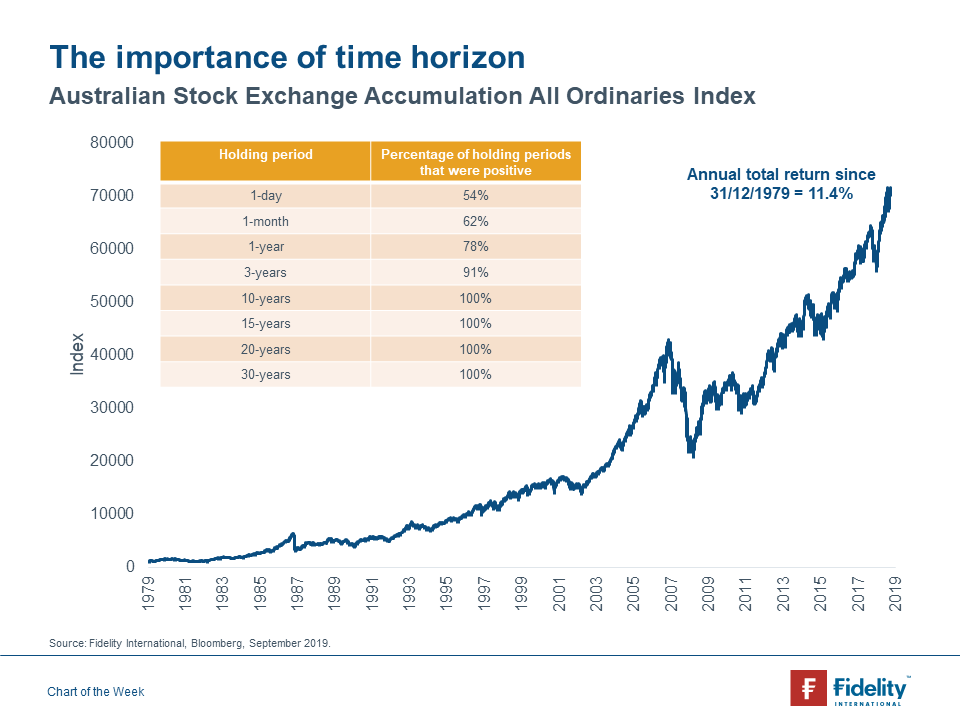

The ASX Accumulation All Ordinaries Index (All Ords) has generated an impressive 11.4% annualised return since 31/12/1979. Of course, what matters for investors in the Australian equity market is the value of the index the day they buy in, and the value of the index on the day they sell out. Another consideration for investors is the length of time that they intend to hold their investment, as those with a longer time horizon have a greater likelihood of experiencing a positive return. For example, if an investor had bought at the index high before the GFC (on 1/11/2007), 1 year later their investment had fallen in value by 39%. 3 years later, the market was still down by 20%. On the 10 year anniversary of the investment in 2017, it had risen in value by 39%. Today, the value of the investment has appreciated by 67%.

To highlight the importance of time horizon, an analysis of daily returns of the All Ords index since 1979 suggests shows that 100% of investment periods greater than 10 years had appreciated in value. In addition, an impressive 91% of 3 year holding periods generated a positive return. Looking at shorter time horizons, 78% of all one year periods had risen in value, while on any given day there was a 54% probability that the Australian equity market was up.