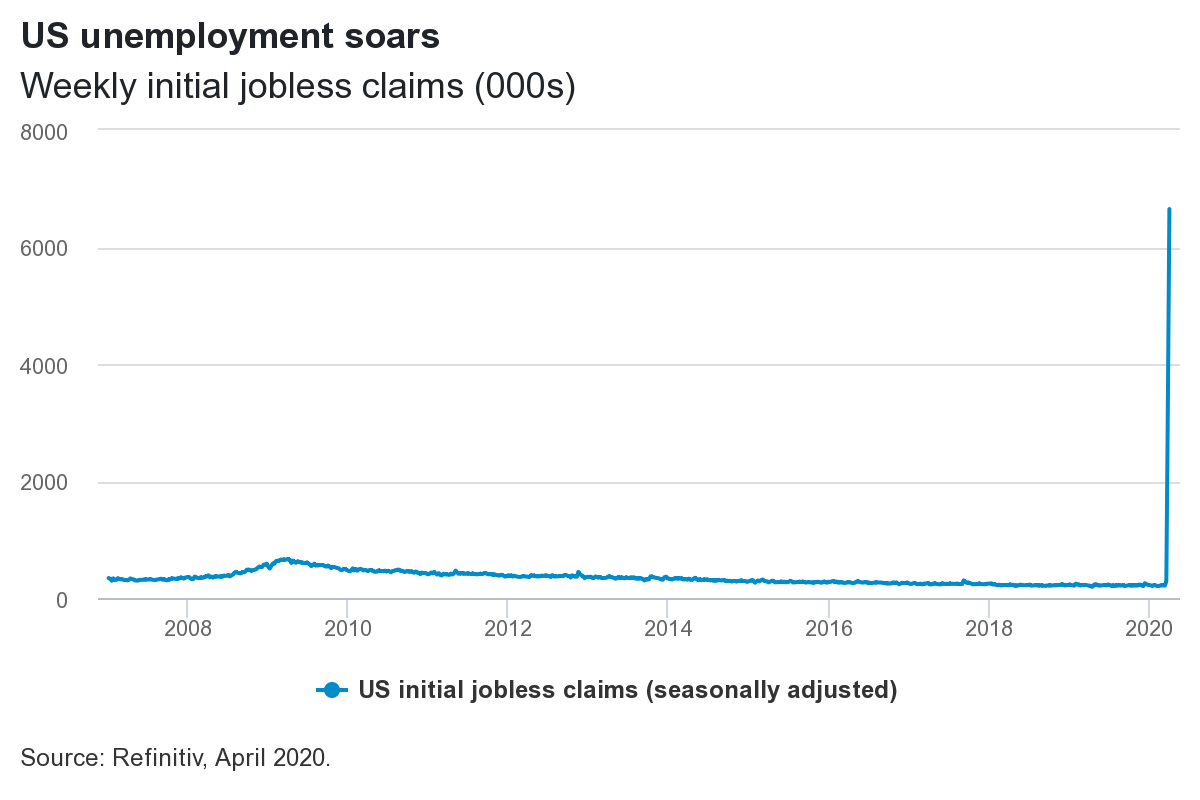

No V-shaped recovery expected in US unemployment

US jobless claims data soared past consensus expectations coming in at 6.6 million - nearly twice as high as forecast. That means 10 million people are newly unemployed in the last two weeks or more than one in 20 of those available to work. We don’t expect these numbers to come down any time soon and US unemployment could potentially reach up to a third of the US workforce. This could set us on course for a vicious cycle where companies won’t hire because consumers don’t have capital, and consumers don’t have capital because companies won’t hire. Much depends on how quickly the fiscal rescue package can get to where it’s most needed.

Dollar liquidity for foreign central banks

The US Federal Reserve, keen to head-off any bottlenecks in financial markets, has launched a US dollar liquidity programme for foreign holders of Treasuries. The FIMA Repo Facility will allow mainly foreign central banks to use their holdings of Treasuries kept in custody at the New York Fed as collateral to swap for US dollars. Foreign central banks have been selling Treasuries to access dollars, which has been contributing to dollar strength and may have exacerbated bond market illiquidity over the past month. This facility should curb those effects by avoiding the need for foreign entities to sell Treasuries in the open market. We recently covered the dash for dollars in a separate blog.

Manufacturing PMIs in sharp contraction

Expectations for IHS Markit Manufacturing PMI data for March were low and they didn’t disappoint. Most regions are in a manufacturing contraction, with the US number coming in below its initial flash estimate and pointing to the fastest deterioration since August 2009. The Eurozone posted its 14th consecutive month of contraction with Italy declining especially sharply. In the UK, business optimism was at a record low with manufacturers struggling to source raw materials. One brighter spot was China. At 50.1, the Caixin Manufacturing PMI bounced back from February’s 40.3, signalling a broad stabilisation in business conditions.