The survey points to a rise in management confidence across all sectors, driven by hopes of further recovery from the pandemic. However, our analysts expect significant differences between individual industries as companies battle continuing supply and labour shortages, an advancing business cycle and increased inflationary pressures.

Energy

The impact of higher oil prices is writ large across management confidence to invest and other survey indicators for an energy sector that has been improving steadily since the collapse in demand for crude oil at the start of the pandemic.

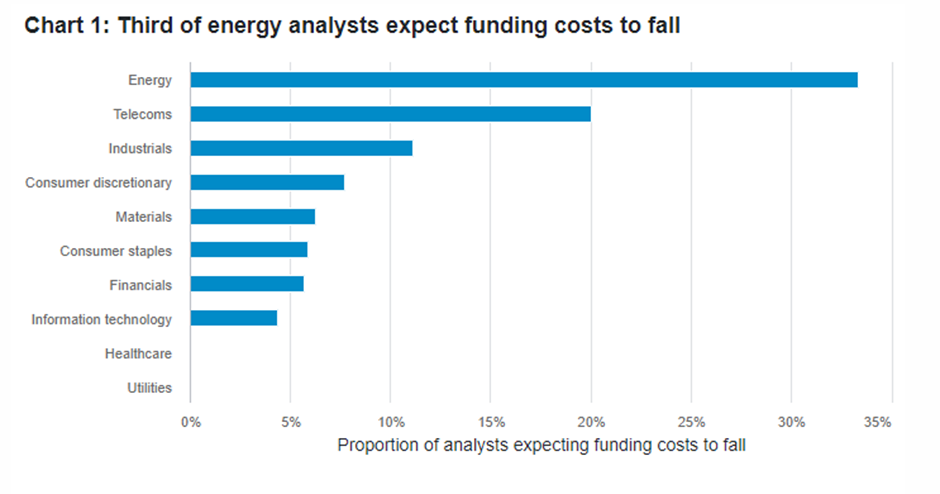

Over half of our energy analysts say management teams are more confident about investing in their businesses than they were a year ago. Almost 45 per cent of analysts expect leverage to fall, while a third expect funding costs to drop as companies prioritise cash flow over growth.

“How, if at all, do you expect funding costs for your companies to change in the next 12 months compared to the last 12 months, based on credit quality?” Source: Fidelity International Analyst Survey 2022.

Dividends are also expected to recover, with almost 90 per cent of analysts saying they could rise over the next 12 months compared to 70 per cent a year ago. Almost 80 per cent of analysts expect a rise in regulation and estimates of how many energy companies will be carbon neutral in 2030 have increased from last year, while more than three quarters of firms are expected to achieve neutrality by 2050.

Key takeaway: Oil and commodity price volatility remains a risk

Consumer discretionary

The end-of-year struggle with the omicron variant of Covid-19 has reignited concerns about the recovery of some of the consumer-centric businesses worst hit by the pandemic. Despite this, 58 per cent of our analysts say that, overall, management’s confidence to invest has grown. More than half also expect returns on capital to improve on the back of further recovery in demand.

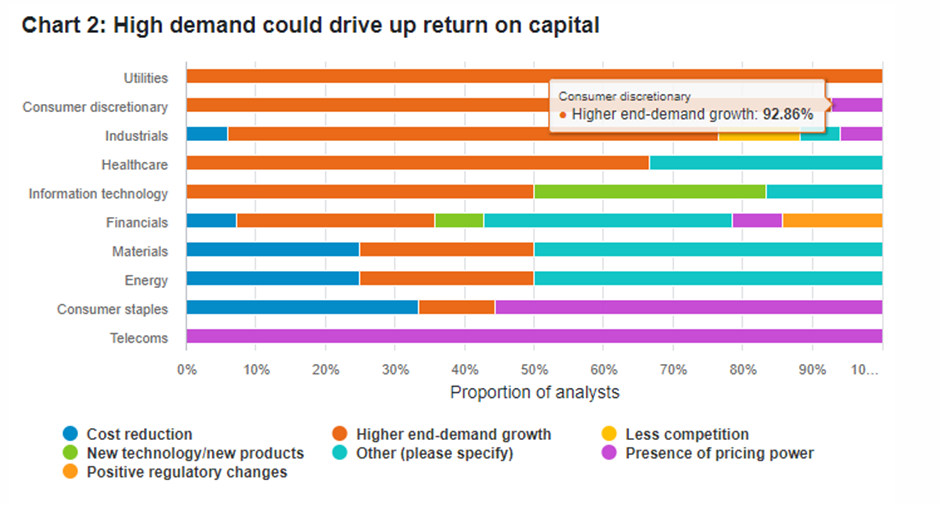

What is the principal cause of increasing returns on capital?” Chart shows the proportion of analysts who expect ROC to increase (42 per cent of all responses). Source: Fidelity International Analyst Survey 2022.

Shortages like those that have hit car and electronics producers will continue to bite until supply chains recover, with 81 per cent of analysts saying the scarcity of labour will reduce earnings this year and two thirds expecting the supply crunch to do likewise.

Following the rebound in valuations and with funding costs rising, our analysts were split on the prospects for mergers & acquisitions (M&A) in the sector. Almost 20 per cent say M&A will be less prevalent amongst their companies over the next 12 months, but a similar proportion believe that deal-making could rise. “In consumer products, we may see bolt-on acquisitions as companies continue to scale their product ranges and optimise portfolios,” says one analyst who covers North American companies.

Key takeaway: Covid-19 impact on demand is central to the sector’s prospects

Healthcare

The healthcare sector is a broad one, covering everything from Covid-19 tests to hearing aids. Some companies have outperformed during the pandemic, while others have struggled with the reduction in elective procedures and other types of care. Overall, almost half of analysts report management teams are more optimistic about the year ahead.

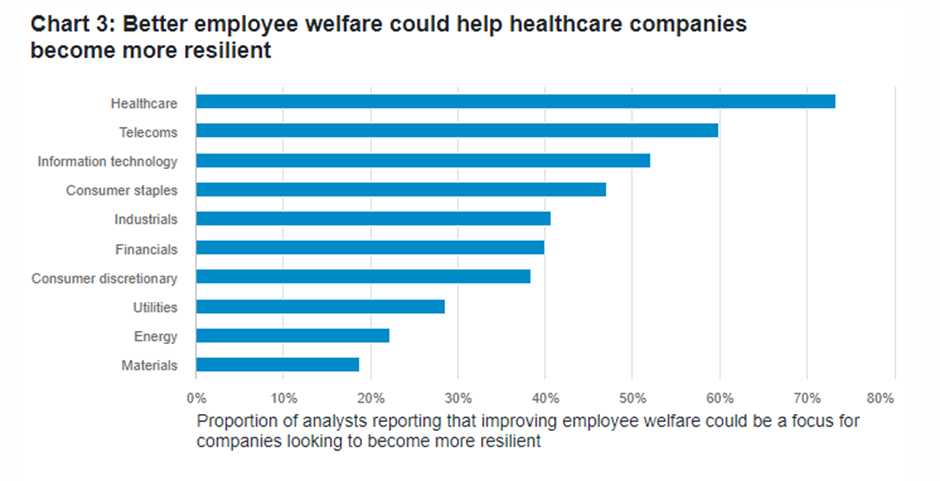

Labour shortages may weigh heavily on the sector: 53 per cent of our analysts say the issue will affect earnings this year and several highlight the shortage of skilled nurses and other clinical staff as a longer-term structural problem that will not be resolved quickly. Our analysts report that companies believe improving employee welfare is crucial to improving the resilience of businesses.

“To what extent do you expect the following resilience measures to be a focus for your companies over the next 12 months?” Chart shows the proportion answering 5-7, where 1 means not a focus at all and 7 means very high focus. Source: Fidelity International Analyst Survey 2022.

One analyst who covers North American healthcare providers says: “Demand for healthcare is not the problem. Nurse shortages constrain (the) ability to grow.”

A growing number of drug companies are also facing patent expiries and a third of analysts expect an uptick in merger activity, in particular bolt-on deals, in order to maintain or grow revenues.

Key takeaway: Labour supply and cost issues may prove to be longer-term problems

Materials

The surge in commodity prices over the past year has been a boon for metals producers and other miners but as the Chinese economy slows and global supply chains work out their kinks, 44 per cent of materials analysts say their companies have reached the mature stage of the business cycle, while the same percentage think the sector will be in slowdown mode within 12 months. As such, over a third of analysts expect returns on capital to fall, driven by a lack of pricing power and slower demand.

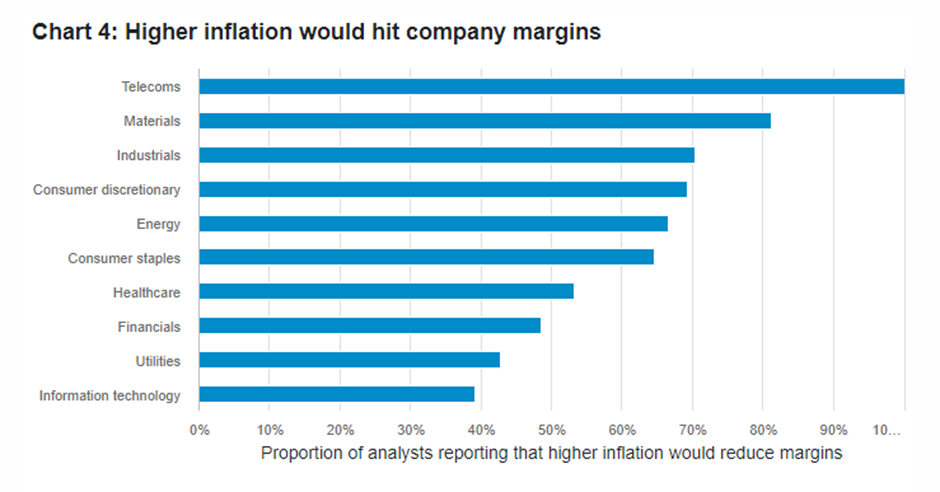

Several analysts say that the key to the coming year will be companies’ ability to deal with cost inflation and the struggle to pass more of it on to end users. Half of all materials analysts expect inflationary pressures to abate over the coming year, but 81 per cent of analysts still believe that higher inflation will decrease margins. Three quarters of analysts say labour shortages would hurt earnings, among the highest of any sector.

margins?” Source: Fidelity International Analyst Survey 2022.

Key takeaway: Expected to slow over the next 12 months after a period of outperformance

Telecoms

Telecoms analysts are the least optimistic of any sector about management sentiment, with 80 per cent saying they expect the mood to be unchanged from a year ago.

Both wage and overall cost inflation present a major headache for an industry that could struggle to raise prices for end-consumers. Forty per cent of Fidelity analysts covering the sector expect pricing power to decrease in 2022, while the same proportion expect returns on capital to fall, driven by the lack of pricing power and increasing costs.

Four fifths of our analysts hold out hopes for an uptick in M&A action across a sector which has been seen as ripe for consolidation for years. However, the prospects of regulatory support for big mergers in major markets mean deals, and value, may be focused in areas like 5G infrastructure and gaming or other media plays, responses to the survey suggest.

Some 73 per cent of companies are expected to need to raise capital this year, higher than any other sector.

Key takeaway: Cost inflation may prove a big problem for mobile operators unable to raise prices

Consumer staples

Lockdowns were a boost for consumer staples producers as people ate at home and shopped more online, but the supply chain issues of the past year have been a problem, leaving gaps on supermarket shelves that eat into sales.

Seventy-one per cent of our analysts say that the supply crunch could reduce earnings at companies this year and many express concerns over the “stickiness” of rises in labour and other costs.

“Food manufacturers are experiencing the most input/commodity inflation, owing to transportation and supply disruption,” says one analyst. “Broad inflation in labour costs is likely to reset [salary] base rates higher.”

The survey, however, also shows that over half of the sector’s analysts expect returns on capital at their companies to rise as the initial costs of adapting to the pandemic fade, with increases largely driven by the ability to pass on more costs to customers.

A considerable 94 per cent of analysts point to automation as an important factor in improving profitability, while some companies may seek to shorten supply chains in a bid to become more resilient.

Key takeaway: Supply crunch will still bite but tighter supply chains and automation could increase resilience

Industrials

Our industrials analysts report that order books are full as companies across the global economy seek to reactivate investments put on hold by the pandemic.

Management confidence was the highest of any sector in the survey - almost three quarters of analysts say that their companies are more bullish about the next 12 months. Returns on capital are widely expected to rise at a time when a third of analysts think the sector is still in the initial expansion phase of the business cycle.

Balance sheets appear to be the second most stretched of any sector in the survey and a third of companies are expected to need to raise capital this year, largely to fund more growth.

Key takeaway: Investment will be needed to capitalise on pandemic recovery

Technology

After a booming year which has seen revenue soar for many tech businesses, the sector has the strongest balance sheets, but there are concerns around the growth and investment outlook. Sixty per cent of analysts say management is more confident about the year ahead, but almost a fifth say the opposite.

Last year’s dramatic chip shortage continues to weigh on chip and other hardware producers. “Sales might have positive surprises if supply chain issues are solved, even partly. If supply chain issues deteriorate, there would be negative shocks,” says one analyst.

Companies may also have an easier road to decarbonisation than many, as well as the capital needed to make changes: 39 per cent of firms are expected to achieve carbon neutrality by 2030, and almost 70 per cent by 2050.

The shortage of engineers, programmers, and other skilled labour make wage inflation a problem across the sector, with almost 80 per cent of our analysts predicting the issue will eat into earnings this year. “Key costs for the internet industry are labour costs, which are structurally rising,” says one analyst.

Key takeaway: Post-pandemic drop off in digital activity is a risk, and the tightness in the IT labour market is not going away any time soon

Utilities

All of our analysts say their companies have become more focussed on implementing ESG policies in the last year and expectations of real action on the environment are everywhere in the survey’s numbers on the sector. Some 64 per cent of companies are expected to need to raise capital this year, with many saying that the funds will be used to adapt businesses for net zero.

Over 70 per cent also expect returns on capital to fall as costs and competition grow, and almost half of our analysts say funding costs for their firms could increase. Change is on the way, though. Although only 16 per cent of firms are expected to be carbon neutral by 2030, the proportion rises to two thirds by 2050.

Key takeaway: Utilities are investing in the energy transition, but capital requirements are high

Financials

Banks traditionally do well when inflation and interest rates are rising and 60 per cent of our financial sector analysts say their companies are more confident about investing in their businesses over the year ahead.

The price of skilled labour is an issue: it was the only sector in the survey where a majority of analysts say price pressures are slightly more structural on balance, and several analysts point to the link between soaring stock markets and asset values, and financial sector wages.

“Wage inflation is the main source of inflationary pressure for banks’ cost bases,” says one analyst who covers European banks.

Companies’ focus on employee welfare, however, may have peaked with the pandemic: 23 per cent of our analysts say the issue will be less of a priority this year, which is higher than in other sectors.

Key takeaway: Rising interest rates should prove a boon for banks.