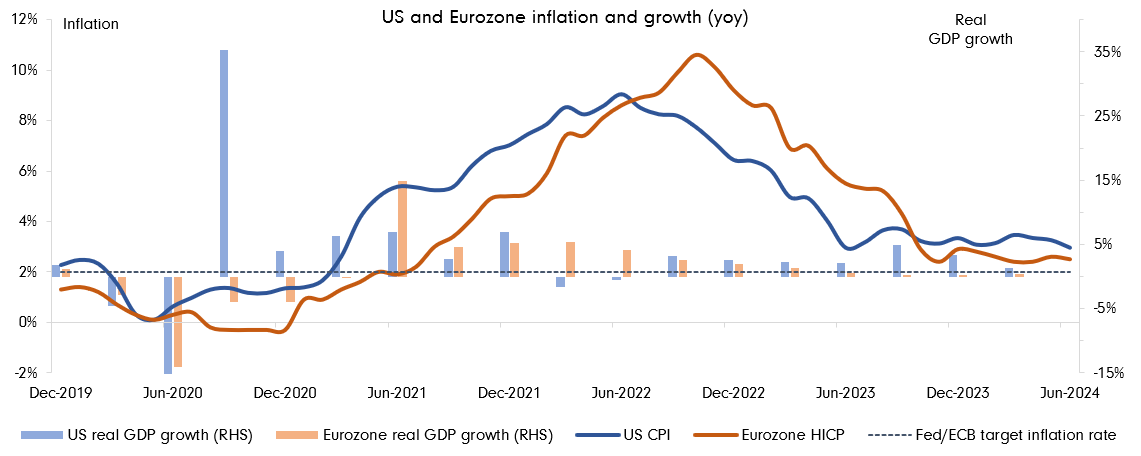

Inflation has stabilised in developed markets, suggesting that central banks are unlikely to raise rates again in this cycle. However, inflation remains above target in many economies including in the US and Eurozone, where it has overshot for three years, and this could persist for longer. As a result, we expect no rate cuts until towards the end of this year or into next year. We highlight some investment strategies that we think could work in this environment.

On track for a soft landing

After the heady levels of inflation in developed markets around the middle of 2022 and a delayed monetary response from many central banks, inflation levels are now more contained. However, inflation remains above target in many markets and the so-called ‘last mile’ is proving more stubborn.

Sticky ‘last mile’ in US and Eurozone inflation

Source: Refinitiv, July 2024

While inflation remains sticky, it’s clear that monetary policymakers have little intention to raise rates again in this cycle. Instead, the next move is much more likely to be a cut. Already some central banks have reduced rates including in Switzerland, Sweden, Canada, and the European Central Bank (ECB) in the Eurozone. Markets are now watching the US Federal Reserve (Fed) and speculating on the timing of its next rate move.

The market expects 1-2 Fed rate cuts this year, with the first in September, possibly followed by another in December. We expect 0-1 rate cuts over the rest of the year, with the timing of the first towards the end of 2024 or early next year. On the economy, our base case is for a soft landing where inflation will be gradually brought to target and growth with slow but remain positive. However, we also place a reasonably high probability on a no landing scenario where growth will continue above trend.

With these dynamics in play through the rest of the year (sticky but contained inflation, 0-1 Fed rate cuts, soft economic landing), we present a range of investment ideas across asset classes that could benefit from such a macro environment.

US mid-cap equities

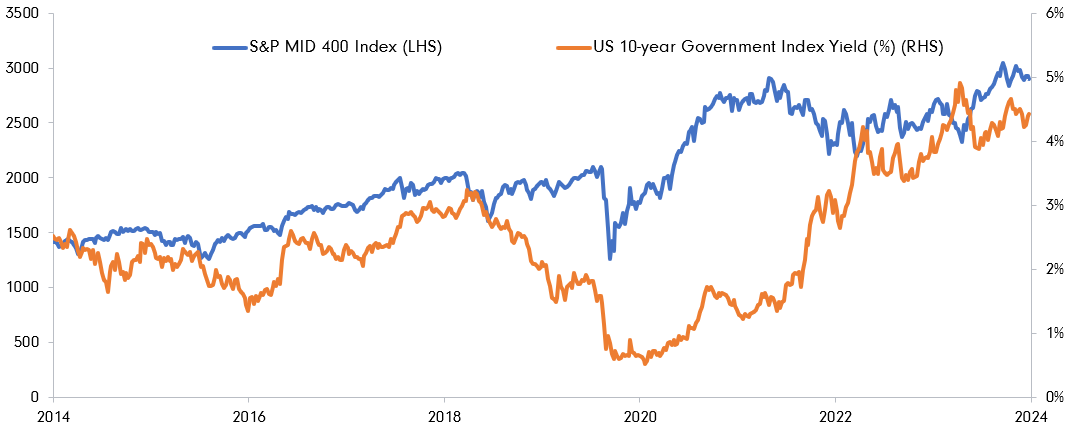

There are portfolio opportunities in this economic regime for investors considering risky assets. In the US, mid-caps and smaller S&P 500 constituents have lagged mega cap stocks. Mega caps have been responsible for around 60% of the S&P 500’s gain this year, with the ‘Magnificent Seven’ stocks returning 37% over the period, while the S&P 500 and S&P Mid 400 returned just 15.3% and 5.3%, respectively as of the end of June. As we gradually move towards a rate cutting cycle, US mid-caps could be primed for outperformance.

Higher interest rates have weighed on mid-caps given they typically face less favourable borrowing terms than larger companies, with lenders offering them relatively higher rates and shorter maturities. Midcaps also tend to have lower cash balances than large caps, which means they cannot as easily fund projects. As interest rate cuts approach, yields should fall, and mid-caps could start to disproportionately benefit compared to larger companies as there is greater incentive to invest organically and fuel growth opportunities.

US mid-caps generally have an inverse relationship with rates

Source: Bloomberg, June 2024

While lower rates could ease expected refinancing rates for mid-caps, it may also result in some of the macro uncertainty dissipating from the economy. Over the past year, the consensus forecast for the economy has moved from a hard landing in the first quarter of 2023, to a soft landing in Q2, back to a hard landing in Q3, to a soft landing in Q4, and now increasing expectations of a no landing in 2024. A gradual and well-telegraphed transition to a rate cutting cycle could provide corporations and investors much welcomed clarity on the direction of the US economy.

While we expect a soft landing in the US, we also place a high probability on a no landing scenario; but either of these outcomes would mean the economy avoids recession and performs strongly compared to other developed markets. Given that US mid-caps stocks are more domestically focussed than their larger counterparts, this could be supportive.

As we move into a rate cutting cycle there could be a broadening out in the US market, with mid-caps a key beneficiary. Powerful themes like artificial intelligence could be explored further and areas such as mid-cap industrials and information technology may be more fully recognised for their exposure to the trend. Valuations are also attractive in the mid-cap space, offering a good mix of risk and reward.