Updated 24 January 2023

Download PDF Download Infographic

Despite the cut in growth forecasts, India will likely be the fastest-growing major economy in the world, which may be attractive for investors cast against a low-growth backdrop. This is because India’s economic fundamentals remain healthy, with cleaner bank and corporate balance sheets, low debt levels, healthy foreign exchange reserves and high import cover.

Geopolitical concerns, high inflation, rising interest rates, and slowing economic growth created a demanding environment for Indian equities in 2022 that resulted in much volatility. We think this is likely to continue in 2023. While it is hard to predict how markets will behave in a year’s time, we believe that India is better placed than most of its peers in such an environment. This is due to its underlying structural growth prospects, which should support corporate earnings and returns over the medium to long term.

Capturing returns as momentum builds

Building on the widespread liberalisation of the country in the 1980s and 1990s, India is experiencing a wave of development under Prime Minister Modi. The government’s most recent package of reforms, known as Make in India 2.0,1 could be a game-changer if executed well.

“I am optimistic on the Indian economy and equities in the medium to long term due to the presence of structural drivers of growth, strong demographics, presence of quality institutions and a culture of entrepreneurship. The Fund continues to focus on owning quality businesses which are market leaders in the structural growth segments.” Amit Goel, Portfolio Manager Fidelity India Fund

The plan is to create 100 million manufacturing jobs and increase the manufacturing sector’s contribution to GDP to 25% by 2025, from the current 16%. It also features a doubling of infrastructure spending in the next five years versus the past five years.

There are also production-linked incentives and tax incentives, and protectionist increases in import duties/bans in areas where local manufacturing can easily substitute imports. The focus seems to be shifting from high-end manufacturing to import substitution, which seems more achievable.

Overall, we expect an immediate contribution of around 0.5 percentage points of incremental GDP growth, and eventually the multiplier effects may lead to a contribution of about 2.5 percentage points.

More on GDP growth

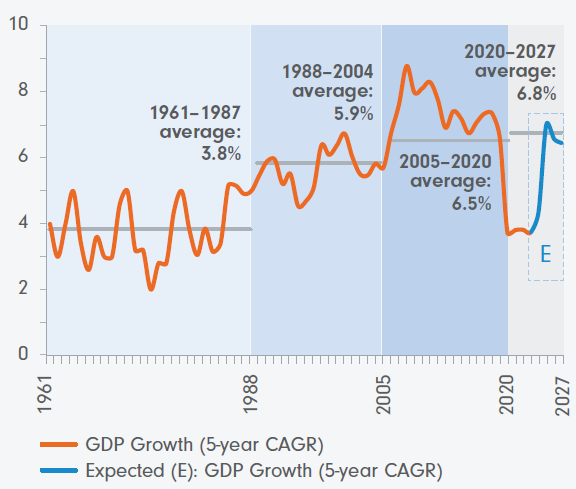

Over the last 61 years, India’s average GDP growth rate has sustained at 6–7%. There is still a lot of scope for economic expansion in India, ranking it one of the fastest-growing economies of the world.

Figure 1. India’s rate of GDP growth from 1961–2027

Source: Fidelity International and IMF World Economic Outlook Database, October 2022.

While growth has so far lagged that of its neighbouring mega-economy China, the key to speeding the rise of India’s young, affluent, urban and educated consumer base is within reach. These reforms and planned infrastructure spend will likely be key to unlocking the growth potential of India’s hugely favourable demographics.

A surging demographic tailwind

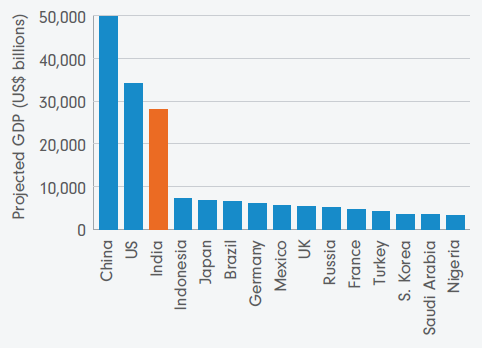

It is projected that, by 2050, India will be the third leading economy (as measured by GDP) after China and the United States – see Figure 2.

Figure 2. Top 15 world economies projected to be the largest by 2050 (GDP US billions)

Source: https://www.worldatlas.com/articles/world-economies-projected-to-be-the-largest-by-2050.html

The positive growth can be attributed to its young population. China and India accounted for the largest populations in these regions, with more than 1.4 billion each in 2022.2

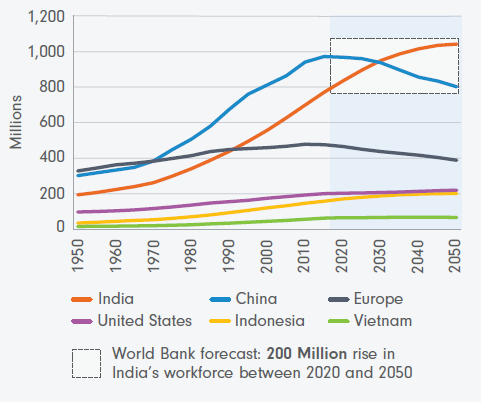

Forecasts suggest that by 2050, India is expected to add 200 million people to its workforce and will surpass China’s working population in size in five years – refer to Figure 3.

Figure 3. India’s workforce is expected to climb by 200 million in the next 30 years and surpass China’s in 2030.

Source: United Nations Population Division, World Population Prospects 2019.

The purchasing power of the country’s emerging middle class is also set to rise dramatically in the next decade or so, with much of this spending spree driven by a surge in urbanisation.

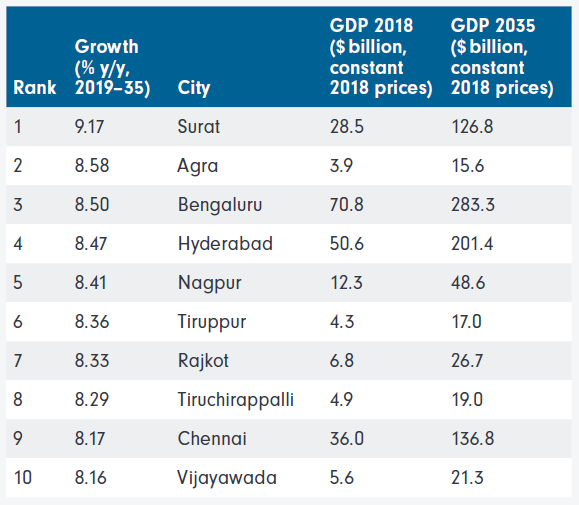

Table 1 ranks the top 10 fastest-growing cities in the world by GDP between 2018 and 2035, highlighting these are all Indian cities. Surat tops the list of the top 10 fastest-growing cities, followed by Agra (home of the Taj Mahal), and Bengaluru – an area renowned as a technology hub and home to large financial service firms.

Table 1: India is home to the top 10 fastest-growing cities in the world, 2019-35

Source: Oxford Economics, ‘Global Cities: The Future of the World’s Leading Urban Economies to 2035’, November 2018.

A large domestic economy

COVID-19 disrupted supply chains and geopolitics saw many countries enforce trade restrictions across regions. However, with private consumption driving 60% of the economy, we consider India has the domestic demand to sustain growth, regardless of global economic trends.4

We expect the trend from globalisation to regionalisation to continue. In the face of this, India is well positioned for sustained growth with reform programs focused on investing in manufacturing and infrastructure with demand growing from a young and affluent middle class.

Indian equities are maturing

In 2022, India had a stock market capitalisation of US$3.5 trillion5 and offers a broad investment universe, diversified across sectors. There are well over 5,000 listed companies to choose from.

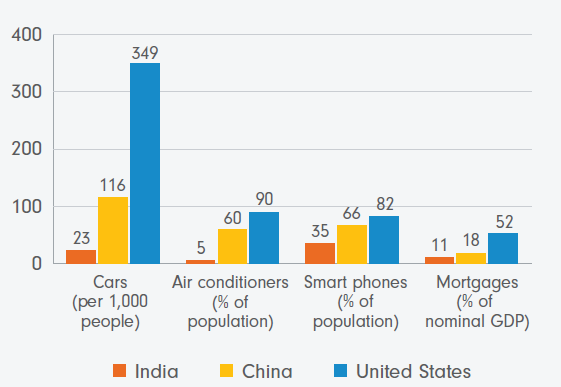

Opportunities for growth across retail, automotive and finance industries look promising. With consumer penetration levels in cars, white goods, mortgage and retail loans lagging far behind countries such as China and the US, the stage is set for many companies to profit from exponential growth in India’s middle class.

Figure 4. Product and services penetration

Sources: World Road Statistics data for 2018; International Energy Agency data for 2018; Statista, Newzoo Consulting, data for 2021; EMF, Hofinet, HDFC estimates 2022.

Beyond consumer goods, other sectors that stand to gain from an acceleration in structural reforms include financials, industrials and healthcare. Having a strong research presence close to the market is critical to pinpoint the companies best positioned to profit from these growth trends.

The active advantage for risk and return

As a key emerging market and a proxy for global risk appetite, India took the full brunt of investor sell‑offs when the pandemic hit in early 2020. Going into 2023, while uncertainties remain, we expect the economy to continue its recovery path and the long-term structural opportunities will again come into focus.

We have a large investment team on the ground in India, backed by over 400 investment professionals worldwide, so we understand the factors shaping returns and risks in this dynamic region.

With Fidelity, investors can access India’s opportunities through our Fidelity India and Asia Funds, or gain exposure via the Fidelity Global Emerging Markets Fund, which is available as a managed fund and an active ETF.

Case Study: HDFC Bank

HDFC Bank is India’s largest private sector bank. It was among the first to receive approval from the Reserve Bank of India (RBI) to set up a private sector bank in 1994. Headquartered in Mumbai, HDFC Bank is the best run and new generation private sector bank providing a wide range of services with a focus on the non-mortgage retail lending. Today, HDFC Bank has a banking network of 5,345 branches and 14,533 ATMs spread across 2,787 cities and towns.

The company’s solid brand franchise with a dominant market share in a growth market like India, and its robust track record of product innovation and capital strength makes it a long-term holding in the Fidelity India Fund.

Expert access to the best investment opportunities in India

Fidelity has been investing in India for over 25 years, with a number of investment specialists based in India.

Our extensive track record and presence in the country means we have a unique and independent view of factors shaping returns from Indian companies.

Sources:

1. https://www.makeinindia.com/home

2. https://www.worldatlas.com/articles/world-economies-projected-to-be-the-largest-by-2050.html

3. World Economic Forum, How India’s globalized cities will change its future, January 2019.

4. World Economic Forum/Bain Insight Report, Future of Consumption in Fast-Growing Consumer Markets: INDIA, January 2019.

5. https://www.bseindia.com/markets/equity/EQReports/allindiamktcap.aspx