When allocating to global equities, investors often gravitate towards large-cap stocks. Here, the team behind our Fidelity Global Future Leaders strategy highlights the unique investment opportunities to be found within the mid and small-cap markets.

Key points

- Small and mid-caps can offer attractive risk and return characteristics, while providing diversification benefits away from large-caps.

- Mid-cap markets are home to many established companies with proven management teams, including household names and spin-offs from larger businesses.

- Identifying the leaders of tomorrow requires extensive research capabilities, deep knowledge of the small and mid-cap markets, and a structured, repeatable investment process.

Characteristics of the mid and small-cap market segments

For investors exploring the opportunity of the global mid- and small-cap segment, there are some key differences to be aware of when compared to large-caps, aside from market capitalisation. These are highlighted in the table below.

Figure 1: Typical characteristics of large-cap, mid-cap and small-cap segments

| Large-cap | Mid-cap | Small-cap | |

|---|---|---|---|

| Maturity level | Generally well established | Generally established | Can be earlier stage |

| Volatility | Low | Medium | High |

| Potential for high returns | Low | High | High |

| Potential for negative returns | Low | Medium | High |

| Liquidity (ease and cost of trading) | Very good | Good | Typically low |

| Availability of company information and detailed research insight | Very high | High | Typically low |

For illustrative purposes only.

Source: Fidelity International, 31 December 2025.

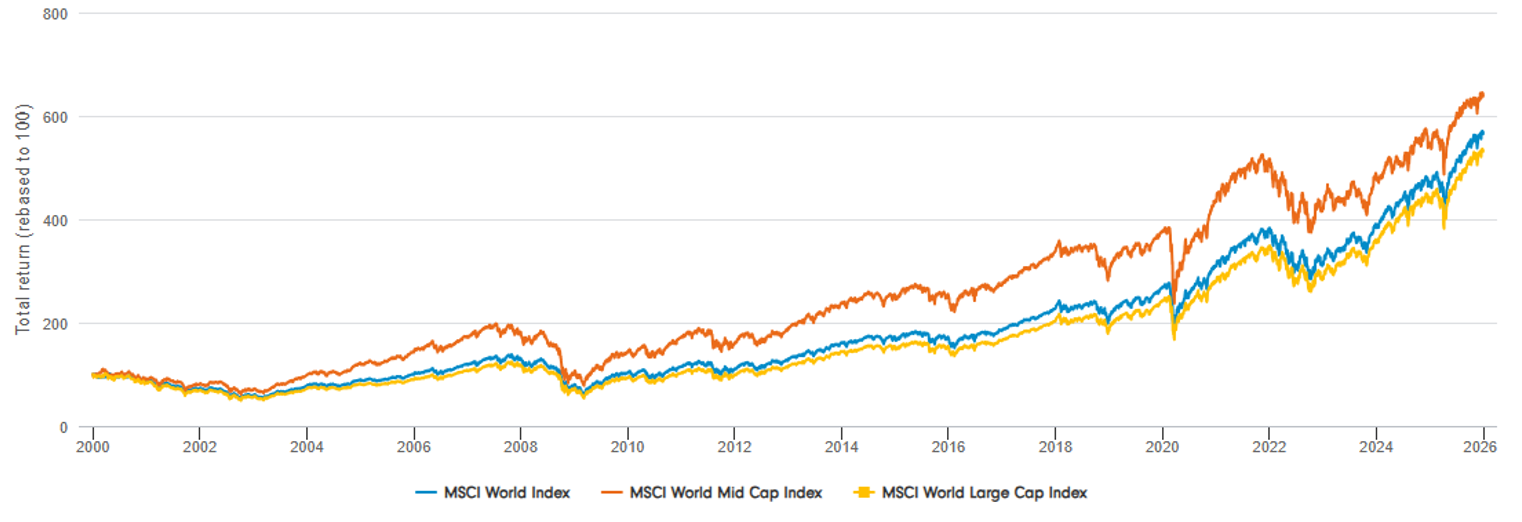

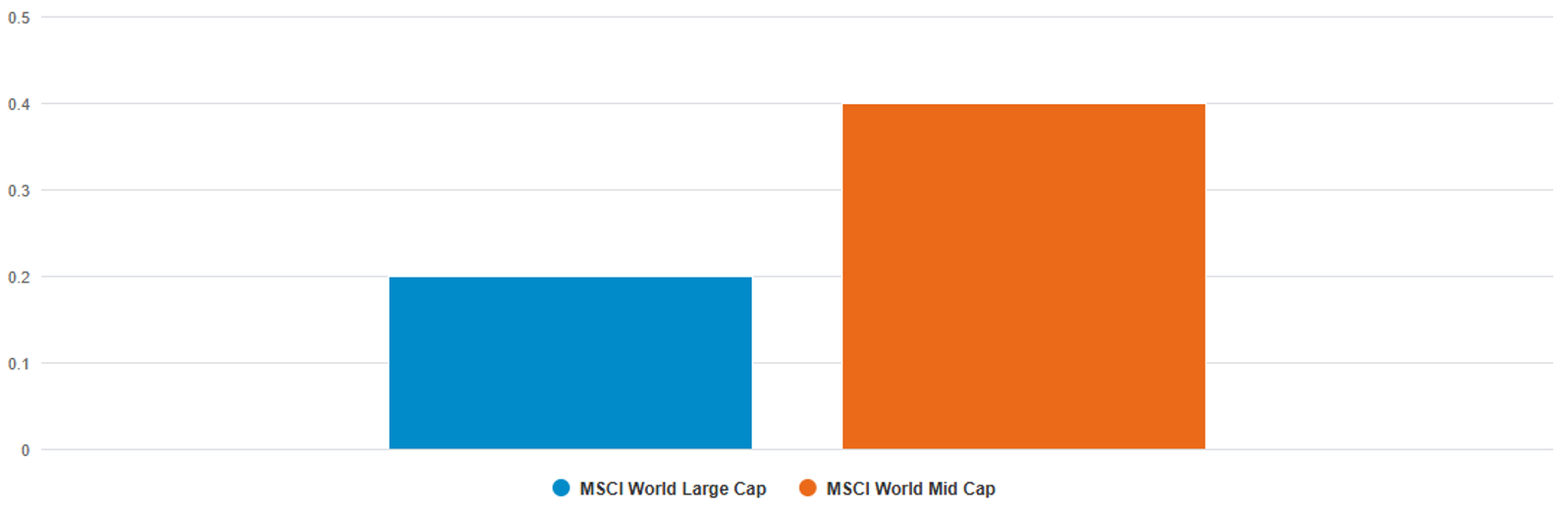

Attractive risk and return outcomes

While smaller companies are characterised by higher volatility, long-term investors have historically been well compensated for assuming this additional risk. Over the past 25 years, global mid-caps have generated higher returns than large-caps. For the 25 years to 31 December 2025, global developed world mid-caps delivered 107% in excess returns versus their large-cap peers. Similarly, when comparing risk outcomes through Sharpe ratios, we can see that investors have been appropriately rewarded for their investment in global developed-world mid-cap stocks over the long term.

Figure 2: Mid-caps have outperformed over the last 25 years

Past performance is not a reliable indicator of future performance.

Source: Refinitiv DataStream, Data period from 1 January 2000 to 31 December 2025. Total returns in USD. Returns may increase or decrease as a result of currency fluctuations.

Figure 3: More attractive risk outcomes (Sharpe ratio) over the last 25 years

Past performance is not a reliable indicator of future performance.

Source: Refinitiv DataStream, Data period from 1 January 2000 to 31 December 2025.

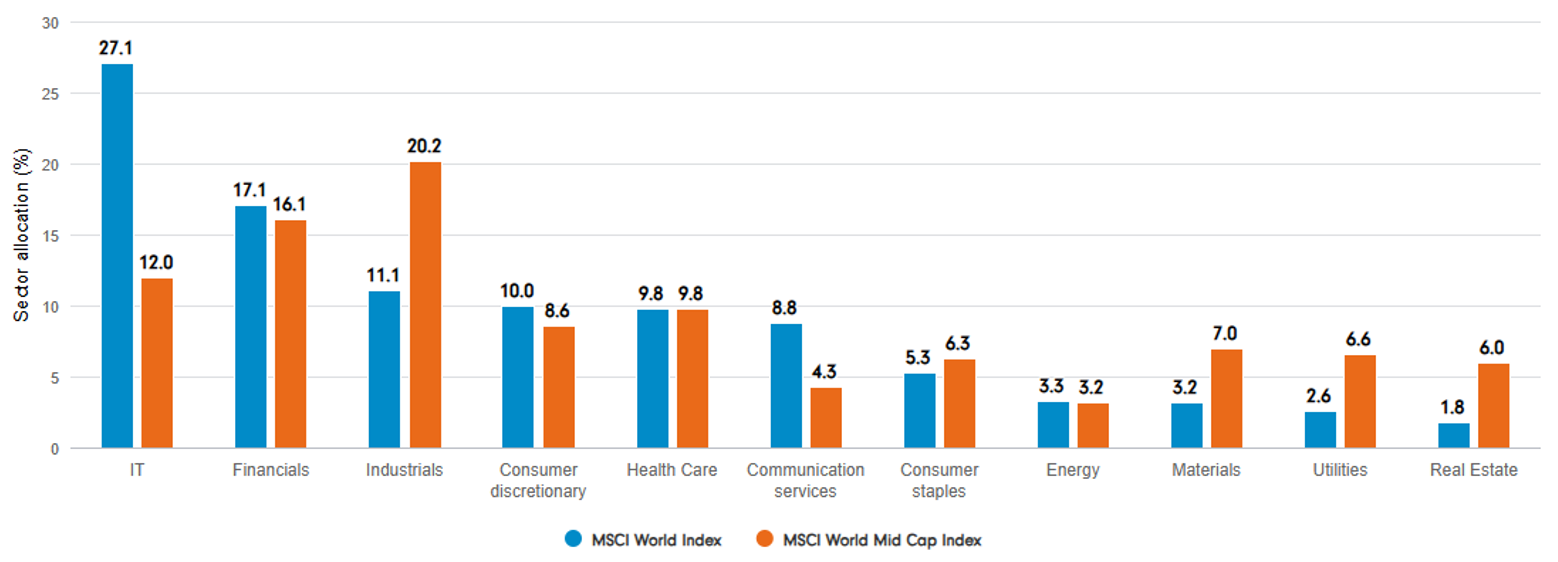

Diversification benefits

Given the concentration at the sector and stock level of major global market indices, many investors will look to other asset classes to help diversify portfolios. Global mid-small caps can help to provide this diversification, offering investors exposure to companies across a broad range of sectors and industries, as shown in the chart below.

Furthermore, it is important to highlight that there are no single stocks or groups of stocks dominating the developed-world mid-cap market, as is the case for mega-caps. There are also no stocks that comprise more than a small percentage of the overall market, reducing the risk of portfolio concentration.

Figure 4: Sector and stock-level concentration is lower for mid-caps

Source: Fidelity International, MSCI, 31 December 2025. GICS classification.

Investing in established businesses with proven management

Contrary to popular belief, the average age of a company in the MSCI World Mid Cap Index is 28 years1. This provides reassurance about the experience and longevity of businesses within this investment universe.

One such example is Moncler, whose high-end outerwear is rapidly becoming familiar to emerging market consumers. The first Moncler down jackets were made in 1954 in France for the company’s own workers, who wore them over their overalls at the small mountain factory. Moncler was listed on the Milan Stock Exchange in December 2013 and has graduated from a small-cap stock at the time of its IPO to an almost US$14.2 billion market-cap stock today2.

Similarly, Ferrari was founded in 1939 and is a well-recognised brand in the luxury car segment. The company is often assumed to be a large-cap stock, but it remained a mid-cap company with a market capitalisation of US$35 billion until March 2021.

Large-cap businesses can also spin off segments of their company to unlock value, presenting the opportunity to invest in small-mid cap companies, with robust DNA and expertise in their industry. For example, Siemens Energy was created as an independent company in April 2020 following restructuring of the Siemens Group. Siemens Energy only very recently graduated from the mid-cap to the large-cap segment in June 2025.

Deep research and investment discipline are crucial

Despite the scale of the opportunity in this universe, history shows that just a handful of today’s small and mid-caps will emerge as future leaders within their fields. Defining the ingredients to success can be difficult, as it requires understanding companies intricately, and many are not covered by sell-side analysts or third-party research. Herein lies the strong opportunity for the Fidelity Global Future Leaders strategy.

To uncover the best opportunities, investors need extensive research capabilities. Our approach benefits from Fidelity’s large global research platform, which includes a team of analysts dedicated to small-mid cap research across geographies. They can go beyond benchmark limitations to explore the full range of listed investment opportunities, helping to identify those that might be missed by others and providing insights into potential long-term winners.

Global mid-small cap investment opportunities are often found in structural winners, technology disruptors, innovators, category leaders and strong brands. Through rigorous research, it is vital to identify these opportunities early, before they are widely recognised, so investors can benefit from both valuation re-ratings and earnings growth.

Experience shows that such companies often include unique, niche operators or specialists that dominate their field, while others are part of a large global theme. Recently, sectors including technology, healthcare, and industrials, as well as businesses targeting global consumers, have become home to such businesses. Many of these companies are also founder-led, with management teams that are both innovative and agile, aligning their interests closely with those of external shareholders.

Our Fidelity Global Future Leaders strategy is run by an experienced portfolio management team, possessing deep knowledge of the mid-small cap market. This can help us achieve differentiated outcomes compared to broad index investments over medium and long-term periods.

Our structured and repeatable process enables us to distinguish between short-term euphoria and long-term fundamentals-based expectations, maintain strict valuation discipline, size positions according to conviction and liquidity, and continuously reassess these convictions to actively manage portfolio positions effectively.

Sources:

1 Macquarie Research, May 2025.

2 Share Information | Moncler Group, 16 December 2026.