Updated May 2024

There’s so much more to global investing than the mega household names such as Apple and Amazon that everyone is familiar with. There’s a whole world out there and so many diverse opportunities.

James Abela, Co-Portfolio Manager, Fidelity Global Future Leaders Fund

Segmenting the market

The value of companies listed on stock exchanges around the world varies enormously. Apple became the first firm ever to reach a valuation of US$3 trillion in early 2022;1 the smallest firms, on the other hand, are typically worth in the millions of dollars.

A useful way to begin this journey is to segment companies in terms of their market capitalisation – or market cap. In this way, each listed company can be broadly categorised as large-cap, mid-cap or small-cap, depending on its value. It is the large-cap stocks that investors are usually most familiar with, and which dominate well-known market indices.

Looking beyond the large caps

Although large-caps dominate the headlines, it would be a mistake for investors to ignore the multitude of mid-caps and small-caps on offer, as these could well offer better growth and returns. After all, on their way to becoming large-caps, the likes of Apple, Microsoft and Amazon began life as small-caps or mid-caps.

As they grew to become superstars, their valuations multiplied several-fold, and those who invested early reaped the rewards of holding these so-called ‘multi‑baggers’ – that is, companies whose valuations increase by many multiples.

The difficulty, of course, lies in identifying these future industry leaders at their early stages of growth – while keeping in mind that for every Apple that makes it, countless others don’t. This is made more challenging by the fact that investment analysts focus most of their research efforts on large-caps, which comprise the bulk of major indices and investment portfolios.

Yet therein lies the opportunity, since the relative lack of research on mid-caps and small-caps increases the likelihood that high-quality businesses with tremendous growth potential are ‘flying under the radar’ and trading at attractive valuations.

Characteristics of small, mid and large cap segments

What’s also important for investors to understand is that small and mid-cap segments of the market may have differing characteristics relative to large-cap segments, as the table below illustrates.

Table 1. Typical characteristics of large-cap, mid-cap and small-cap segments

| Large-cap | Mid-cap | Small-cap | |

|---|---|---|---|

| Maturity level | Generally well established | Generally established | Can be earlier stage |

| Volatility | Low | Medium | High |

| Potential for high returns | Low | High | High |

| Potential for negative returns | Low | Medium | High |

| Liquidity (ease and cost of trading) | Very good | Good | Typically low |

| Availability of company information and detailed research insight | Very high | High | Typically l |

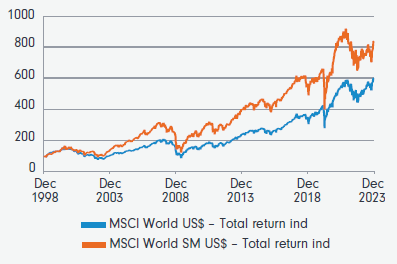

Over the past 25 years or so, taken as a market segment, global mid-caps and small-caps have generated higher returns than large-caps (Figure 1). Looking ahead, new leaders will continue to emerge from the mid-cap segment – in part due to the difficulties incumbents face in staying ahead of the curve. After all, large established firms may not have the appetite to develop new, disruptive technologies or ways of operating.

Figure 1. Long-term total returns profile comparison (US$)

Source: Factset, Refinitiv DataStream, 31 December 2023. Data period from 31 Dec 1998.

Indices referenced in blue: MSCI World Large Cap & MSCI World Mid Cap.

Indices referenced in orange: MSCI World & MSCI World SMID Cap Index (MSCI WORLD:SM).

Please remember past performance is not a reliable indicator of future performance.

There is no shortage of examples of this in action. Take electric vehicles: While it may be more challenging for the world’s most established car manufacturers to do a hard pivot to focus on electric engines, Tesla has had no such concerns.

The success of small and mid-cap companies may also make inroads into markets held by incumbents much faster than expected. Twenty years ago, few would have imagined the force Amazon has become in retail. Amazon founder Jeff Bezos famously predicted his company would eventually fail, and that lifespans of large companies ‘tend to be 30‑plus years, not a hundred-plus years’.2

The reality is, just a handful of today’s small-caps and mid-caps will one day emerge as future leaders within their fields. Defining the ingredients to success is often difficult as it requires understanding the competitive nature of the market, their competitors, the financial position of the company and what is unique in their product or service that differentiates them. Successful companies in the global mid-cap universe are typically structural winners, technology disruptors, innovators, category killers or brand leaders. Some are unique niche operators or specialists that dominate their field.

Others are part of a large global theme. Sectors such as technology, healthcare, globally focused consumer, and industrials have more recently been home to such business models.

Table 2. Example small and mid cap themes

| Sector | Themes |

|---|---|

| Technology |

|

| Energy, resources and utilities |

|

| Consumer |

|

Many of these businesses are also founder-led. Where they are, their management teams tend to be innovative and agile, and their interests are generally strongly aligned with those of outside shareholders.

Sustainability mindset integral for small and mid-cap companies

At Fidelity, within the context of a fund portfolio and at an individual stock level, we think about ESG factors holistically.

Any company with the ambition of becoming a future leader must operate with a sustainability focus to retain its viability and credibility as a long-duration business. Without an ESG-conscious and ESG-inclusive approach, not only will the cost of capital rise significantly for businesses, but their products and services may also not be able to capture market share in their specific areas. Simultaneously, experienced investors would also vouch for the importance of assessing the stock and company’s sustainability credentials and differentiating it from a momentum-driven uptrend in a ‘green theme’, to ensure that both the returns on capital can endure and that, as institutional investors, we continue to adhere to our sustainability pledges.

Why go global?

Over the past decade in Australia, we’ve witnessed some amazing mid-cap and small-cap businesses evolve from an idea to established international businesses, including now well-known names such as Domino’s, Resmed, and CSL.

Looking beyond Australia makes sense; it brings a greater chance of finding those unicorns because the global mid-cap and small-cap opportunity set is far broader and deeper. Investors have the opportunity to capture significant growth, as shown by the returns generated by some global mid-cap firms in Table 3.

| Company | Sector | Region | Total returns over a decade ^ |

|---|---|---|---|

| CDW | Information Technology | US | 981% |

| Ares Management | Financials | US | 885% |

| United Rentals | Industrials | US | 646% |

| Quanta Services | Industrials | US | 595% |

| NVR | Consumer Discretionary | US | 582% |

| James Hardie Industries | Materials | Australia | 453% |

| TDK | Information Technology | Japan | 375% |

| Cboe Global Markets | Financials | US | 295% |

| Ametek | Industrials | US | 235% |

Source: Fidelity International, Refinitiv DataStream as at 31 December 2023.

^ Calculated on a daily basis from 31 December 2013 – 31 December 2023 in local currency terms.

Reference to specific securities should not be taken as recommendations to the investor to buy, sell or hold the same and may not represent actual holdings in the portfolio at the time of viewing. Performance of the security is not a representation of the Fund’s performance.

The benefits of active management

Recent market challenges have highlighted the importance of investing in high-quality names, characterised by sound balance sheet structures that enable companies to weather more challenging environments. Finding such companies takes work – it’s a research-intensive process.

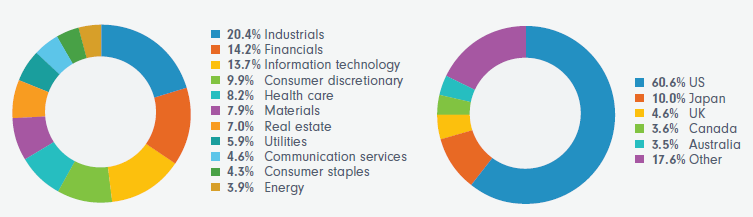

Figure 2. MSCI World Mid Cap Index sector and country weightings

Source: MSCI World Mid Cap Index (USD) as at 29 February 2024.

Additionally, investing in a fund that has an active management approach brings advantages for investors as it allows investment teams to select opportunities from a much broader universe than those available in the benchmark index, as well as take active positions across countries, sectors and companies.

Case study: Quanta Services

Quanta Services is headquartered in Houston, Texas. Quanta holds an approximately 15% share3 of the $70 billion market of supplying electrical transmission and distribution infrastructure services to US utilities. The company is a leader in a growing market of utilities infrastructure to accommodate the fast growth in wind and solar power supply, as well as growing demand from clean energy investments, which require modernisation of existing grids. It is considered a trusted provider in large-scale projects, holding a strong market share position in the outsourced market. Revenue mix exposure towards regulated utilities which require ongoing repair/replacement/upgrade creates a strong recurring revenue base.

A proven manager in small-mid caps

Our fund is co-managed by James Abela, Portfolio Manager of Fidelity’s Future Leaders Fund, who has been successfully managing the Australian-specific Future Leaders Fund since its inception in 2013. His co-manager, Maroun Younes, brings extensive experience covering a variety of sectors including telecommunications, media, technology and resources.

Along with their wealth of experience, these proven portfolio managers leverage the insights of one of the world’s largest research teams in making their investment decisions. Fidelity’s 400+ team of investment professionals covers all geographies and sectors in which the bulk of global future leaders are likely to reside.