The message for 2019 that we should take away from the volatility of 2018 is that it is going to be a year of divided outcomes. In most years, there are always enough reasons to worry but one can also invest with a bottom-up mindset without spending too much time on the macro. Unfortunately, 2019 is unlikely to be one of those years. Trade policy (what kind of agreement the US/China reach), global central bank policy (driving US$ liquidity) and a potential US fiscal stimulus will be important drivers of earnings and hence stock price performance. One needs to believe that these macro drivers will shift positively to take a positive view on the markets.

To jump to the conclusion, in a nut shell, I believe the probabilities are in our favour and am feeling more positive - at least tactically. Don’t get me wrong, there remain (as there always are) enough reasons to run for the hills. But below are a few reasons why I am positive tactically (but still cautious structurally) on global equities.

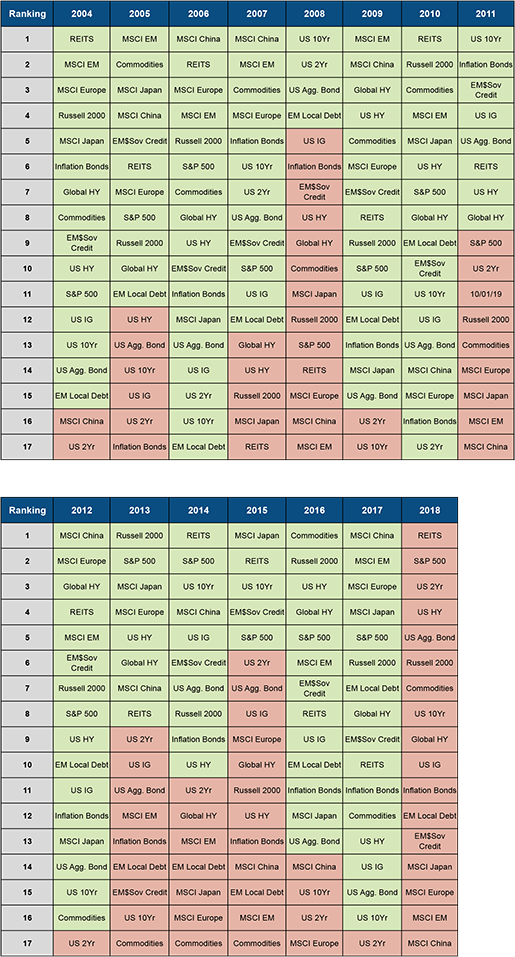

Clearly 2018 was one of the worst years in terms of performance across asset classes. There was literally no place to hide. All investor worries around the macro (slowdown), trade wars, oil, China, dollar seem to have been reflected in equity market performance.

Fewer asset classes are beating inflation than in 2008

Source: Bloomberg, Morgan Stanley Research. Note: We compute annual returns minus US headline inflation. Green means returns (in USD) beat inflation, and red means returns trailed inflation. 2018 data as of 21 November 2018.

And 2019 seems to have begun on the same volatile note with the first four days bringing a poor Chinese PMI print, Apple’s first negative preannouncement in 16 years, a mini flash crash in the currency market and the worst ISM drop since Oct ’08. We concluded the week with a $74bn pharma mega merger (which left most people scratching their heads!), the largest payroll beat of the cycle and the US FED governor who did everything he could do to appear “flexible” and “patient” (almost dovish v/s his comments in early October which were interpreted as being quite ‘hawkish’).

The good thing amongst all this volatility is that almost every worry that we worried about in the past now seems to be in some part discounted by the markets. In fact, one could argue that the market has tried to discount the potential of a 2020 recession in the month of December 2018 - talk about Christmas pudding indigestion!

So here are my reasons to be positive:

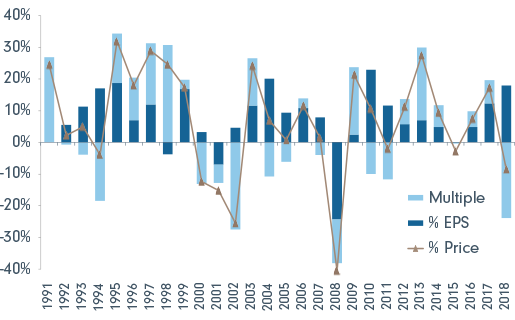

- Valuations - Equities have taken quite a multiple de-rating - Earnings in 2018 will be up anywhere 15-17% - with the US leading the charge at a +20% year driven by the tax cut. Yet equities around the world were down in 2018. For 2019, Fidelity equity analysts expect this to be a slow growth year - only 4.5% earnings growth, a shade below consensus. However, with the valuation de-rating this suggests to me that for the first time really since 2016 we are getting paid to take risk intelligently. See below for the S&P 500 multiples since 2002 with performance broken up into EPS growth v/s multiple expansions.

Figure 1. Significant multiple contraction during the year

P/E vs EPS growth (biggest multiple contraction since 2002 despite biggest EPS growth since 2010)

Source: Baird Research, Bloomberg, January 2019. The chart shows the performance of the S&P 500 each year and its attribution from EPS growth and P/E expansion/contraction. The brown line is the % change in the S&P 500 price each year. The dark blue bars represent the % change in forward EPS estimates (estimates are 18% higher than they were 12 months ago) and the light blue bars represent the difference between this and % market performance.

- Sentiment seems quite washed out after the poor 4Q especially in the technology bell weathers. The crowding that we saw in the markets particularly with a narrow part of the market (the FANGS) doing well has been cleared out. At least from a market structure perspective this is positive.

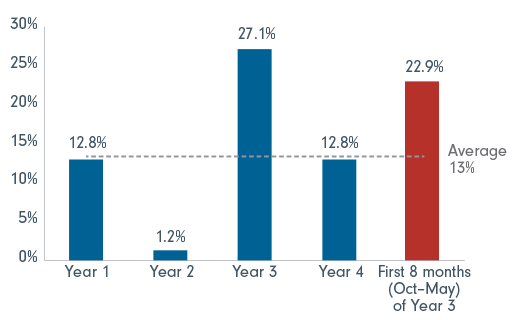

- The 3rd year of the US presidential cycle delivers the best returns historically. In fact, the US market hasn’t given you negative returns in the period between November and April since 1946 in the 3rd year of the presidential cycle. Jeremey Grantham from GMO has done some great work on the US presidential cycle returns. So, if you are betting on a bear market you have some serious history to contend with - It may be different this time but just worth heeding the message of history!

Figure 2. Presidential election cycle returns (1928 – 2012)

Source: CRSP, Stan Clark Financial Team

But most importantly on a fundamental basis, the poor stock market performance of 2018 also increases in my view the probability of:

- a trade deal between US and China

- A more dovish Fed and possibly ECB and Japanese & Chinese central bank

- A follow through fiscal stimulus bill which drives capex spending in the US

Putting all this together a base case would suggest that Central Bank policy would be more accommodative as the FED Chair hinted in his comments last Friday (4th Jan) driving the strong rally in the US markets and with the prospects of a trade deal between US and China, the markets can breathe a sigh of relief - moving from discounting an outcome of worse to less bad (which is incidentally where a lot of money can be made).

However, before you think I am suggesting that we go all in, it is worth pointing out that reasons to stay structurally cautious haven’t disappeared:

- Financial markets remains addicted to central bank policies of capital subsidization and insolvency prevention - maybe we have one last hurrah (new market highs) but everything from the social and political order to the economic make up of markets is changing - The investment environment of the next decade will be clearly different from the past and we will need to at some point contend with high levels of debt which we have built up in this cycle across both corporates (primarily in the US) and federal debt levels (China, US) . A new playbook still needs to be written!

- From a more tactical perspective, we have all the hallmarks of a late cycle with low unemployment, peak earnings, declining multiples, yield curve near inversion etc.

- It is quite possible that the FED could make a policy mistake and continue to talk dovish but not follow through with real action in which case the downside in equities could be significant. Earnings typically fall at least 10% when the yield curve (2-10) inverts and this is no way discounted in estimates. This would paradoxically be quite positive from a longer-term perspective (in getting rid of zombie companies) but the attendant social and political upheavals as also the asset price deflation which inevitably come with a recession could be quite significant. This is the bifurcated other side of no trade deal and a hawkish central bank with downside greater than 20-30%.

- So, what we are hoping for is that global central banks follow through their dovish talk with action i.e. expansion of central bank balance sheets, else the developed market credit pyramid will continue to exhibit higher signs of instability and volatility which could push the global economy into a synchronized recession. (Note as per Jim Grant’s estimates in Q4 2017, the Fed, ECB, and BOJ combined asset purchases were $100B per month, this dropped to zero in late 2018 and in 1Q 2019 will turn negative to a roughly $20B per month withdrawal - the direction of this flow must change!)

Signs to look out for that this is not happening would be

- High yield spreads and the performance of the corporate debt market (for e.g. no high yield issuance in December is a clear amber light)

- Emerging market currency and dollar performance.

- China’s balance sheet remains a worry and while they can stimulate, marginal return on credit seem to be deteriorating (i.e. more and more credit required to create the same impact on GDP growth). To investigate this further, I am in Shanghai this week and will report back on what I learn.

- Geopolitics will continue to have an increasing (not decreasing) impact on markets - the wealth divide remains significant and more Pandora’s boxes like BREXIT will be opened around the world. For example, before the end of the year we need to navigate uncertainty of BREXIT, a new ECB governor, possible political change across Europe, Consumption tax increases in Japan besides the trade/tariff issues between China, US and the rest of the world.

Tactical positioning

My view is that the economic and earnings data in 1Q is going to make it tough to be unabashedly positive. Further as Apple showed in profit warning, the economic and trade related issues are having a real impact on company earnings (which is why macro is so important for 2019). Given trade related worries it is likely that a lot of pre-ordering happened in Q3/Q4 2018 - this makes comparisons for 2019 difficult as also increases the amount of inventory in the system. From Fedex to Apple everyone is signing from the same hymn sheet of trade related troubles.

Putting this together. Q1 earnings guidance is likely to be muted and with margins likely to be under pressure due to both operating leverage (rising labour costs) and financial leverage (rising rates) it is unlikely that CFOs will have the same confidence in guiding for 2019 earnings like they did in the heady tax stimulus days of January 2018.

Consequently, while I am looking to be tactically positive, it is only after making sure we have a high degree of margin of safety in the companies we hold or are looking to buy. This means a margin of safety on both valuations of the stocks we are buying as well as their forecast earnings and cash flow in various market scenarios. It is clear, bottom up stock picking is more important but equally important would be how one navigates volatility and does not get whipsawed and connects the dot on a global basis (for example focussing on the Taiwanese supply chain made sure that Apple was amongst our largest underweights).

It is not going to be easy but invest with a long-term view & continue to revaluate the investment thesis with diligence and higher than normal regularity and flexibility.

Areas we like/ or think we can find value (coincidentally risk on sectors)

- Emerging Markets (I am in Shanghai this week as the Chinese market was one of the worst performers of 2018)

- Energy stocks

- Technology (selectively and yes even some of the FANGS as I think the market will differentiate between them)

- Cyclicals (US/European interest rate sensitives in the scenario that the US President & Congress negotiate a good fiscal stimulus program)

- Companies in any sector which have their own company specific factors driving earnings (restructuring, product cycles, market growth etc)

- Stocks where the market has discounted an outcome which is very bad but where we think there is a lot of upside if things are just ok (I daresay European cyclicals especially financials fall into this category)

Areas we would be cautious on would be stocks/sectors where expectations and valuations are high. While scarce growth will still trade at a premium, however if these companies miss expectations the stocks risk a double whammy of both decline in multiples and earnings expectations - potential for significant capital loss.

One last point is on volatility and that we should also be cognizant of the change in the structure of the equity markets. The rise of ETFs/Algorithmic investing on the one hand v/s the decline in importance of the broker dealer/prop desks (who provided liquidity in times of stress but can’t do so now due to regulatory capital constraints) means programmatic trading/machines are a lot more in control of the short-term gyrations of the markets.

This has also meant that historical signals/tools are no longer providing the early warnings as moves across asset classes are becoming a lot more correlated (my fixed income colleagues tell me they are looking at the equity market for direction just as we look at them for guidance!). The only way to look for uncorrelated return will be found in the mundane - doing the work stock by stock basis with a focus on valuations based on earnings and cash flows under various market/macro scenarios.

In summary

The message is that in the near-term markets are now offering selective good value. Use the Q1 earnings season to deploy cash in high quality companies available at good valuations taking a longer-term view. However, continue to revaluate the investment thesis periodically and don’t forget to have a good margin of safety and make sure you protect capital!

And If trade policy or central bank policy go the other way v/s base case or the credit markets fall out of bed - make sure you have your running shoes on! After all its January!

For more insights from Amit or information about the Fidelity Global Equities Fund visit the Fund page.

Learn more

This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL No. 409340 (“Fidelity Australia”). Fidelity Australia is a member of the FIL Limited group of companies commonly known as Fidelity International.

Prior to making an investment decision, retail investors should seek advice from their financial adviser. This document is intended as general information only. Please remember past performance is not a guide to the future. Investors should also obtain and consider the Product Disclosure Statements ("PDS") for the fund(s) mentioned in this document before making any decision about whether to acquire the product. The PDS is available on www.fidelity.com.au or can be obtained by contacting Fidelity Australia on 1800 119 270. This document has been prepared without taking into account your objectives, financial situation or needs. You should consider such matters before acting on the information contained in this document. This document may include general commentary on market activity, industry or sector trends or other broad-based economic or political conditions which should not be construed as investment advice. Information stated herein about specific securities is subject to change. Any reference to specific securities should not be construed as a recommendation to buy, sell or hold these securities. While the information contained in this document has been prepared with reasonable care, no responsibility or liability is accepted for any errors or omissions or misstatements however caused. This material may contain statements that are "forward-looking statements", which are based on certain assumptions of future events. Actual events may differ from those assumed. The document may not be reproduced or transmitted without prior written permission of Fidelity Australia. The issuer of Fidelity's funds is FIL Responsible Entity (Australia) Limited ABN 33 148 059 009. Details of Fidelity Australia’s provision of financial services to retail clients are set out in our Financial Services Guide, a copy of which can be downloaded from our website.

The information transmitted is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this in error, please contact the sender and delete the material from any computer. Any comments or statements made are not necessarily those of Fidelity Australia. All e-mails sent from or to Fidelity Australia may be subject to our monitoring procedures. E-mail communications cannot be guaranteed to be timely, secure, error or virus-free. The sender does not accept liability for any errors or omissions which arise as a result.

© 2019 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited.