Download PDF Download Infographic

Updated 16 March 2023

To many outsiders, investing in Chinese equities might conjure up images of a huge momentum-fueled market rife with speculation or a market driven by opaque regulations and policies. But developments on the ground in China show a changing market, with familiar features such as liquidity, a diversified opportunity set, advanced trading and settlement systems, and securities oversight that you would typically encounter in Australia or any other developed economy. While it remains a retail-driven market, international institutional investor participation in China’s onshore market has broadened over the last decade, and foreign investors have increased their exposure to the world’s second-largest economy in their portfolios.

Moving to centre stage

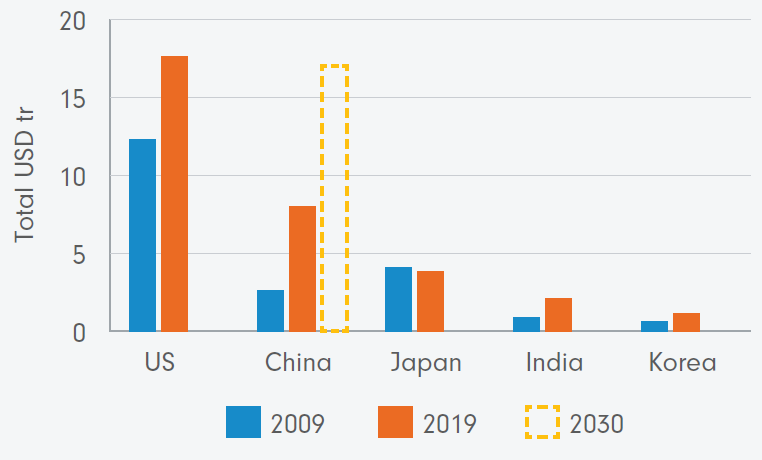

For more than 40 years, the Chinese economy has been undergoing rapid transformation driven by a government-mandated shift from agriculture to manufacturing and technology. This growth

momentum is propelling China closer to surpassing the US, to become the world’s largest economy. China is the largest contributor to global growth, and the IMF forecasts this to continue in the coming years.

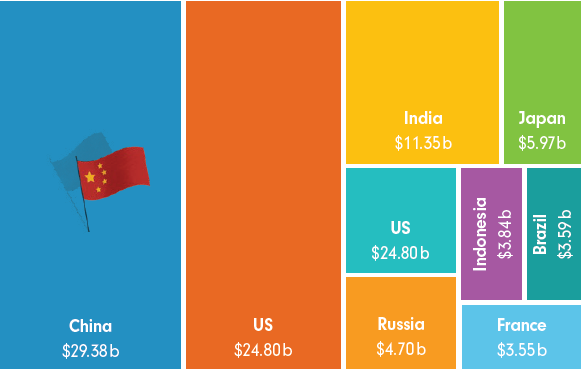

Figure 1. China is the main driver of global growth

Contribution to global GDP in US$billions, based on purchasing power parity

GDP Forecast by Country, Statistics from IMF 2021–2025

Reflecting the size of its economy, China’s capital market has also grown in depth and breadth. It is home to the world’s second-largest equity market by market capitalisation and a diverse range of industries across state-owned and private sectors.1 This broad investment universe implies an attractive diversification source for international investors.

China’s 14th five-year plan outlines a vision for 2025

The key to China’s long-term economic success rests on revitalising productivity growth, which requires substantive economic reforms. The 14th Five-Year Plan has laid out a blueprint for the way forward. Launched in 2021, the Plan outlines China’s goals and policies in key focus areas — which may yield opportunities for equity investors over the next several years. Let’s take a high-level look at some of the main themes outlined in the Plan.

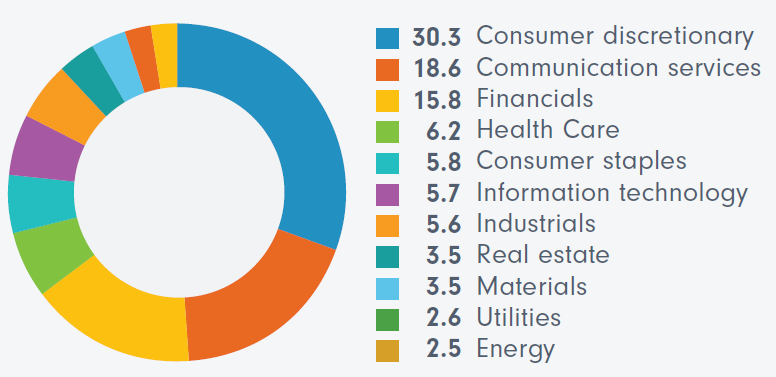

Figure 2. China’s broad investment universe offers opportunities across growth industries

Global leadership in technology and manufacturing innovation

China aims to be a leader in innovation by 2035. To achieve that, it is increasing funding for research and development, seeking to achieve breakthroughs in core technologies such as artificial intelligence, cloud computing, and semiconductors, to name a few. Another key target is to get 56% of the country on 5G networks over the same period.2

As China ascends the value chain, the government plans to transform the nation into an advanced manufacturing superpower to increase China’s global competitiveness in areas such as robotics, agricultural machinery, new energy vehicles, and aircraft development.

Emphasis on the environment

China aims to reach carbon neutrality by 2060, with an energy policy that emphasises the clean and efficient use of coal, and a move toward new and alternative energy sources, with the Global Wind Energy Council recognising the country as the global leader in new offshore wind capacity. As China aims for higher standards of environmental protection, demand for related equipment, services and investment is expected to grow and create new opportunities in this space.

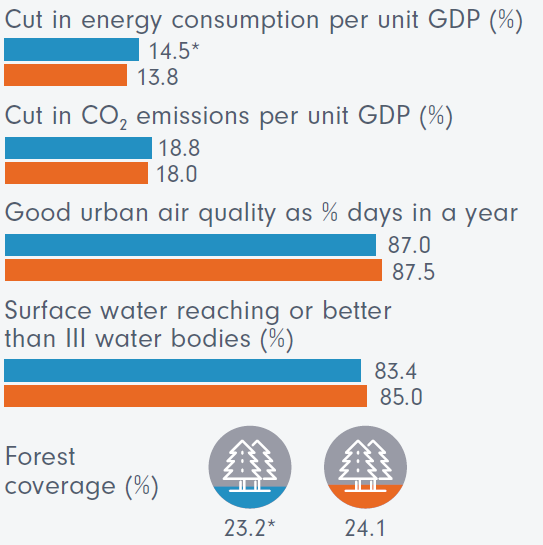

Figure 3. Snapshot of Chinese environmental targets under the 14th Five-Year Plan

China’s 14th Five-Year Plan (2021–2025) Report, Hill+Knowlton Strategies

Rural revitalisation and new urbanisation

China’s urbanisation trend is set to continue, with significant implications for infrastructure as well as income and consumption trends. With over 500 million people still living in rural areas, the government targets to increase the urbanisation rate by 65% by 2025.3

Given the gains in poverty reduction over the decades, the government is recalibrating its strategy to prevent people from falling back into poverty through rural revitalisation and new urban strategies.

Market access for foreign companies

China plans to widen market access in specific sectors by reducing the number of industries currently off limits to foreign investors. The government is also encouraging foreign companies to invest in new and high-end technologies, advanced manufacturing and energy conservation sectors.

Factors driving investments in China

The widening of access to China’s domestic market and the inclusion of locally traded A-shares in the main global equity indices in recent years have helped accelerate the flow of foreign investments. Today, China represents close to a third of the MSCI Emerging Markets Index, the largest country weighting in the benchmark.4 As this weighting grows in line with China’s economic trajectory, it is expected to further spur foreign participation in the capital market.

The spectrum of opportunities for investors spans the ‘old’ and ‘new’ economy industries — from agriculture and automotive to health care and IT — and in between, including China’s world-leading electric vehicle industry, which straddles traditional manufacturing and the zero‑carbon economy. At the 20th Communist Party Congress in October 2022, President Xi Jinping

reiterated the importance of growth in a variety of sectors, ranging from emerging and strategic industries like aerospace, IT and biopharmaceuticals to infrastructure and high‑end manufacturing. The reference to building a healthier China should also positively impact the health care sector, along with consumption around culture and activity.

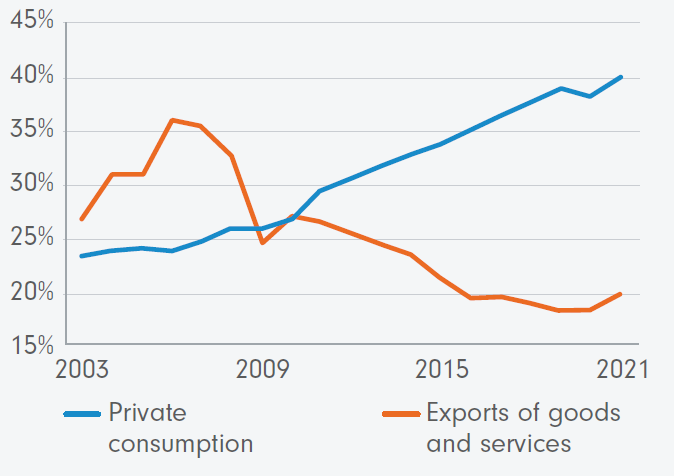

China’s broadening middle class and rising urbanisation are driving a consumption upgrade. Private consumption as a percentage of GDP continues to increase amid the shift from an export- and investment-led growth model to a consumption-driven one. Younger Chinese consumers are favouring brands that are of higher quality, environmentally friendly and offer an emotional connection. Local companies have caught on, and the premiumisation of local brands is becoming a major theme. While still a relatively new trend, we expect this to gain momentum as Chinese consumers become more affluent and educated, and prouder of their own culture and society. Digital technology underpins this trend, helping create new business models across the economy.

Figure 4. China is the fastest growing and largest consumer market in the world

China consumption as % of total GDP continues to grow

One of the fastest-growing and largest consumption markets

Refinitiv DataStream, August 2022.

Furthermore, ensuring a sustainable future continues to be a key policy and investment theme and we expect China to increase its focus as a leader in green and low‑carbon technology, which will remain an important part of the economy.

The active advantage for risk and return

With its continuing economic growth trajectory and rising incomes, China certainly offers exciting investment potential. However, investors can also expect to encounter volatility and risks, which makes a compelling argument for an active allocation strategy.

Fidelity is one of the largest active managers in China and our on-the-ground experience in the country reaches back more than 20 years. Additionally, our proven stock selection process is informed by our team of local analysts focused on the China market. Through a rigorous portfolio construction process, the best ideas from our research are selected to benefit from China’s growth dynamics.

The opportunities in the Chinese market can be accessed in several ways. Fidelity offers a standalone allocation through our China Fund. The Fidelity Asia Fund, Global Equities Fund and Global Emerging Markets Fund also offer exposures to the China market as part of a broader portfolio. The latter is available as a managed fund and an active ETF on the ASX.

What are the risks?

All investments involve risk; however, Fidelity actively manages risk within its investment portfolios and employs a range of monitoring procedures with the aim of reducing overall portfolio risk. The main risks of investing in Chinese assets are increased market volatility and settlement difficulties when investing in China, changes to laws, rules and regulations which may affect a fund’s ability to invest in Chinese assets, Chinese renminbi currency and conversion risk, movements in exchange rates, market risk, specific security risk and derivative risk. For further details

on the specific risks of investing in a fund, please refer to the Product Disclosure Statement.

“China is a unique emerging market which offers a number of interesting investment opportunities. Given the strategy’s value style bias, we continue to find many companies that continue to have an attractive risk/reward profile. Having a tried and tested investment philosophy as well as on-the-ground research capabilities is an essential part of our investment process. A real understanding of the companies, industry dynamics and policy direction enables us to participate in the economic growth potential of the world’s second-largest global economy.” Nitin Bajaj, Portfolio Manager Fidelity China Fund

Stock spotlight

Focus Media Information is one of the Fidelity China Fund’s high-conviction holdings. The company is an out-of-home media group, with an 80% market share. Advertising is expected to grow faster than GDP and out-of-home advertising growth is set to outpace overall advertising. Clients fund advertising in advance, which gives the business a good cash profile. With its dominant market share, the company enjoys scale and lower costs than its competitors. Given the company’s valuation and strong corporate culture, we believe there is significant room for growth over the coming years.

Source: 1 - World World Federation of Exchanges, as of September 2022. Market cap in US dollars.