|

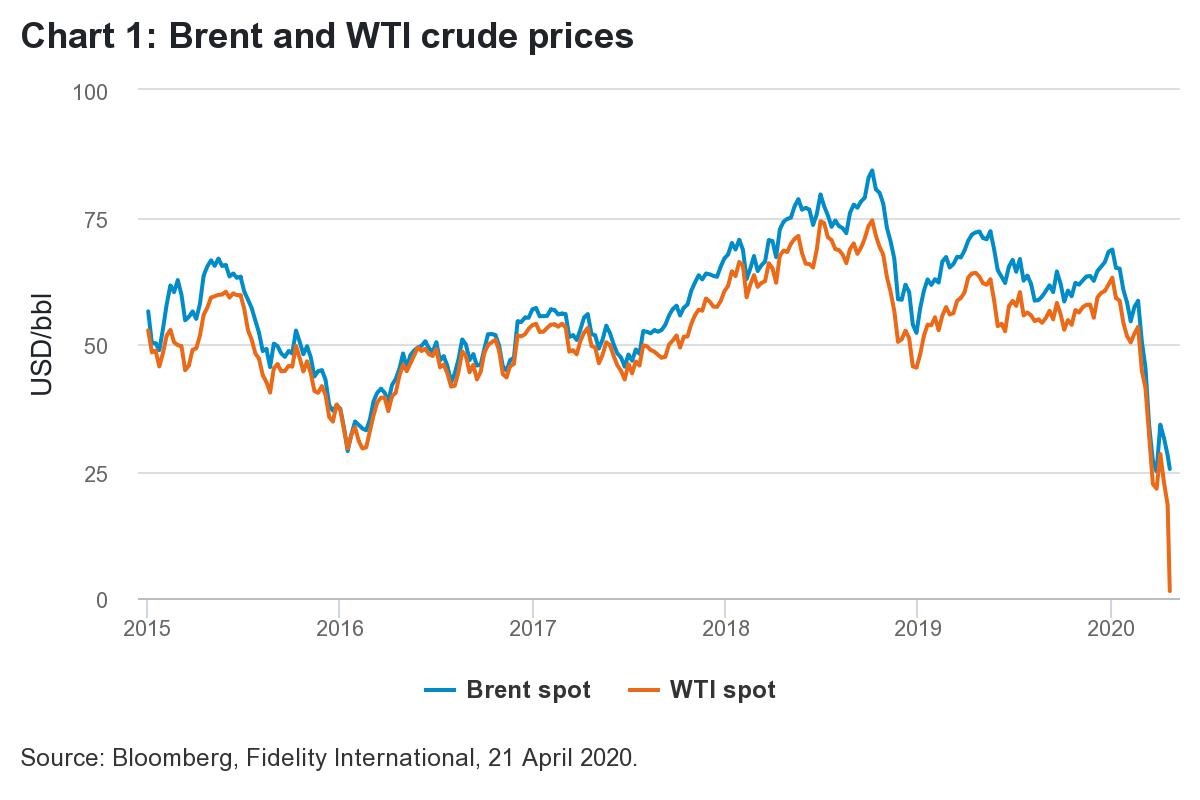

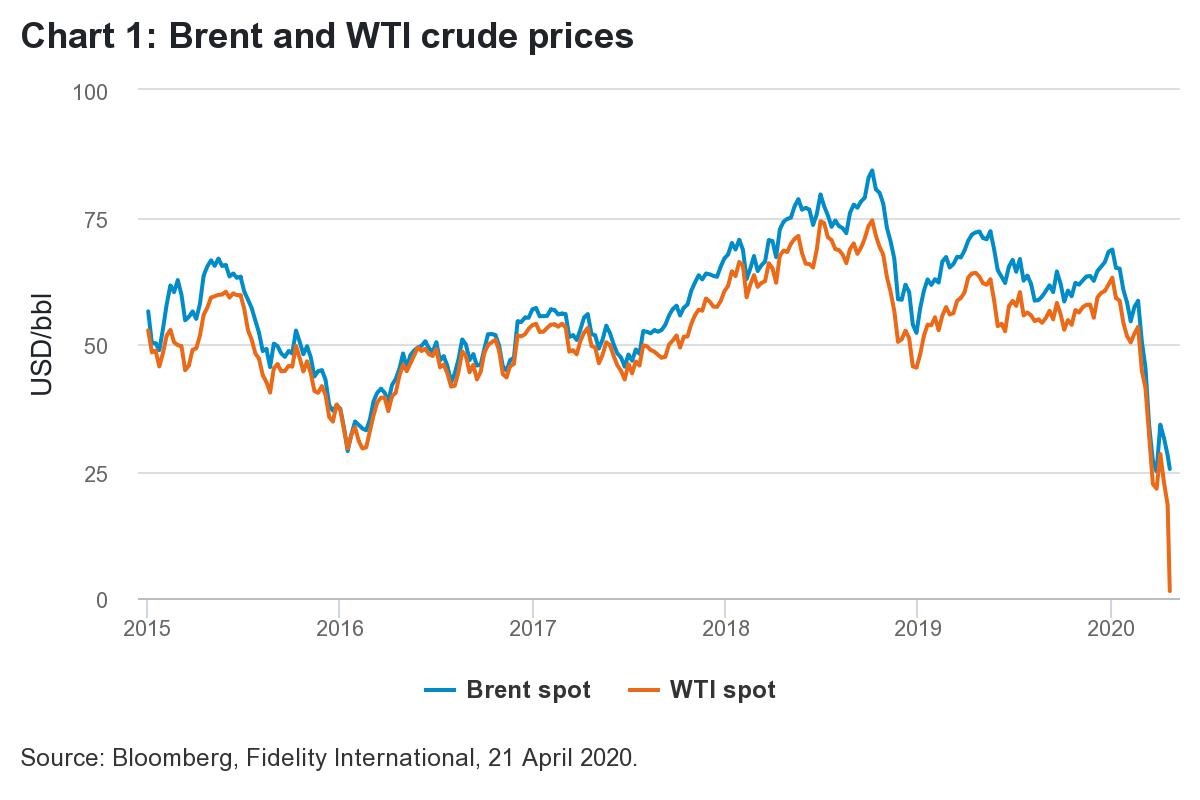

The plunge into negative prices for US WTI oil produced some shocking headlines, but is due to a technical effect of the futures market. Oil fundamentals are weak - but Monday’s price move should be seen as an outlier.

Monday’s plunge in oil prices was both fascinating and unprecedented. US benchmark futures prices for West Texas Intermediate (WTI) dropped to negative $37.63 a barrel before recovering. Is this a sign that underlying global demand for oil, or the depth of the production glut, is much worse than anyone thought?

We think not. Clearly, oil fundamentals are pretty terrible. But yesterday’s price action is best understood as a quirk or peculiarity of futures trading - one that has been made much more extreme by the current situation. Here’s what’s going on:

- First, remember that oil futures are contracts to eventually deliver the physical commodity of a particular grade to a specific location. When we look at the prices on a financial data provider like Bloomberg or Reuters we are seeing the paper market for future months (delivery for next month, or in six months, etc.). As the delivery date approaches, these contracts need to be rolled-over to the subsequent period.

- For WTI, the current ‘front month’ is for delivery at Cushing, Oklahoma in May. But this contract expires April 21, and as of April 22 the new ‘front month’ will be for June. Any financial player or speculator who has been long the current May contract and doesn’t want to take delivery of a physical barrel of oil needs to sell the contract or roll it forward.

- What we saw yesterday in Monday’s selloff is that there were no buyers for WTI physical delivery in May because there is scant demand, refining runs are being cut, and storage at Cushing has already grown to more than 15 million barrels in the past month - and is expected to soon be at capacity for the first time ever.

Investment implications

The price movement confirms that near term demand is very weak. But it isn’t cataclysmic. We don’t see negative oil prices as a new normal going forward. The spot WTI price is now better reflected by the June contract (which was at around $21 as of writing). For comparison, Brent crude, the international benchmark that is less tied to US consumption, did not see the same price action (and the front month is still around $25 as of writing). Dubai crude futures, which are used more as a benchmark for Asian downstream names, is at around $21.

This said, given the global demand shocks stemming from the Covid-19 outbreak, I expect oil prices and associated equities in the sector to remain broadly weak over the near term. The supply cuts that were recently agreed by the Organization of the Petroleum Exporting Countries (OPEC+) group of oil-producing economies are not likely to be sufficient to balance the market soon, in my view. Over the medium term, I see oil price gains capped, as accumulated storage must be unwound, spare capacity must come back online, and the oil-intensity of the economy probably settles below pre-crisis levels.

|