Most Fidelity International analysts expect inflationary pressures to be greater this year than last, posing economic risks that companies and central banks have not faced for decades. These pressures arise from a cocktail of transitory and structural effects, with anecdotal evidence that higher labour costs may prove more entrenched than those of raw materials and freight.

Key takeaways

- Inflationary pressures increase, driven by a mix of transitory and structural factors

- Supply and labour shortages are set to weigh on earnings growth

- Labour cost pressures could prove more entrenched with skills gaps across sectors

Inflation fears have haunted financial markets in recent months, and for good reason. Both US core and headline consumer price inflation have reached their highest levels since 1982 at a time when labour markets across the developed world are looking increasingly stretched, implying substantial upward pressure on wages that, combined with supply shortages, could spur interest rates higher. Rate increases, even from very low levels, would eventually weigh on corporate earnings growth.

Companies face greater inflationary pressures

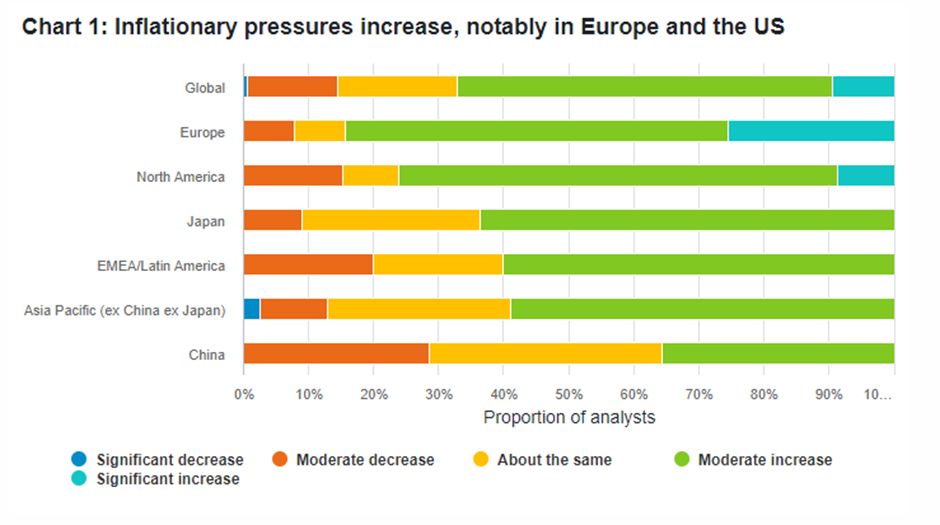

More than two thirds of Fidelity analysts expect inflationary pressures to be higher this year, up from just over half in 2021. Analysts that cover European companies stand out as more concerned about inflation, with 84 per cent reporting that they expect pressures to be higher over the next 12 months compared to the last 12 months - far above any other region (see chart 1) but from a lower starting point than many.

The costs of labour and of goods are both to blame. One Europe analyst reports that retailers she covers have already renewed transportation deals at current high prices for global freight, extending that elevated price level into next year. High cotton prices are affecting the cost of apparel, she adds, while Brexit has reduced the pool of available labour in the UK, further adding to wage inflation there.

Another analyst covering European industrials companies also expects higher costs to persist. “This is not a three to six-month issue but rather is likely to continue to impact into FY23,” says the analyst. “Also, those that have hedged raw materials and energy at these higher prices have effectively ‘locked-in’ higher costs for the next two to three years.”

Price increases are driven by a mix of transitory and structural factors

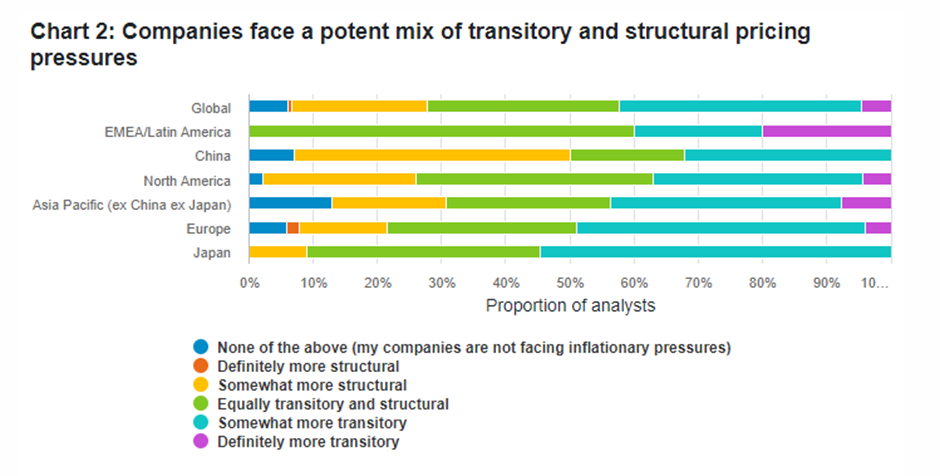

Despite expectations of higher costs throughout 2022, the majority of analysts believe that the surge in inflation is due more to one-off temporary effects caused by the pandemic and other price shocks. Just over 42 per cent say that the inflationary pressures on companies are more transitory than structural (see chart 2).

However, Matthew Siddle, European equity portfolio manager, cautions: “This survey finding could be a question of timing. Transitory is only transitory when people see the end coming and that will not be the same across all sectors.” Another 30 per cent of analysts believe that inflation is equally driven by both transitory and structural effects, up from 22 per cent when we last asked the question in September, while just over 20 per cent of analysts say outright that inflationary pressures are now more structural.

“Some issues feel very specific to Covid, for example the acute increase in certain raw material, freight and logistics prices, and are therefore more transitory,” says one analyst covering European healthcare companies. “The labour market is less clear.”

Another analyst covering North American consumer discretionary firms also distinguishes between pricing pressures that are more transitory, and those such as higher wages that could persist for longer. “I think the freight costs appear to be more transitory and should abate over time. The wage increase looks more durable given historically low unemployment rates and consistent commentary around labour shortages,” he argues.

Some analysts point to the cost of decarbonisation as a factor that could make inflation more of a structural issue over the long term. “Underinvestment in fossil fuels may lead to a structurally higher oil price,” says one analyst covering Chinese industrials companies, while another points to pressure to end deforestation potentially increasing prices for palm oil.

An analyst covering European autos reports: “Car companies face structural cost inflation from new technologies such as electric and autonomous vehicles.” Given that emerging climate technologies could eventually prove deflationary, and many firms have yet to grasp the nettle on net zero, this is an area to watch.

Labour and supply shortages could hit earnings

Problems with the supply of materials and labour have affected a wide range of companies over the past year, from carmakers seeking chips for assembly lines to supermarkets struggling to find delivery drivers.

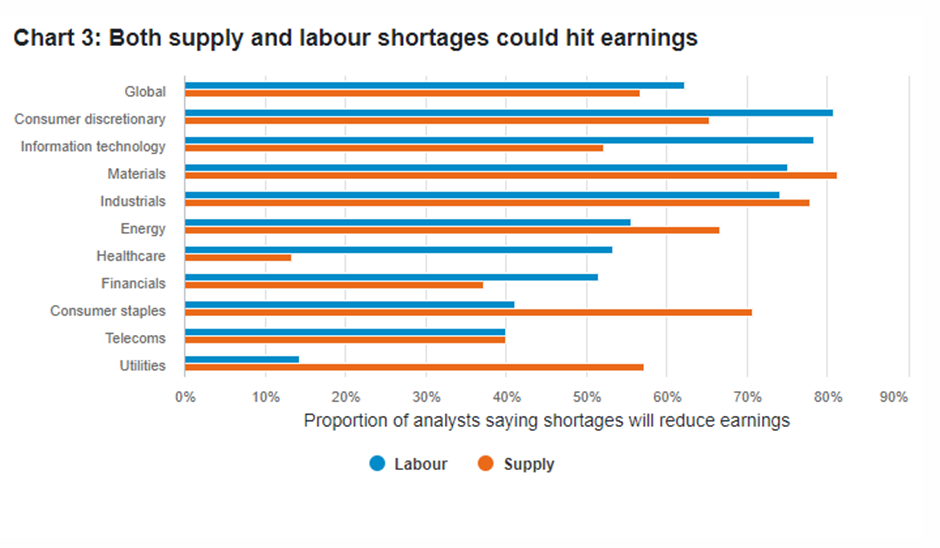

With knock-on effects on pricing now kicking in, especially for sectors like telecoms and materials where pricing power is decreasing, just over half of our analysts think that supply shortages will have an impact on corporate earnings this year, with the proportion rising to over 60 per cent for labour shortages. Consumer discretionary, tech, materials, and industrials companies are among those expected to be particularly affected by labour shortages, with staples companies more impacted by supply issues.

“Shortages have been partially compensated by higher pricing to date, however companies do not think pricing can increase indefinitely as this will hurt their competitive positioning,” reports one analyst covering European industrials companies. “Therefore, if shortages continue, we will likely see a reduction in earnings year-on-year.” Some analysts also raise the possibility that lower growth coupled with still high inflation could lead to stagflation.

Wage pressures are set to persist

Not only are labour shortages viewed as a bigger threat to earnings than supply issues over the next 12 months, but many analysts give examples of structural gaps in skills and worker availability, from the struggle to find nurses and other clinical staff in healthcare, to the need for coding skills across the economy.

An analyst who covers big US tech names says that corporate managers are forecasting significant labour cost increases in next year’s budgets as a result. “These are people businesses,” he says. “Wages are a key inflationary pressure and tightness in the IT labour market is not going away anytime soon.”

For US retailers and restaurant chains, analysts point to management hopes that more workers will return to the market as the pandemic eases and fiscal support is rolled back. But the danger is they have found alternative options.

“Companies are messaging that labour is also transitory, but I think the jury is still out and it’s a big factor if its structural,” says one analyst who specialises in US retail, restaurant, and other consumer discretionary names.

A year of living expensively

Although the survey generally paints a positive picture of 2022 as vaccines help countries deal with Covid-19, a majority of Fidelity analysts predict higher inflationary pressures for companies this year than last, despite central banks tightening policy to rein these in. The analysts believe these pressures are largely due to transitory effects, with some commenting that rises in certain raw material costs could start to ease later this year. However, as wage pressures mount and the need to decarbonise becomes ever more pressing, the risk of more sustained inflation over the medium term remains high.