Download PDF Download Infographic

Updated 2 May 2024

At the confluence of change driving growth

Asia is at the confluence of many forces driving growth globally. Demographics and digitalisation have fuelled economic and business expansion, which has played an important feature in the management of the region’s resilient economy. Looking ahead, we believe Asia’s enduring role in driving global growth can continue.

New possibilities are emerging as opportunities arise from dislocation and existing trends accelerate. Countries in Asia with younger populations and growing middle classes have consumption tailwinds and offer some of the best growth opportunities. Economies shifting from globalisation to regionalisation, and countries with large local regional populations, also stand to benefit.

“The last five years have been quite challenging. Markets in this region have been volatile, particularly China, and that has preserved opportunities

we’ve taken advantage of.

Anthony Srom, Portfolio Manager, Fidelity Asia Fund

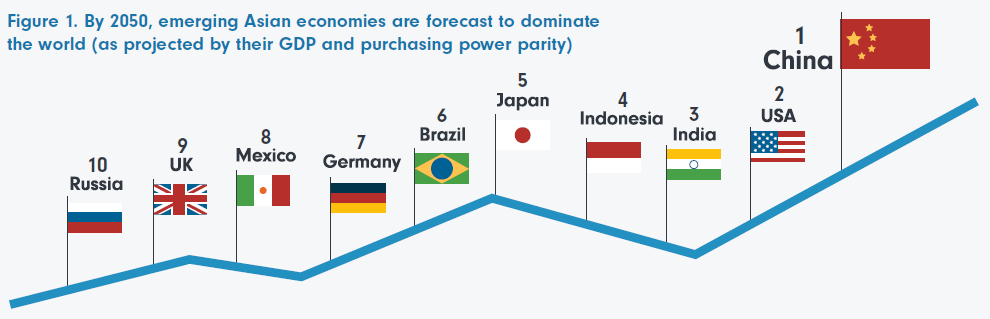

Source: World Economies Projected To Be The Largest By 2050

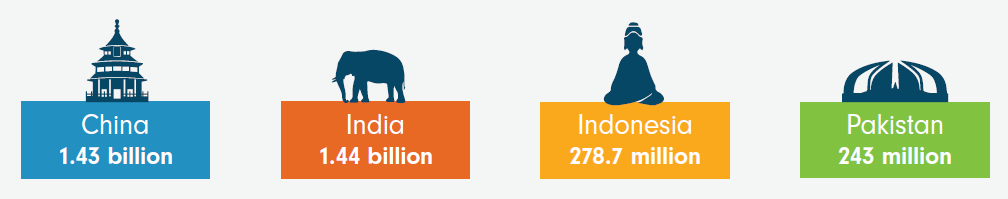

Figure 2. Asia is home to 60% of the world’s population

Source: Asian Countries by population (2024)

For investors seeking long-term growth and diversification, the case for investing in Asia remains strong. However, no-one can ignore that domestic imbalances and geopolitical risks persist.

There is increasing dispersion across Asia at a country, sector and company level, and to choose the winners of the next decade, local expertise and a selective approach will be paramount.

How demographics and technology are driving growth

The World Data Lab expects 113 million people to joining the global middle class in 2024, with the vast majority coming from Asia.

The following table breaks down Asia’s 91 million new consumers for 2024, by country. Note that only countries which contribute at least 1 million consumers are broken out, with the rest grouped into ‘Other’.

Table 1. Asia’s 91 million new consumers for 2024

| Country | New consumers (millions) |

| China | 31 |

| India | 33 |

| Indonesia | 5 |

| Bangladesh | 5 |

| Vietnam | 4 |

| Pakistan | 3 |

| Philippines | 2 |

| Turkiye | 1 |

| Thailand | 1 |

| Other | 6 |

China and India are projected to be the two biggest sources of additions to the global middle class in 2024. Both countries have massive populations, rising income levels, and high rates of urbanisation.

Further down the list, we can see Indonesia and Bangladesh adding five million consumers each.

Both of these countries have an expansive population pyramid, meaning they have a relatively young average age and growing labour forces. It’s interesting to note that many of the countries listed above, including Vietnam, Philippine, and Thailand, also happen to be some of the fastest growing e-commerce markets in the world.

Digital economy driving growth

During the pandemic, digital connectivity in Asia played a vital role in overcoming the difficulties of conventional trade. The digital economy acted as a key enabling factor in the Asian recovery and, according to Nikkei Asia, the pandemic has had a striking impact on Southeast Asia’s digital economy: 60 million people in the region became online consumers during this period.

With this accelerated uptake of technology, there was an increase in nearly all e-commerce during the pandemic, with solid growth in sports equipment and supermarket items. Asia now accounts for nearly 60% of the world’s online retail sales according to Digital Commerce 360.

Four of the MSCI AC Asia ex-Japan top ten holdings come from the information technology sector (refer to Table 2, following), which speaks to the importance of this industry in the Asian growth story.

Table 2. MSCI AC Asia (ex Japan) Index top 10 companies as at 29 February 2024

| Company | Country | Sector |

| Taiwan Semiconductor MFG |

Taiwan | Information technology |

| Samsung Electronics | Korea | Information technology |

| Tencent Holdings | China | Communications services |

| Alibaba Group Holdings | China | Consumer discretionary |

| Reliance Industries | India | Energy |

| AIA Group | Hong Kong | Financials |

| PDD holdings A ADR | China | Financials |

| Infosys | India | Information technology |

| ICICI Bank | India | Financials |

| SK Hynix | Korea | Information technology |

Source: MSCI AC Asia ex Japan index.

Spending on digital growth is set to continue. The IDC FutureScape Report 20241 predicts that in 2024, digital spending growth will outpace that of the region’s economy.

Digital opportunities beyond the large caps

At the stock and sector level, we’ve seen the rise of digital innovation in Asia, with Chinese internet giants Tencent and Alibaba snapping at the heels of their FAANG (Facebook, Apple, Alphabet, Netflix, Google) counterparts in the US. But these large-cap players are just a part of the tech enterprise movement in Asia.

There has been a recent surge in new digital businesses that don’t yet feature in broad market indices. Investors looking to capitalise on tech innovation and growth in the region need to look beyond established stocks and indices.

Supply chain resilience

We are also witnessing new trends developing across supply chains. Intra-Asian trade – which for most economies in Asia already represents most of their exports and imports – has accelerated over the past few years. Proximity increasingly features as a factor to overcome any friction of travel and transport in supply chains.

Countries like Vietnam, Malaysia, Indonesia and Thailand stand to benefit as global firms adjust their China exposure or pursue a so-called ‘China plus one’ strategy by relocating part of their supply chains to the ASEAN bloc.

We also expect to see the rise of regional economic centres where growing demand from large economies such as China or India fuel growth in other developing countries nearby.

Are investors missing out?

Despite the strong economic and demographic trends in this region, Asian companies are under-represented in global equity indices. In the MSCI AC Asia (ex-Japan) Index, Asian stocks (excluding Japan) make up just 9.1% of the global index.2 And for those investors invested in Asia via a market index, you may be missing out on tomorrow’s growth drivers, as much of the index is still laden with state-owned enterprises and ‘old economy’ companies.

Active managers, not beholden to the index, can capture new opportunities because they take a forward-looking approach to allocating capital and aim to invest in companies well positioned to benefit from the long-term structural developments. Investing is Asia is complex and requires a nuanced approach to be able to navigate the risks and identify the long-term winners.

Expert access to the best investment opportunities in Asia

Fidelity has been on the ground doing business in Asia for more than 50 years. This extensive track record in the region provides our Fidelity Asia Fund Portfolio Manager, Anthony Srom, with a truly unique and independent view of the factors shaping returns from Asian companies. Based in Singapore, Anthony joined Fidelity in 2006 and has over 20 years of investment experience.

Case study

TSMC: Leading the field in chip technology

Taiwan Semiconductor Manufacturing Company (TSMC) has been at the forefront of chip design since the early 1980s. Today, TSMC dominates the outsourced semiconductor industry and enjoys more than 50% market share. It supplies the world’s leading technology companies including the biggest brand of all – Apple. In 2022 it delivered its thirteenth consecutive year of record revenue, and its 5-nanometer family of technologies contributed 26% of TSMC’s revenue. Its R&D investment in

2022 was US$5.47 billion, and it has an ongoing commitment to sustainability and corporate social responsibility.3

A consistent focus on developing a sophisticated and large-scale manufacturing capability has enabled the business to benefit from growing demand for its product. Providing chips for a wide range of devices has broadened its expertise, keeping it one step ahead of competitors in the race to release the next generation of chips.

Access our best ideas in Asia

Portfolio Manager for the Fidelity Asia Fund, Anthony Srom, is backed by a 400+-strong team of investment professionals worldwide. He carefully selects 20 to

35 companies from more than 1,500 Asian equities to build a concentrated, high-conviction portfolio of our best ideas in Asia.

Sources:

1. 1. IDC FutureScape: Worldwide Digital Business Strategies 2024 Predictions – Asia/Pacific (Excluding Japan) Implications, IDC.

2. Fidelity International/MSCI All Worlds Index, 31 December 2023.

3. TSMC Annual Report 2022.