October 2014

It’s something of which many Australians are aware but perhaps people fail to appreciate the extent that it could reach into their everyday lives. It’s the recent tumble in commodity prices. The decline in the price of our biggest exports such as coal (15% of our exports) and iron ore (25% of foreign receipts) has such consequences that it could end Australia’s 22 ½-year stint of unbroken economic growth.

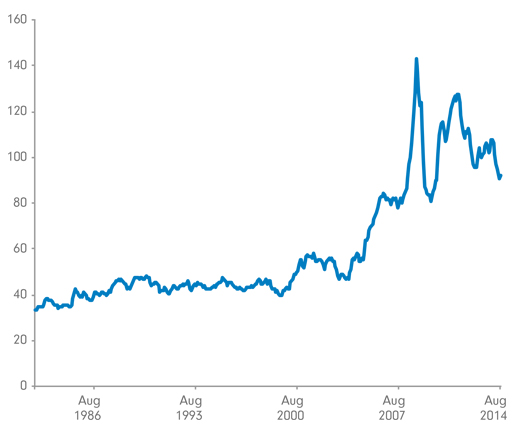

The industrialisation of China in recent decades benefited Australia in many ways. The most potent was by the tripling from 2004 to 2011 of the prices at which we could sell our main commodity exports. Now China faces an economic crisis. Its appetite for the steel that iron ore makes and the power that coal generates is dimming, just as extra supply is hitting the market thanks to all the investment in recent years that expanded production.

Lower demand and more supply are a textbook situation for lower prices. Iron ore prices have plunged from US$140 a tonne in January to below US$80 per tonne in September, a decline heading towards 50% and the lowest level in more than five years. (Thermal) coal prices have more than halved over the past three years. The Reserve Bank of Australia’s commodity price index, which tracks Australia’s biggest material exports, slumped 16.0% in Australian dollars in the 12 months to September.

A drop in commodity prices is having the opposite effect to what the more-than-doubling in Australian’s term of trade did from the late 1990s to their peak in 2012-13. (The terms of trade measures the price of our exports against imports and is the broadest indicator of where the prices of our exports sit.) Our terms of trade have slumped 25% since their record high in 2011 for not only are iron ore and coal prices slipping, so too are the prices of wheat, sugar and even gold.

Back in the glory days of rocketing commodity prices, the Australian dollar soared to as high as 110 cents to the US dollar. Investment and employment boomed as companies expanded mining capacity. The jobless rate fell as low as 3.7% in 2008 (compared with 6.3% in August just gone).[1] Rising company profits boosted the government’s tax receipts, allowing it to spend more on services and to cut taxes without running a deficit. The higher Australian dollar boosted the wealth of all Australians and, via lower import prices, kept inflation under control. Naturally, the stock market boomed. (If you think the mining boom bypassed you, it didn’t once you allow for its indirect effects.)

Now the Australian dollar is dropping – on October 3 it reached a four-year low of 86.82 US cents. Mining companies are holding back on investment, shedding jobs and even going bust. Lower company profits are putting more pressure on the federal government’s budget. The last two consequences are not conditions favourable for fast economic growth. (You can expect Canberra’s finances to dominate politics for a while yet!)

Not all is gloom, however. The Reserve Bank of Australia has cut the cash rate to a record low of 2.5% to help the economy, which hopefully will do more than just ignite a housing boom. The lower Australian dollar helps our exporters or local businesses that compete with foreign ones – tourist attractions in Australia, for instance, are better placed. The investment in recent years that boosted mining capacity means that our commodity export revenue has held up fairly well because we are selling more commodities even as we get less for them. Outside Australia, the US economy is improving while countries such as India and Japan are making big efforts to turn around their economies.

But China’s economic outlook appears to be worsening and could even result in export volumes being hit. The pessimism surrounding China’s outlook could hit consumer sentiment and household spending, which is behind about 50% of Australian’s output. Some commentators are forecasting that the Reserve Bank may even cut the cash rate to as low as 2% in 2015 to prop up economic activity (and that the dollar’s decline has a way to go yet).[2]

The broadest government report on Australia’s economy, known as the national accounts, that was released in September showed that real net national disposable income per person fell for the two years to June this year as prices for our exports dived.

Net national disposable income adjusts gross domestic product to allow for changes in the terms of trade, real net incomes from overseas and the depreciation of fixed assets used in production. It is considered a broader measure of national wellbeing than changes to gross domestic product.

The worrying thing is that the two-year drop in this measure on a per-capita basis was the first time this has happened since the recession of the early 1990s. It doesn’t mean a recession lies ahead but it warns of tougher times in coming years than perhaps to which we have become accustomed. Such is the hold that export prices hold over an economy.

RBA index of commodity prices since 1982 in $A

Source: RBA. August 2014

Information on commodity prices in this article largely comes from the Reserve Bank of Australia’s index of commodity prices. http://www.rba.gov.au/statistics/frequency/commodity-prices.html. Terms of trade and net national disposable income data comes from the Australian Bureau of Statistics release 5206.0 “Australian national accounts: National income, expenditure and product”. 3 September 2014. http://www.ausstats.abs.gov.au/ausstats/meisubs.nsf/0/4D57FAE7569ECB7FCA257D4700123D88/$File/52060_jun%202014.pdf. Share of iron ore and coal in exports comes from the ABS’ publication 5368.0. International trade in goods and services”. 4 September 2014. http://www.ausstats.abs.gov.au/ausstats/meisubs.nsf/0/004C390F1A733602CA257D480011B2CB/$File/53680_jul%202014.pdf

Other inancial information comes from Bloomberg unless stated otherwise.

[1] The Australian Bureau of Statistics. 6202.0 – Labour Force, time series spreadsheets. “Table 02. Labour force status by sex – seasonally adjusted.” The jobless rate fell to 3.7% in February 2008. http://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/6202.0Aug%202014?OpenDocument

[2] The Sydney Morning Herald. “'Dr Doom' Nouriel Roubini's firm warns of 20% Australian dollar slump.” 22 September 2014. http://www.smh.com.au/business/the-economy/dr-doom-nouriel-roubinis-firm-warns-of-20-australian-dollar-slump-20140922-10kc2e.html#ixzz3E17C9tvw