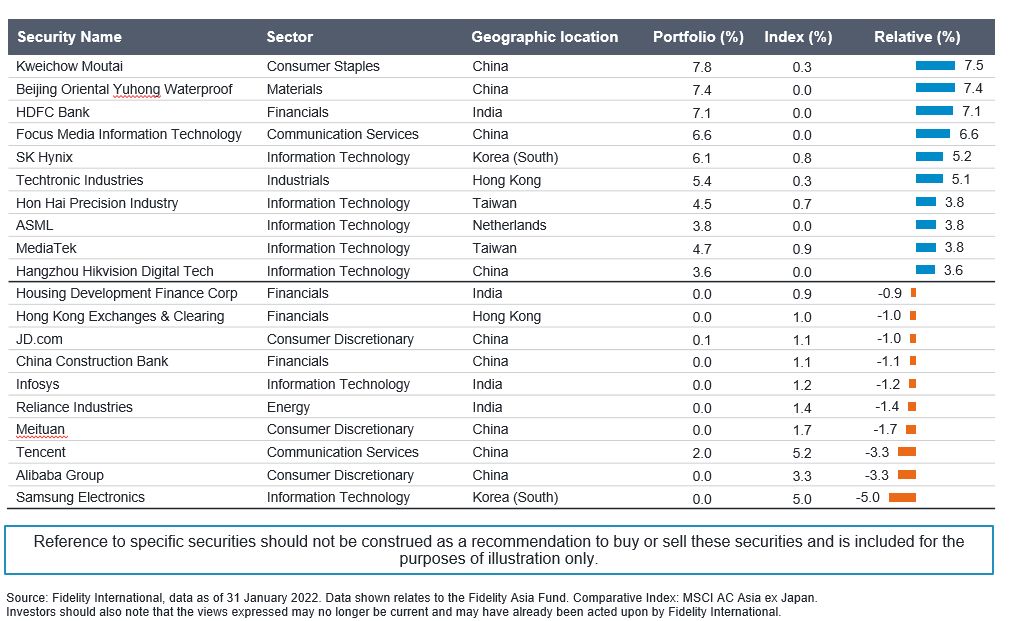

Since inception the Fidelity Asia Fund has delivered 11.26% pa to investors outperforming the benchmark by 3.15% pa. Investment Director, Gary Monaghan sits down with Portfolio Manager, Anthony Srom to discuss some of his top and bottom active positions and the role they play in driving performance.

*Inception date 29/05/05

Gary Monaghan

Firstly welcome Anthony, the Fidelity Asia Fund has proved to be a very popular strategy in the Australian market and I wanted to spend some time today looking at your active positions so investors can better understanding what you’re thinking and how you’ve constructed the portfolio to drive returns.

So, there’s only 25 stocks in the portfolio. You’re a high conviction manager. Let’s start with one that wasn’t in the portfolio a year ago. Focus Media - what’s the thesis there and can explain how you built conviction to add it to the portfolio?

Anthony Srom:

Throughout the first half of last year, it was a relative underperformer, but came back quite strongly in the second half. But to explain, what got me interested in the first quarter of last year was the regulatory crackdowns that we saw. The first shot was directed at online education providers in China and in aggregate, those guys made up about 5 per cent of Focus Media's revenue. Focus Media is a digital display advertiser (so think, LED or LCD screens in hotel lobbies, office lobbies, lifts, cinema advertising, etc). So that got smashed about 20% on the back of a 5% notional revenue wipe out.

So you’re buying into that relative weakness on the view that it's kind of being mispriced. And as the year progressed, and you track the quarterly earnings releases and the revenue damage is not as bad. The earnings damage is not as bad. So it's kind of meeting to slightly exceeding consensus expectations. The underlying quality of the business is improving because they're less reliant on bigger customers. They've spread their customer base much more, higher quality, providing better services at higher ASP, and the earnings are coming through. The market just didn't care about it until fourth quarter of last year and it popped quite substantially.

So, when I look at Focus Media, I still think it's quite undervalued. The fundamentals are tracking along nicely. And I think when things open-up more in China, advertising will be a beneficiary.

Gary Monaghan:

So we go down that list a little bit, Techtronic, which is a name that was added, I recall almost nearly two years ago when COVID first hit, it's been a great performer, but still a big position in the portfolio. Are you concerned about valuation or is it just such a high-quality business that you want to continue holding?

Anthony Srom:

I think the stock price has indicated that it maybe ran a little bit ahead of itself, underlying that is the market's fear of rising rates, dampening US housing demand. Techtronic basically manufactures power tools for do-it-yourselfers right up to contractors who need high end equipment. We’ve seen a similar situation in Australia with James Hardie, it's peeled off from 55 to mid-40s.

I think there's a lot of pent-up demand which isn't really going to go away if the Fed tightens 150 basis points. The other concern for Techtronic is supply chain issues, which again is not unique and and we’ve seen other companies stock prices fall. These guys report in about a week or two so we'll see. In my mind, this is kind of shorter-term noise and potentially a buying opportunity. It's still looking like a relative long term outperform in my mind.

Gary Monaghan:

And number ten on the list, Hangzhou Hikvision, as on the 3rd of June, it's going to be formally added to the US CMIC list. So what actions will you be taking there?

Anthony Srom:

The sell actions have already been occurring. This CMIC list has been pushed out from its original date. If we look at 2021 the stock price had two very steep rallies during the first quarter and in mid-year. At a price in the 50s into the 60s we reduced the position. While the clock is still ticking the investment thesis is still intact, so we’ll look to exit at more opportune times over the coming months ahead of the June deadline.

Gary Monaghan:

And then final one for me Anthony is just on the underweights. We talked earlier about the technology sector and the structural opportunities there, but you don't own one of the big names in Samsung Electronics. Why is that?

Anthony Srom:

Because the fund owns SK Hynix. For both of them, the key driver is memory. If we go back to first quarter 2020, both companies got hit and you're just weighing up do you buy Samsung or do you buy SK Hynix? And if you want pure play exposure to memory, you go for Hynix. I didn't want the baggage of consumer electronics and other bits and pieces that Samsung's got. And we’ve got foundry through TSMC. I'm not saying that's baggage, but it's not as good quality as TSMC and so therefore we went for the pure play because it stacked up again on its own risk/reward merit.

Gary Monaghan:

Thanks for that Anthony. Always interesting to get your thoughts on stocks and look forward to your next update.

*The Fidelity Asia Fund is now also available via the Colonial First Choice Platform.