This is an excerpt from an article originally published on Livewire markets on 13 September 2023

There's a famous saying that predictions are hard to make, especially about the future.

For the closing session of Livewire Live 2023, we asked six presenting fund managers to step out of their comfort zone and deliver a shocking prediction for 2024 and beyond. The aim of the exercise was to stimulate debate; to get investors thinking about where the consensus view could be challenged; and the time frame over which these could play out.

Our speakers delivered opinions on topics ranging from food prices and the end of obesity, plus views on asset prices, inflation, Australia as the lucky country and international travel.

The international travel boom is about to bust

Timeframe: 1 year

Speaker: Casey Mclean, Portfolio Manager, Fidelity Australian High Conviction Fund

Casey McLean's own recent travel jaunts and those of his friends haven't changed his view that the post-COVID revenge travel trend won't last. But it's not evidence of declining US credit card spending on travel in the June to September quarter, or declining US airfare prices that is strongest for McLean.

His favourite indicates the wait time at Disneyland on 4 July 2023: 24 minutes compared with 39 minutes in 2019.

He also counsels not getting too excited about China boosting international travel. Not only is the Chinese economy weak, but the Chinese population is also becoming worried about their incomes and property values. They are increasingly seeking out domestic travel - staycations are becoming a trend. He also notes that younger Chinese tourists having different travel preferences to their parents and are not so interested in group travel.

Furthermore, seeking out international travel destinations to buy luxury goods is no longer required as duty free shops have opened in China in places such as Hainan, 'the Chinese Hawaii'

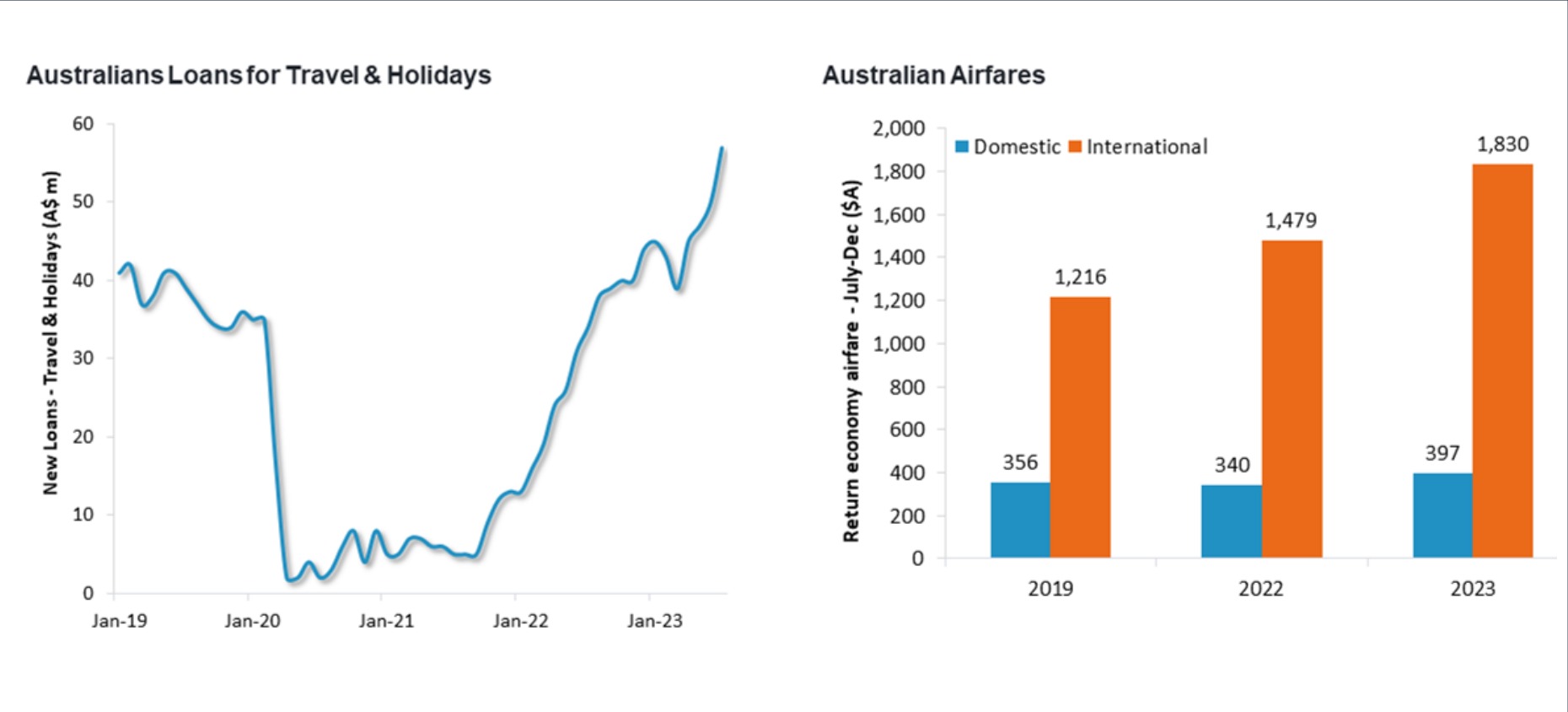

What of Australia? McLean noted the increase in Australian loans for travel and holidays, and also an increase in international airfares. "As international travel enters a nosedive it is the Australian airlines that will be impact."

Source: ABS, Kayak, Fidelity International September 2023

So while there will be headwinds for the airlines, he still sees opportunities in the sector. His pick? Siteminder (ASX: SDR) is a channel management software for hotels, allowing them to manage their inventory of rooms and prices across booking sites. It helps them sell rooms and manage costs.

"There's still a runway for penetration as around 500,000 hotels worldwide still use excel spreadsheets. And they've only converted 39,000. The unit economics are very strong and we believe this can improve as they roll out more features," Mclean told the event.