Updated March 2024

Predictable long-term trends shaping global growth

Demographic analysis is the study of historical and projected changes in population over time that have the power to significantly impact society and economies. These trends, which can be predicted with a relatively high degree of certainty, can create exciting opportunities for the active stock-picking investor.

Unlike macroeconomic cycles and investor sentiment, demographic trends are slow-moving, so their cumulative effects are not properly valued by myopic markets. This creates an opportunity for investment strategies like the Fidelity Global Demographics Fund that focuses on companies benefitting from these long-term structural changes.

What are demographics?

Demographics are slow-in-duration, highly predictable mega-trends that we can use as a compass for investing in the future. While markets can be moved in the short term by fads and fashions, we focus on finding high-quality, sustainable companies set to benefit long term from the structural tailwinds of demographics.

“By investing in companies where demographic trends are the most important factor for earnings, we believe the Fund will enjoy strong long-term earnings growth and lower volatility than the market.” Aneta Wynimko, Portfolio Manager Fidelity Global Demographics Fund

Three mega-trends shaping global growth, on which active investors can capitalise.

1 We are living longer lives

According to the United Nations’ Population Division, the world is undergoing a period of population ageing that is ‘without parallel in the history of humanity’.

This process is a result of the combined effects of declining mortality rates, increased longevity, and lower fertility rates. Older persons aged 60 and over today comprise the world’s fastest growing age group, and in 2045 this group is expected to exceed the number of children (aged under 15) for the first time.

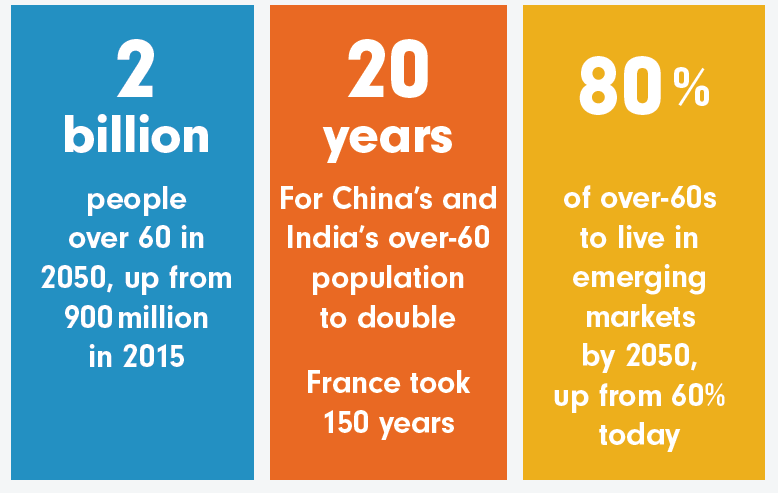

"By 2050 there will be two billion people aged over 60.”

While ageing populations is more prominent in developed countries, it is a global phenomenon. By 2050, one in three people in developed countries is expected to be aged 60 and over compared with one in five today.

Source: Fidelity International, HSBC, UN Population Database, February 2021.

Ageing of the world’s population has massive investment implications and opportunities in industries such as healthcare, robotics, aged services and finance.

Opportunities in health care

Private hospitals, care services and drug manufacturers are positioned to see rising demand. As people live longer, there will also be increasing demand for discretionary treatments for eye and hearing products to improve their quality of life.

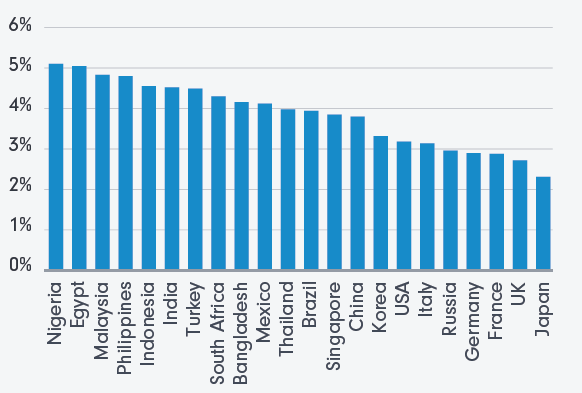

Figure 1. Increase in healthcare spend (2019 – 2045 compound annual growth rate)

Source: Global Demographics, HSBC estimates, https://www.research.hsbc.com/C/1/1/320/xCDPDnl?_lrsc=5b442a9a-aeb0-4cc5-bf21-4d5b6774b0a6

Case study

IQVIA is the world’s largest clinical research organisation (CRO) and runs clinical trials, and offers research services to the pharmaceutical and biotech industry. The fundamental backdrop of the CRO industry is extremely attractive due to high levels of biopharma funding and the growing number of clinical trials. Thanks to its differentiated product offering, market-leading data and technology, and ‘one-stop shop’ approach, IQVIA is a premium operator in this field. Global population ageing and increasing healthcare spending create a favourable backdrop for the company.

Opportunities in robotics and automation

As a population ages, the size of its workforce also declines, creating opportunities for companies in robotics and automation. Japan and Germany have some of the oldest workforces in the world and have some of the highest density of robots and automation.

In its most basic form, automation is the replacement of a human worker with a machine. These machines reduce costs, free up worker capacity for other tasks – and they never sleep. We see a long runway for growth in automation, with low density rates in other parts of the world as almost all industries have adopted automation to some degree in their supply chains.

2 Better lives via expanding middle class

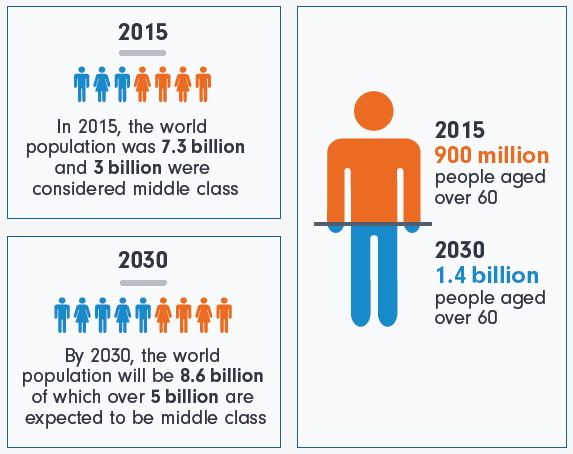

The composition of the global population is changing as rising incomes, particularly in the developing world, translate into an expanding middle class.1

Over recent decades, the middle class has grown exponentially. Of the 7.6 billion citizens in the world, 3.6 billion now belong to the middle class. This is staggering considering that just 10 years earlier, the size of the middle class was only half as much.2

The middle class speed of growth is also accelerating. After reaching the first billion at the end of the 1980s, it took more than 20 years to add another billion to the middle class, but only around eight years to add the next 1.6 billion. Latest estimates place the middle-class population at around 5.2 billion in 2030, representing two‑thirds of the world’s population.

Figure 2. The difference 15 years can make

Source: United Nations Department of Economic and Social Affairs, Population Division, World Population Prospects: The 2022 Revision. Produced by: United Nations Department of Public Information. Middle Class definition is that of households spending $11–110 per day per person in 2011 PPP, building on the definition outlined in Homi Kharas (2010), White Paper No. 285 for the OECD Development Center.

A multi-trillion dollar opportunity with Asia at its epicentre

Most of the growth will come from the developing world, particularly Asia, which McKinsey estimates will represent over US$10 trillion worth of consumption over the next 10 years.3 The growth in the emerging middle class provides support for a wide range of discretionary products from phones to fashion and electronics to automobiles, boosted by the trend of ‘premiumisation’, where consumers trade up for superior products as incomes rise.

Case study

LVMH is a French global luxury group active across six sectors: wines and spirits, fashion and leather goods, perfumes and cosmetics, watches and jewellery, selective retailing and other activities. LVMH’s portfolio of brands offers good diversity and less cyclicality compared to peers. The company has delivered consistently high returns on capital and has one of the best management teams in the sector. Emerging middle class expansion remains a key engine of growth for the business, as consumers ‘trade up’ as their incomes rise.

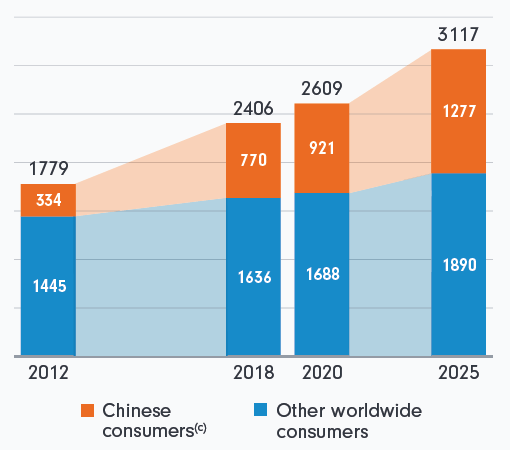

Figure 3. Global personal luxury goods(a) market evolution, RMB(b) billion

(a) Ready to wear, accessories, watches and jewellery, and beauty.

(b) Fixed exchange rate of £1=7.3 RMB.

(c) Both domestic and overseas spending.

Source: McKinsey China Luxury Report 2019 estimates, HSBC.

Focus on sustainability

As more people join the middle class, the challenge for businesses will be to meet this demand while protecting the long-term sustainability of people and the planet. Over the past 50 years, global consumption has been exerting increasing stress on the Earth’s ecosystems.

In general, consumers are growing more aware of sustainability issues and making more conscious purchasing decisions, with most younger people willing to use their consumption power to affect change. The new consumption patterns born will both benefit and disrupt several sectors, crystallising the need for an ongoing focus on sustainability.

3 More lives

Over the past few centuries, there has been a dramatic increase in population and this trend is set to continue.

By 2100, the global population could more than double the 5.3 billion in 1990. The overwhelming drivers of growth are developing countries. This is a result of the combined effects of declining mortality rates, increased longevity, and lower fertility rates. Older persons aged 60 and over, today comprise the world’s fastest growing age group and in 2045 this group is expected to exceed the number of children (aged under 15) for the first time.

Figure 4. Projected world population to 2100

Source: United Nations Department of Economic and Social Affairs, Population Division, World Population Prospects: The 2015 Revision Produced by: United Nations Department of Public Information.

The projected population will boost global demand and underpin economic growth. But a growing population also raises demand for resources, such as food, water, arable land and energy, contributing to climate change. The World Bank estimates that demand for food will rise by 70% by 2050. This poses a serious challenge for food production, particularly given that the amount of arable land in the world is falling due to industrialisation and urbanisation.

To help meet this demand, companies are producing sustainable fertilisers and pesticides and developing precision farming techniques to increase crop yields.

Likewise, to meet increasing water and energy demands, we expect to see investment in sustainable water solutions across the supply and distribution of water, as well as into renewable energy sources, with wind and solar set to be the largest beneficiaries.

Case study

SolarEdge Technologies is a global solar inverter company. It is the leading Israeli solar invertor business with a strong long-term growth outlook. A market leader, it is generating double-digit returns and benefits from the long-term rise in electricity demand, fuelled by population growth and urbanisation.

As sustainability considerations mount, Solaredge is set to gain from the growing trend of electrification in areas previously dominated by fossil fuels.

Sources:

- Middle class is defined in line with Homi Kharas’ (https://www.oecd.org/dev/44457738.pdf) as households spending $11–110 per day per person in 2011 purchasing power parity, or PPP.

- All numerical estimates are made using the methodology developed by Homi Kharas. See H. Kharas (2010), ‘The emerging middle class in developing countries’, OECD Working Paper; H. Kharas (2017), ‘The unprecedented expansion of the global middle class: An update’, Brookings, and data from the Word Data Lab.

- McKinsey, Global Institute Analysis, August 2021 (https://www.mckinsey.com/featured-insights/asia-pacific/beyond-income-redrawing-asias-consumer-map)