This article first appeared in Livewire markets on 23 March 2023

Investors would be forgiven for thinking the risk of a recession was universal. After all, high inflation and rising interest rates have been a global theme for the past year. But in truth, not every country has the same concern and investors may be missing some of the bigger opportunities, even in these challenging times.

In Fidelity’s Investment Forum 2023, "Game on! A new investing playbook," the team was positive about China’s prospects, while being wary of the US.

It’s not a sentence investors may have expected to read a year ago when most headlines were negative about China. But Gary Monaghan, investment director for the Fidelity Asia Fund, says that sentiment is more balanced and the reopening of China late last year continues to be a big driver.

A tale of two countries

To state the obvious, the US and China are the biggest drivers of global economics and Australia is tied to the fortunes of each. The year ahead looks vastly different for each.

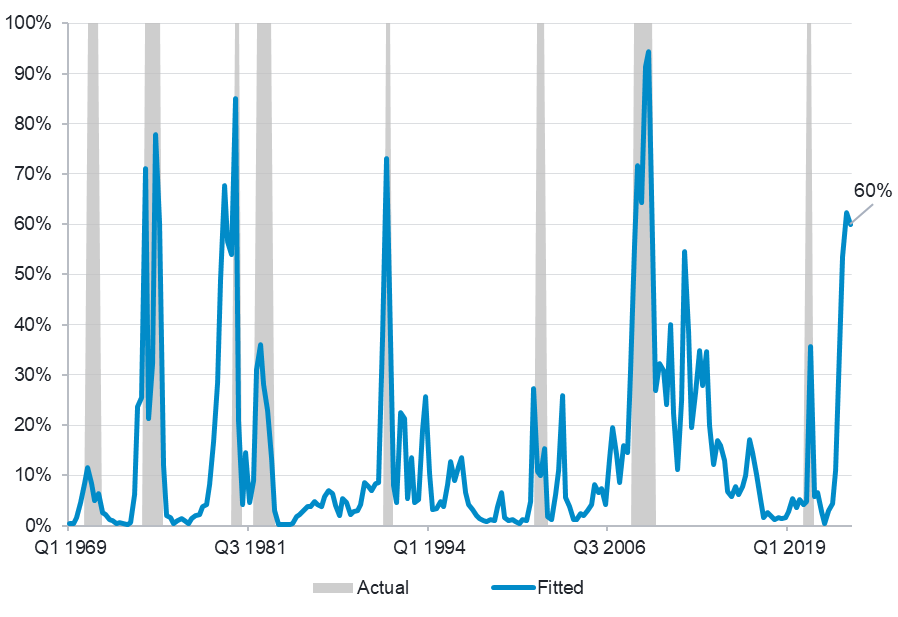

“The leading indicators for a hard landing in the US are high. We see a 50% probability of a hard landing and the US could already be in a cyclical recession,” says Marty Dropkin, head of equities Asia Pacific for Fidelity.

Recession probability from US future activity trackers (2 quarters ahead)

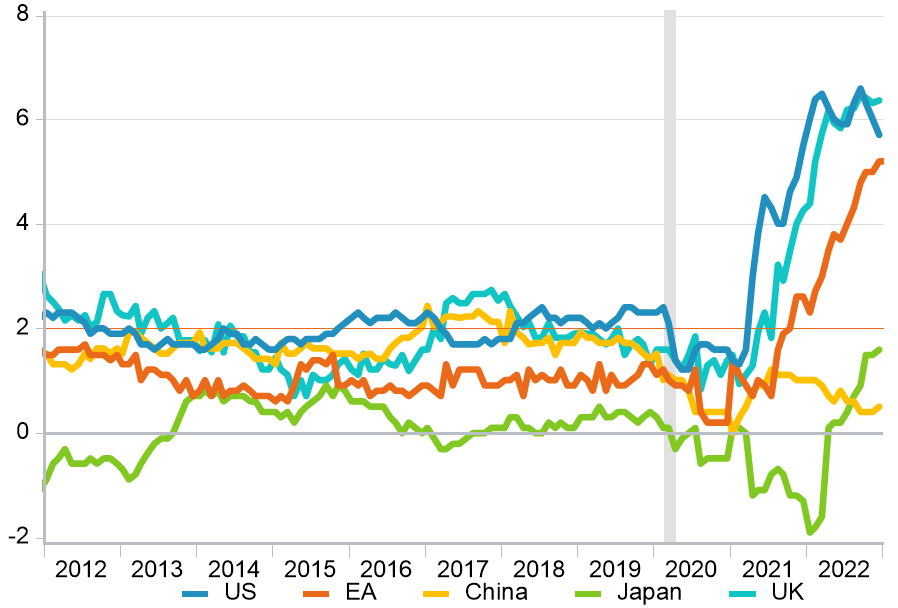

- the Chinese government is in a stable period,

- inflation is relatively low,

- household savings rates are high, and

- consumer confidence and spending have yet to pick up post-China's reopening.

Source: Fidelity International, Bloomberg, February 2023.

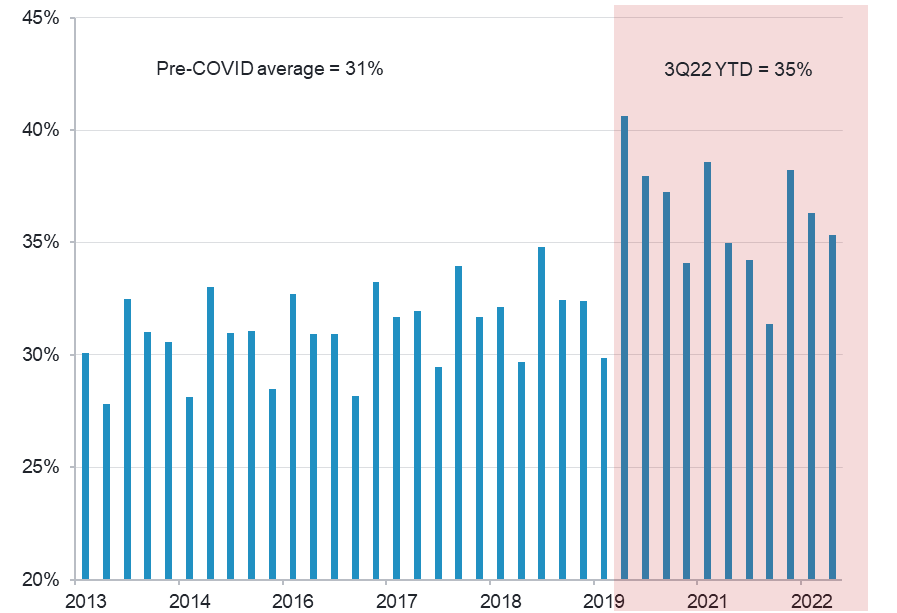

It’s worth considering the comparison of western countries like Australia that reopened in 2022. Australian household savings were elevated and consumers were ready to go out and spend on goods and services, with travel high on the list. It was a massive boon to a range of companies and, for some time, provided a buffer from rate rises.

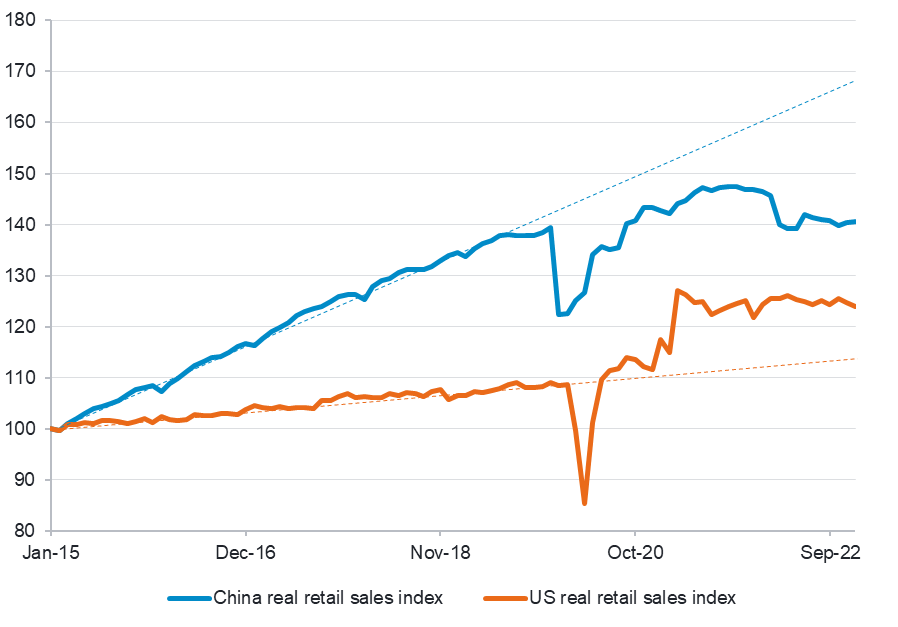

If you translate that activity to the situation in China, where there is a far larger population with money to burn, the implications for a range of industries are immense. Consumer spending in China has still lagged behind other countries but is likely to build as confidence returns.

“There’s pent-up demand with pent-up savings,” says Monaghan.

These are all factors that the Chinese government is conscious of and planning towards.

“Consumption was a key theme and focus in the 13th National People’s Congress in China. So investors should focus on this too. Consumers are ready to spend, but the confidence isn’t there yet,” said Amit Goel, portfolio manager for the Fidelity Emerging Markets Strategy.

That’s not to say that investors should flood in and expect returns.

“The easy money from reopening has been made. Now the focus needs to be stock selection,” says Monaghan.

“The easy money from reopening has been made. Now the focus needs to be stock selection.”

Where to find opportunities in China

Monaghan points to three orders of play he is using for China based on consumer spend and demand.

- The first order looks at direct consumer activity. Companies like Trip.com (NYSE: TCOM) are likely to be beneficiaries of China’s reopening and an increase in consumer confidence. Trip.com has a 60% market share and has already experienced a massive boost in its share prices.

- Monaghan’s second order of play looks at slightly more unexpected beneficiaries of reopening, such as AIA Group (HKG: 1299), the biggest life insurer in Asia. “Around 70% of new business in Hong Kong was generated by mainland visitors looking for better coverage. That dropped to 3-4% over the pandemic but business is picking up again from reopening and the return of visitors,” he says. AIA has also opened stand-alone operations in China.

- Monaghan’s third order of play considers the boost in consumer goods and services. But rather than select winners from brands, he has focused on shared plays across companies. Focus Media (SHE: 002027), for example, will benefit from consumer spending as brands seek to compete using advertising and marketing. It currently holds around 75-80% of the market in display screen advertising. While risks to Focus Media include rising competition and internet regulation, it has net cash on the balance sheet to support its survival and Monaghan views it as a long-term play on the expectation that consumer sentiment will turn around.

Should we still fear Chinese developers?

Chinese developers like Evergrande and Shimao may still be front-of-mind concerns for investors. Monaghan suggests suppliers rather than developers are a more sensible approach.

One example he provides is Beijing Oriental Yuhong (SHE: 002271), a waterproofing supplier. The company had deeper pockets to survive through the pandemic and is positioned to benefit from government policies bolstering infrastructure and development.

The lucky country…again

China has typically been an economic saviour for us - and Fidelity head of investments Paul Taylor suggests this time will be no different.

“Australia is a complementary economy to China. We have primary and tertiary industries, China has secondary. We don’t compete. Despite the tensions between the US and China (and to an extent, Australia), China is more focused on practicalities. China still buys our iron ore, tariffs were focused on peripheral markets,” says Taylor.

While our commodities industry should benefit from reopening, Taylor also points to the tourism industry.

“Tourism to Australia, particularly Sydney, is high on the agenda for many Chinese tourists. And we’re also seeing the return of secondary and tertiary education,” he said.

Investing in Australia and China

Despite the very real challenges facing Australia in terms of inflation, the return of China to global economics will be a buffer for us - particularly when it comes to the prospect of a US recession. Australia is still likely to experience a slowdown, but may avoid recession - although that will depend on the pace and extent of interest rate rises.

It gives rise to a few considerations for investors.

Exposure to those industries in Australia best positioned to service the reopening of China, along with exposure to those international businesses (both in and external to China) positioned to take advantage of that future consumer spending from Chinese households.