Most Japan analysts expect rising returns on capital in 2022, although the country may be later in the business cycle than other regions.

Key takeaways

- Robust demand fuels expectations for returns on capital in the year ahead

- Inflationary pressures set to rise further, though analysts believe these are largely transitory

- Focus on decarbonisation is likely to accelerate as Japanese companies pursue net zero targets

A mild slowdown for Japan's economy in the final quarter of 2021 hasn't taken the shine off expectations for a solid year ahead. Our analysts think that managements at Japanese companies are largely positive about the next 12 months, with over half expecting an increase in the confidence of management teams to invest in their businesses.

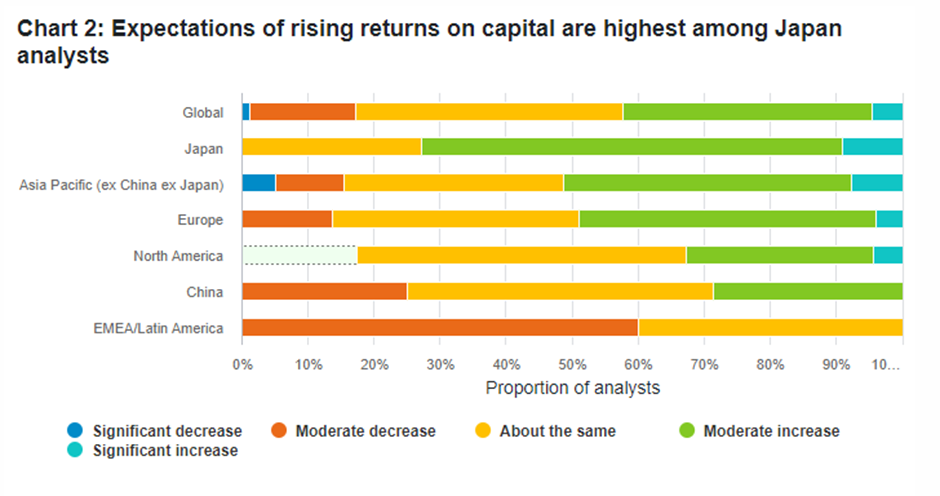

Analysts generally expect Japanese firms to maintain robust balance sheets, while three quarters of survey respondents in the country anticipate significant or moderate increases in returns on capital at their companies over the next year, the highest of any region globally. Japan also has the lowest proportion of companies globally needing to raise capital this year.

“What is the outlook for overall returns on capital for your companies for the next 12 months versus the last 12 months?” Source: Fidelity International Analyst Survey 2022.

That said, Japan could be closer to the tail end of the business cycle than other regions. A substantial 73 per cent of analysts say the country is currently at the mature stage of an expansion cycle, with 27 per cent forecasting a slowdown in 12 months.

The government forecast in December that the world’s third-largest economy would expand by 3.2 per cent in the fiscal year that begins in April, based on a growth spurt that began last autumn driven by resurgent private consumption, easing economic restrictions, and a period of relatively subdued Covid-19 infections. Recently, however, an omicron outbreak prompted the government to downgrade its consumption estimates. Signs of weakness also came through last quarter as corporate spending tightened on plants and equipment, though exports remained strong.

Inflation re-emerges in an economy long used to deflation

Inflationary concerns in Japan, meanwhile, turned sharply higher in the second half of last year, as prices around the world rose on a consumer boom and commodity shortages. Those worries haven’t completely receded.

The Bank of Japan warned in January that rising energy costs are likely to spur gradual consumer inflation this year. Our analysts agree. Nearly two thirds report that they expect inflationary pressures to be greater in 2022, a novel threat to corporate margins in an economy long used to stagnant prices.

Still, 55 per cent of our analysts view such pressures as transitory rather than signals of structural malaise. Anecdotal evidence also suggests that cost pressures in some areas could be starting to ease. “The semiconductor shortage, one factor for the cost push, is getting resolved for the auto industry, which I expect is a good leading indicator,” says one Japan technology analyst.

Japanese companies in the food sector and smaller consumer businesses, meanwhile, tell our analysts that demand resilience in recent months has put them on a stronger footing to raise prices. “We are passing peak shortages,” says an analyst in the healthcare sector.

Increased focus on decarbonisation and technology

A third of analysts covering Japan think that decarbonisation is now a top priority for their companies, when asked to rank it relative to other areas of focus such as growth investment, shareholder returns, and employee welfare. Although this proportion is still relatively low, it compares favourably to the global average of 19 per cent.

Analysts also expect almost 30 per cent of their companies to be carbon neutral by 2030, the highest level of any region. Japan is one of the few regions where this proportion has risen since last year, with most other regions moderating their expectations for 2030 carbon neutrality as the scale of the challenge ahead becomes apparent.

Finally, Japanese companies remain at the forefront of global businesses embracing technology, with 91 per cent of our analysts saying that automation could increase profitability and 73 per cent saying the same for AI. Japan also has the highest proportion of analysts globally - 91 per cent - indicating that they see investing in new technology as the best way to improve corporate resilience in the face of the many challenges ahead.