Key takeaways

- 29% of Australians aged 50 and over are underprepared for retirement by more than 10 years against average life expectancy

- 36% of pre-retirees feel most uncertain about whether they will have enough money to last throughout retirement

- 65% of Australians have executed some sort of retirement planning with only 15% of those seeking professional financial advice

Research from Fidelity International, in partnership with the National Innovation Centre for Ageing (NICA), reveals one third of Australian pre-retiree and retirees aged 50 and over are financially unprepared for retirement and are facing a retirement savings shortfall of at least a decade, expecting average retirement savings of around $540,000.

Fidelity’s new report, The Longevity Revolution: Preparing for a New Reality, highlights the need for an urgent rethink of how people prepare for longer lives. Drawing on global research across 13 markets and in-depth surveys of over 11,800 participants aged 50 and over, the report highlights the growing gap between rising life expectancy and financial preparedness.

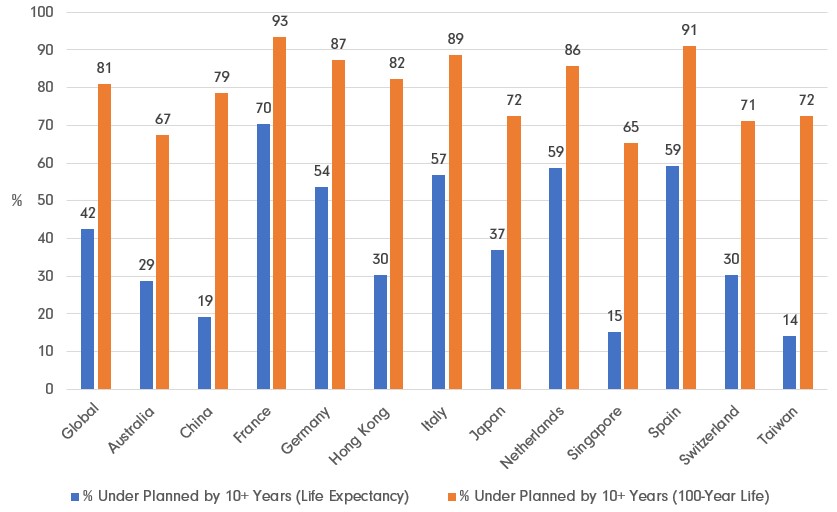

The 10-year savings gap was revealed by comparing how long people expected their retirement savings to last against the average life expectancy in their location. Globally, 42% of those surveyed were under-prepared by 10 years or more, although the proportion was notably lower in Asia-Pacific (APAC).

However, with life expectancy continuing to rise, the challenge is only growing. By 2050 an estimated 3.67 million people globally are expected to reach 100**. When measured against a potential 100-year lifespan, globally, nearly four in five (81%) aged over 50 are underprepared by at least a decade, with around two thirds of Australians (67%) underprepared.

This is most notable among Australian pre-retirees with 51% of pre-retirees noting they may need to work for longer when considering the possibility of living a longer life, with 36% feeling most uncertain whether they will have enough money to last throughout retirement.

Percentage of respondents whose retirement savings are projected to fall short by 10 years or more, against both average life expectancy and an assumed 100-year lifespan

Simon Glazier, managing director of Australia at Fidelity International, comments: “While the majority of Australians feel prepared when it comes to their retirement savings and longevity, there is still a significant number that are experiencing a mismatch between life expectancy and savings. This is especially true for pre-retirees, who are concerned about whether their savings will allow them to retire at their desired age. With the right planning, longer lives can be a positive reality, but it requires a new mindset and earlier action to ensure financial security.”

Preparing for a longer life

The top area where Australians need more support and guidance in planning for a longer life is in health and wellbeing maintenance (48%), followed by more support or guidance in financial planning and pensions (26%).

Around one in five Australia’s fear living longer than expected and running out of money, with 64% flagging they need to plan for more years of financial independence and security.

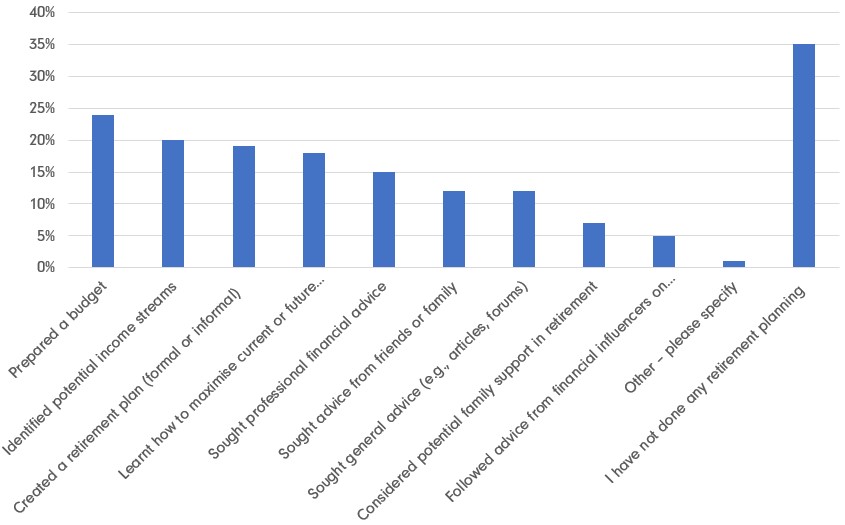

Overall, 65% of Australians have executed some sort of retirement plan, with 15% of those seeking professional financial advice, but this is significantly lower than others in the APAC region, with Taiwan (85%), Singapore (81%), and Hong Kong (79%) generally more proactive and demonstrating the highest rates of retirement planning.

Steps taken for retirement planning

Drilling down further, less than a fifth (18%) of global respondents know how to maximise investments, though this rises to 35% in Singapore and 32% in Taiwan. In Japan, just 9% have learnt how to do this as part of their retirement planning. While 59% of pre-retirees globally report knowing where their retirement assets are and how to access them, one in five do not - either because their savings are across multiple accounts (15%) or they have lost track of them (5%). Clarity around retirement savings is lowest in Hong Kong (44%) and Taiwan (51%), and highest in Australia (73%) and China (68%).

Rising healthcare costs, unexpected major expenses, changes to government policies around pensions and taxation, and insufficient savings were identified as the top financial worries among Australians during retirement. The top risk related to preventing them from achieving their long-term retirement goals included an unexpected life event (39%), high inflation (30%), and not having saved enough (26%).

The majority of Australian retirees rely on a state/public pension as a source of income (67%), followed by a private pension arranged by the individual (25%), and other private investments outside a pension (22%). This compares to pre-retirees in Australia, where 49% of are planning to rely on a state/public pension, followed by 36% on other private investments outside of a pension and 35% on a workplace/employer pension. Cash savings remain the predominant form of investment exposure for both pre-retirees and retirees in Australia (71%), followed by stocks (31%) and property (20%). Pre-retirees are more inclined to allocate to digital investments (11%) than retirees (1%).

Mr Glazier says: “While Australian pre-retirees are open to new investment opportunities such as digital assets, they generally continue to prefer holding cash, similar to what we see with those already in retirement. As life expectancy continues to rise, it’s increasingly important for people to shift their approach and move away from holding large amounts of cash and instead investing more actively. However given the high liquidity of cash, and the small percentage of people seeking professional advice, these active investment options may be misunderstood. The length of time savings are invested, especially within a diversified portfolio, becomes crucial for retirement security. By reinvesting dividends and embracing the investment opportunities in growth assets, individuals can take greater advantage of compounding returns and better prepare financially for a longer life.”

The four pillars to longevity readiness

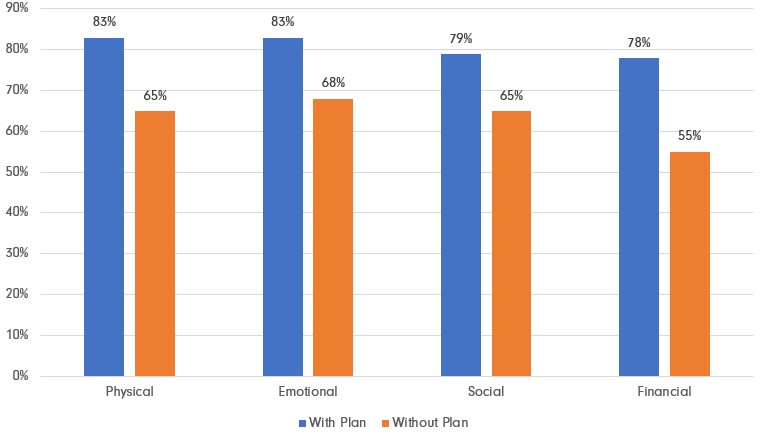

Financial stability, physical health, emotional wellbeing, and social connectivity are all vital elements in longevity readiness. Fidelity’s research found that those Australians who had taken steps to plan for retirement, such as preparing a budget or identifying potential income streams, felt significantly more ready for life after work across each of these measures.

This highlights how preparation serves as the foundation not only for long-term financial security but also for the maintenance of critical determinants of holistic wellbeing in later life.

Australians who have done some retirement planning feel much more prepared across all wellbeing pillars

Mr Glazier adds: “When finances are secure, people can invest in their health, maintain social connections, and approach retirement with confidence. When they’re not, the entire structure is weakened.”

The critical success factors for longer lives

The report outlines five critical success factors to unlocking a roadmap to help people thrive in longer retirements and for enabling organisations and policymakers to respond effectively to demographic change:

- Address financial anxiety early – Early financial guidance and education can reduce uncertainty and stress, helping people make informed choices and build long-term confidence.

- Champion innovation in technology – Digital platforms, AI-powered tools and personalised guidance can bridge gaps in financial literacy with the appropriate guardrails, enabling individuals to plan more effectively.

- Prioritise health and care – Addressing wellbeing and care needs early is essential. Helping people plan for health and care provision removes major uncertainties, supports independence, and improves quality of life.

- Build trust in public systems and institutions – Transparent communication, reliable products and consistent policy frameworks are essential to building confidence in retirement systems.

- Support holistic wellbeing – Timely interventions across all four pillars — financial, physical, emotional and social — ensures that no aspect of wellbeing is neglected, enabling individuals to enjoy longer, healthier, and more connected lives.

Mr Glazier concludes: “A longer life should be something to look forward to, not fear. We have an opportunity to create the conditions for people to not only live longer, but to also feel more financially secure and have a fulfilling retirement. Organisations and policymakers who embrace longevity wisely will not only support individuals in achieving security and purpose, but also establish a society that is wealthier, healthier and more cohesive than the one before it.”

|

*The analysis compares the number of years people are likely to spend in retirement against the number of years they expect their retirement savings to last. Results are then compared against both average life expectancy in their location and a potential 100-year lifespan to assess whether individuals are over-planned or under-planned for later life, and by how long. Because participants gave their answers in ranges rather than exact figures, NICA used a statistical model to estimate the most likely values within those ranges.

**Source: Pew Research Centre, March 2020 About the survey Fidelity International’s “The Longevity Revolution: Preparing for a New Reality” report draws on global research across 13 markets over 11,800 participants aged 50+. The survey was conducted by Opinium between 11 August and 11 September 2025. Further analysis of the data was conducted by National Innovation Centre for Ageing (NICA). In addition, focus groups of between 10 and 12 retirees and pre-retirees were conducted from August 12 to September 15 2025 by NICA in Germany, Singapore and the UK. |