The very strong performance of cyclical shares in the second half of 2016 has left many investors arguing that their re-rating was unjustified, citing an uncertain political and macro-economic environment as reasons to avoid them, and stick to exclusively ‘defensive’ strategies. Indeed, having seen such a significant re-rating of many lower-quality businesses, one can see the sense in questioning the attractiveness of these businesses today. Although this view may appear intuitively sensible, I think it contains a faulty analysis of today’s market.

The outsize returns in cyclical stocks during 2016 primarily reflect their historically unloved and under-owned status at the beginning of the year, rather than rampant optimism at the end. In other words, it was a big bounce off a low base. It is true that earnings expectations have recovered but, in selected areas, they are by no means excessive. So, while the relative performance potential of cyclical shares remains attractive, a more discriminating approach will be required to separate the best opportunities from those that could disappoint.

Let’s look at an example where valuations remain attractive:

Royal Dutch Shell

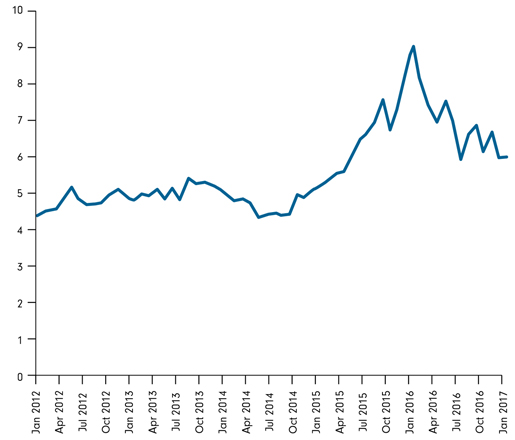

Despite rising 50% last year, Shell shares still trade on a 6% dividend yield, suggesting that the market does not believe the company will be able to sustainably cover its dividend with free cash flow, and that it will ultimately be forced to cut the dividend.

Chart: Shell’s dividend yield

Source: DataStream, December 2016

However, my view is that improved capital discipline at the company and rising cash flows from BG’s assets will allow the dividend to be covered, and possibly in time, grow once again. Although Shell’s valuation did rise last year, this was primarily driven by the recovery in the oil price rather than the market fundamentally re-appraising its view of the value of the company - meaning there is considerable potential for Shell’s share price, despite the gains of last year.

Don’t be disappointed

Where I have some sympathy with the sceptics is around the fairly indiscriminate nature of last year’s value rally. Markets are now expecting an earnings recovery across nearly all global cyclical areas. While there are some areas where these expectations could well be surpassed, equally there are other areas where I think there is a good chance of disappointment.

As a generalisation, the stocks I have invested in have been in industries which have seen a reduction in supply and competitive intensity. These are the companies where I see the most potential for returns to improve materially and sustainably. The banking and oil sectors fit this description, but there are other cyclical sectors, such as mining, where I am wary.

The demand improvement in the mining sector is being driven primarily by Chinese stimulus, the economic value of which is highly questionable and it is unlikely to last forever. With no meaningful supply-side adjustment taking place in key industrial metal markets, there is a real risk of significant disappointment if a withdrawal of Chinese stimulus packages causes a fall in spot prices. As such, I continue to avoid the area for the time being.

Proper diversification includes some cyclical exposure

The unforeseen political changes in 2016, alongside reasonable global GDP growth, have presented the first serious challenge to the deeply embedded ‘lower for longer’ interest rates framework. If interest rates have finally stopped falling, this would remove what has been a structural headwind, and create a much more supportive environment for value investing to re-assert itself in the mainstream market, after a long period in the wilderness.

While I do not expect value investing to outperform in a straight line from here, or necessarily to repeat the dramatic short-term outperformance of last year, 2016 should serve as a reminder to investors that proper diversification means being prepared for multiple macroeconomic scenarios, including inflation, growth and rising rates.