Nobody likes the middle seat. Recently on one of my flights with British Airways, I had the pleasure of having that seat. As a long only portfolio manager one always looks for patterns, analogies and silver linings!

So seated in between these two gentlemen to me felt like the seat one has in the markets between being bullish and bearish, value and growth, developed markets and emerging markets. The list goes on... and the silver lining, it could have been much worse; I could have been seated between a Trump/Brexit supporter and an anti-trump/Remain supporter!

But honestly, for all of us in this world of 140 word policy statements, differentiating between what is noise and what is signal has become even more difficult. Consequently, I always try and pen my thoughts so that I can have a framework to evaluate what worked and, more importantly, what did not!

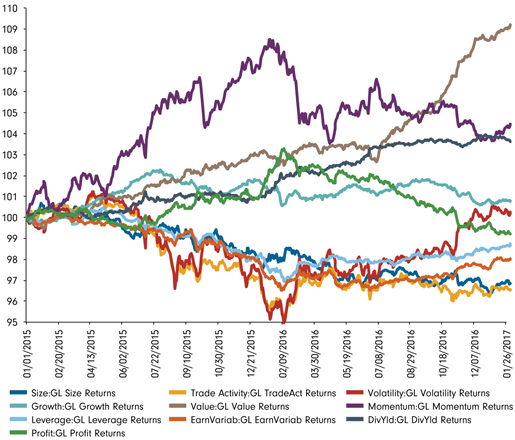

If you remember my 2016 macro framework (appended below) had a four sided coin toss - oil/Dollar/Fed interest rate/China. The framework served us well - as the market became less worried about China and more sanguine about oil we saw a strong reflationary bias. While Brexit briefly threatened to derail it, OPEC came back together, China continued with its stimulus and Trump’s election in the US further solidified the cyclical/reflationary bias. Quality growth and quality at any price, which were the strategies of 2015 and early 2016, gave way to ‘Value’, as commodities, materials, energy and, after Trump, the financials had their day in the sun (after 1000+ days of winter!). In fact (as you can see from the chart below), quality growth companies had one of their worst relative years in 2016.

As a famous commentator put, even if you had all the inside information on how Brexit/US elections would turn out you would have almost certainly made the wrong portfolio choices.

Bloomberg Global style factor performances - daily since 01/01/15

Source: Bloomberg, as at 2 February 2017

In contrast to the four sided coin toss, 2017 in my view has a much simpler macro framework. I think the year is really only about the direction of interest rates.

Where you think rates will get to and what will be the impact on the real economy is perhaps the only question we need to answer. Everything else is ancillary.

Let me elucidate. Oil I think is closer to fair value at US$55 a barrel than when it was US$35 a barrel. Don’t get me wrong, I still think there is upside here but the easy money has been made. China has the all-important party congress - the party has already shown its hand that when pushed, they are no different from any western central bank and will re-inflate rather than carry out any serious reforms. The US Dollar is now a prisoner of Trump’s MAGA (‘Make America Great Again!’). A strong Dollar has never been good for US manufacturing and jobs, and so is likely to be quickly in the cross hairs of the new administration.

This therefore only leaves interest rates. Bill Gross - the erstwhile bond king - thinks 2.6% yield on the US 10-year yield curve is the critical mark. Jeff Gundlach - the new bond king - thinks the number to ring the end of the 35-year bond bull market is closer to 3%. Everyone is watching this like a hawk and the market, from being a machine that anticipates, is turning increasingly to a machine that only reacts. In a nut shell, the complexity of factors required to accurately estimate the forward outlook is so great that most have given up trying!

Below are my thoughts on the key variables that I think matter:

Interest Rates

The US economy has been showing signs of improvement since late 2015 and, in fact, wage pressures have started to increase. With the economy near full employment (as per the Fed) and the new Administration threatening to put more fuel over the economic fire with another infrastructure and tax stimulus, the Fed has to be more on guard on inflation. Historically, most economic expansions are always curtailed by Fed policy. The question this time around is what is the number on the straw that breaks the camel’s (economic expansion’s) back? Is it one rate rise, or three, or four, from here?

I believe no one really knows but, given the years we have spent in a low interest rate environment with the attendant misallocation of capital, it is best to be a bit more cautious on this point. Corporate leverage is also at fairly high levels and as shareholders we have enjoyed the ‘dividends’ of that over the past few years. So the key call really this year is how interest rates move and how aggressive the Fed is. As long as it does not stymie growth and Trump’s policies encourage further corporate capex, the music and dancing can continue for a bit longer. Watch housing and mortgage availability in the US as a lead indicator carefully!

Trump’s Policies and Tweets

Analysing someone as polarising as Trump is fraught with danger. Your personal emotions and political leanings come in the way of balanced analysis. The one thing I would not underestimate though is Trump’s difference versus every other politician before him. So far he has done exactly what he said he would do and I think based on that we can only believe that this will continue and companies will have to adapt to his ‘Build in America, Buy American, Employ American’ slogan. The transmission of these policies is likely to be initially more negative for the rest of the world and over time more negative for the US. Calibrating your portfolios to that time difference is important. In the short term the bully almost always gets his way. In the medium term, the teacher is always involved to set things right. If the teacher however is the new bully, then change takes a bit longer! One should also not underestimate how difficult it is to navigate the Washington bureaucracy. The checks and balances are there for a reason and hence paradoxically it is much easier for Trump to have an impact on the rest of the World then it is for him to have an impact (in the near term) on his own country!

Geopolitics

Having said that, the biggest impact from Trump will be felt geopolitically. His conversation with the Mexican President and the Australian Prime Minister will put everyone on notice that all erstwhile friendships and combinations are up for recalibration. Unfortunately (for the Americans) the winner of this transactional approach will be China. Seeing the changed realities of US global policy, China will find Mexico, Australia, the ASEAN countries even more amendable to give them a toehold in their geographies. This is, of course, a loss for the US but the impact on American business will probably be more long drawn out. How the US/China trade war plays out over the next few months is key - there will be a tweet but, again, appreciating the time difference between that tweet and its impact on earnings and multiples of a stock is important! Apple stock is your best lead indicator here!

China

I spent some time in Shanghai at the start of the year. The Chinese economy seems to have found a way to soft land with the worries of March 2016 giving way to a better cyclical outlook driven by government stimulus since. However, make no mistake, a drug addict has just been given his fix (more stimuli) and there has been no real cure (financial and structural reform). While this extends the time line of the eventual D-Day - it still lies in the future. To quote Grant’s Interest Rate Observer (dated Jan 13th) - “between year-end 2008 and Sept 30 2016 Chinese bank assets have grown at a compound annual rate of 18%. These total up to US$32.2 trillion which is equivalent to 297% of Chinese GDP and 43% of the world GDP. The US which has its own experience with QE shows commercial bank assets at $16.8 trillion or 90% of US GDP”. So this is a bubbling volcano with no seismologist able to tell you when exactly it will blow, just that you should be far away when it does! Compounding this problem is the $3.8 trillion in wealth management products, which are your ticking time bomb under the volcano. Investors in commodities and commodity oriented economies can enjoy the near term upside that this debt binge is bringing but should be mindful of being close to exit when the music does eventually stop (or pray that the middle kingdom remains in Alice in Wonderland for longer!)

Europe

The positive impact of China was clearly visible in Frankfurt last month, where I had the opportunity to meet a number of companies. Cyclical businesses (industrials, materials, energy companies) are seeing improved activity and consequent earnings upgrades for the first time in many years. While stock performance and consequently valuations look expensive in parts, this is part of the market that is likely to continue to see earnings upgrades versus the quality spectrum (consumer staples, healthcare) but does not share the same volatility of earnings either on the way up or down! This explains in large part as to why these sectors have done well. Stocks follow relative earnings and these stocks have seen the upgrades. This is also an election year in Europe (French, Danish, Italian and German), and the school of thought here is that politicians would like to keep the ship moving along and paper over all the leaks in this critical year. However, this is also the year where the electorate will be able to make its own verdict on Europe. It is my base case that we should anticipate more Trump/Brexit like events rather than hope for status quo to win out. Just like Trump/Brexit, however, it is not a pre-ordained conclusion that a negative political event is necessarily a negative market event.

Emerging Markets/Oil

While in the first half of the year we might see oil prices spiking towards the high $US60s per barrel, as US shale rig count picks up and supply follows, if the US supply response is strong, we might see the market going back into oversupply towards the latter half of the year. I plan to spend some time in Houston in March to research this further but for now have brought down my energy over-weights quite substantially. Other emerging markets will react to the path of interest rates and the Dollar. As long as we live in a benign environment and are seeing cyclical improvement, there is a set of emerging markets which will gain from any US/China spats. A weak Dollar (which is probably the most anti-consensus trade out there) will be positive for emerging markets. Amongst these I am interested in the prospects for Thailand, Indonesia and India. Mexico and Turkey show up on my value screens especially as the currencies seem quite cheap but both have some political issues to deal with first.

How I plan to manage the Fund

To torture my middle seat analogy further, running a global portfolio is a bit like flying an aeroplane from the middle seat. Appreciating both sides of the argument and finding the right balance is very important, and in the current environment it is even more so.

- To be flexible and open minded - try and escape the echo chamber, at least as far as your portfolio allocation is concerned. Opportunities for alpha are limited!

- Over the last few years patience was rewarded as the market was trending in one direction, however, I think now is the time for agility! Portfolios need to be agile.

- Remember interest rates have an impact on valuations. If rates go up, the long term value of your quality/growth companies does come down (it is pure maths of how a discounted cash flow works). So to think that you can be long term and invest in (for example Amazon) long term winners without bothering about the direction of long term interest rates is being lazy! A 1% move up in long term rates reduces my Amazon fair valuation by 30% - not something to be scoffed at.

- If 2016 taught us one thing it was that diversification is important. While in the race of the tortoise (quality stocks) and hare (cyclicals) it may be tempting to bet on one versus the other, a 60:40 wager can have a significantly superior payoff matrix over the long term.

- The best approach to create value is to look for stocks with their own story, whether it relate to some restructuring, management change, industry leadership or M&A optionality. The Global Focus portfolio has lost two of its long term holdings (Booker and Mead Johnson) to M&A in 2017.

- Finally no change to my thinking that capital protection is of utmost importance!