Major Asian economies are carefully steadying their ships as they sail into the second quarter, while domestic imbalances and geopolitical risks persist.

Asia remains a top engine of global growth, with its economies largely on track for their annual GDP targets, but stability has become a major focus for the region heading into the second quarter.

China is battling structural headwinds to stabilise growth around its 5 per cent target, while Japan searches for a balance between raising interest rates and keeping the momentum of its reflating economy. In Southeast Asia, central banks patiently await clear signals from the US Federal Reserve (Fed) before they may start easing. In India, where growth is robust, stabilising inflation has become an important task.

How Asian countries address their internal imbalances will have a profound impact on the region’s outlook for the rest of 2024.

Controlled stabilisation in China

China is engineering a “controlled stabilisation” of its economy, as the country weathers a property downturn and seeks to rebalance away from debt-fuelled expansion towards consumption and high-end manufacturing. We are closely monitoring fiscal measures such as bond issuance by the central government. Our forecast for China’s annual growth rate comes slightly below the official target, as we haven’t seen strong enough policy support.

On the monetary side, we are not expecting any significant rate cuts by the People’s Bank of China before the Fed clearly pivots. Even if the Fed starts easing, rate cuts in China are likely to be moderate; monetary easing will probably play a supporting role to fiscal measures this year.

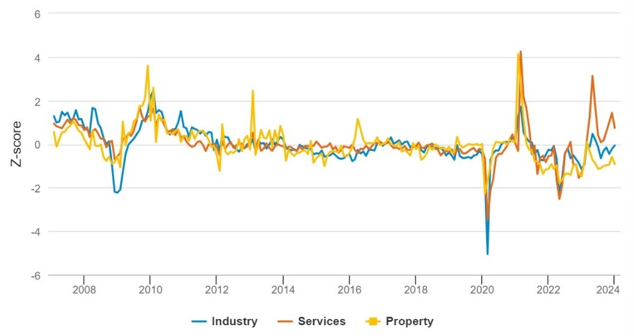

We are seeing some early yet encouraging signs that China’s economic activities are reclaiming momentum. As the chart below shows, services are climbing and industries are reverting to a long-term average, though the property sector stays below trend; all of which suggests the government is making progress in its aim to rebalance the economy.

Chart 1: China activity indicators by sector

Source: Bloomberg, Have Analytics, Wind, Fidelity International, February 2024

Japan’s brave new world

Optimism is more abundant in Japan, where the economy has emerged from more than two decades of recessions and stagnation, with mild and broad-based price increases. However, the Bank of Japan (BOJ) is treading on eggshells with its pace of policy normalisation, after raising interest rates earlier this month for the first time in nearly two decades. Hiking too fast could dampen growth and affect financial stability.

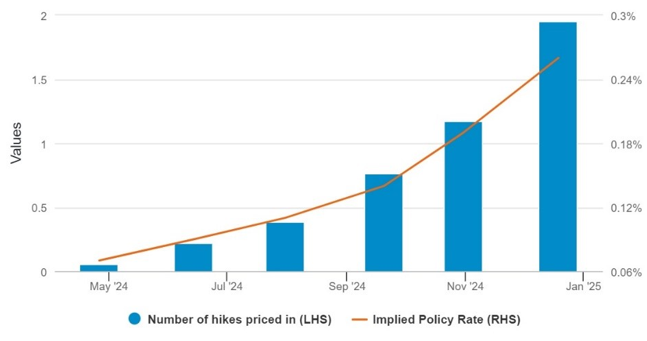

Following consumer price gains, many industrial unions have won pay rises for workers in this year’s “Shunto”, or spring wage negotiations. We believe that a virtuous wage-price cycle is likely to be sustainable from here, ultimately leading to a higher neutral rate for Japan. The BOJ may need to raise its policy rate further to adhere to the 2 per cent price stability target.

Chart 2: Market-implied BOJ policy rate

Source: Bloomberg, Fidelity International, March 2024. Based on 20/03/2024 pricing. Hikes are assumed to be 10bps each.

As reflation continues, we expect Japan’s financial markets and property sector to keep receiving capital inflows, which are driven both by Japanese investors repatriating their overseas funds, and foreign investors.

The region’s balancing act

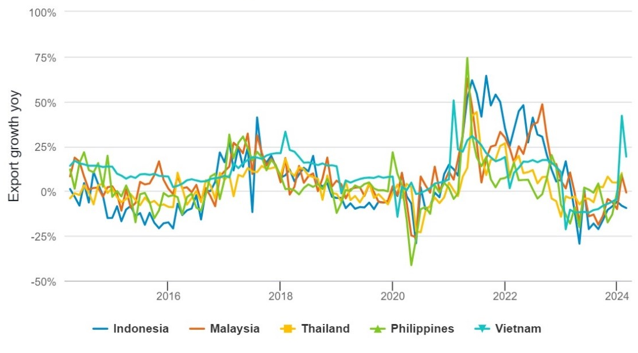

Robust domestic consumption is supporting growth In Southeast Asia, but exports remain soft due to uncertainties in global demand. An ongoing reshoring of manufacturing activities from China could provide a boost to the region’s exports. Countries like Vietnam, Malaysia, Indonesia and Thailand stand to benefit as global firms adjust their China exposure or pursue a so-called ‘China plus one’ strategy by relocating part of their supply chains to the Asean bloc.

Chart 3: Asean exports struggle to regain momentum

Source: Bloomberg, Fidelity International, March 2024

Despite sluggish exports, Asean countries are reluctant to cut interest rates or weaken their currencies before seeing clear easing signals from the US. If history is any guide, easing too aggressively could trigger disastrous capital outflows in the region, where external funding plays an important role.

On balance, we think the region is on track for an annual growth rate slightly above last year’s 4.3 per cent. Potential upside surprises could come from faster reshoring of manufacturing from China, or stronger global demand.

India is heading for a general election from April to June, with opinion polls favouring Prime Minister Narendra Modi’s ruling party. How policymakers can keep inflation at bay will have a big impact on the economy, while strong growth momentum continues. The country is also benefiting from the realignment of global supply chains as well as capital inflows.

That’s symptomatic of the region as a whole. Asia’s economic ships remain fully powered, but their helmsmen are focusing on internal stability for longer and safer journeys.