Biodiversity is becoming an increasing priority for companies. The general public and investors are demanding better biodiversity standards in businesses, and companies are likely to respond by aligning their operations more closely with biodiversity considerations given the evolving disclosure framework.

The developing regulatory framework for biodiversity will also add further impetus to changing business practices. We believe that the strong momentum behind biodiversity will result in a much faster take-up by companies of biodiversity disclosures and measures to solve biodiversity decline than for climate change.

Biodiversity blunders cost companies

In 2021, Constellation Brands, the third largest brewer in the US and maker of products including Corona and Modelo beer, posted a US$650 million impairment charge related to its water use at a plant in northern Mexico. In an example of communities fighting for their environmental interests, locals voted against the construction of a new brewery in the city of Mexicali, arguing that the plans prioritised the limited water resources for the American drinks market over the needs of local farmers and the community.

Constellation was part way through the US$1.4 billion construction project and was forced to record the impairment charge. What was telling about the event was that Constellation is a deep-pocketed multinational and had the support of local officials.

Crucially, not only did Constellation lose its upfront capital investment, but it also took a hefty knock to its share price, losing 11% or US$2.6 billion of its market value on the day of the plebiscite result.

Constellation is far from the only example of a company wrong footed by not being sensitive enough to environmental concerns. Ence, the Spanish multinational pulp maker that also supplies renewable energy, has strong sustainability credentials but even it has suffered from a lack of biodiversity oversight.

Last year, its Pontevedra pulp mill in northwest Spain shut operations for four months because drought conditions affected its water supply from the Lérez River. Ence’s fourth quarter pulp sales volumes fell 37% year on year and its cash costs rose 55% because of the stoppage. Operations were only resumed when Ence developed a new solution that regenerated wastewater from the pulp mill and a nearby wastewater treatment facility, reducing its demand on the Lérez River - an example of how companies can be forced to adopt measures that are also good for biodiversity.

Ence’s positive innovation was driven more by necessity than careful risk management, and it cost the company millions of euros as a result. As the examples of Ence and Constellation Brands show, companies that embark on projects without due thought to biodiversity challenges, often specific to the local environment, can face significant penalties.

Plethora of forces driving biodiversity investment growth

Companies are increasingly having to pay attention to biodiversity whether they like it or not. Businesses face opposition from communities and potential marketing disasters if they do not sufficiently respect the local environment, but it also makes operational sense to incorporate biodiversity into strategic plans to manage this key risk.

Investors are becoming more vocal about the topic. In the past two years, the number of biodiversity-focussed investment funds has trebled and assets under management has risen even faster. While biodiversity is still a relatively small part of the overall thematic investing universe, it has been growing twice as fast over the past five years. Investors are quickly recognising that biodiversity is an essential part of sustainable investing. It is an enormous, secular investment opportunity worth trillions over the coming decades where companies will have to adapt their business models and operations to the transforming biodiversity landscape. As more and more investors become aware of this, more pressure will be exerted on companies to comply with biodiversity standards.

The regulatory framework around biodiversity is rapidly evolving. At the December 2022 COP 15 meeting, the Kunming-Montreal Global Biodiversity Framework (GBF) was agreed with the aim to halt and reverse biodiversity loss by 2030 and achieve full recovery by 2050. The Taskforce on Nature-related Financial Disclosures (TNFD), which was finalised in September 2023, builds on the GBF by fleshing out specific detail on biodiversity-related reporting recommendations for companies.

TNFD will transform the visibility of companies’ operations impact on biodiversity

The TNFD is a risk disclosure and assessment framework, equivalent to climate’s TCFD (Task Force on Climate Related Financial Disclosures) and effectively sets the bar for disclosure metrics on nature. At its heart, it is a framework to help companies assess nature-related impacts, dependencies and associated risk and opportunities.

The TNFD framework covers four main disclosure pillars:

- Governance: how the company manages and supervises nature-related impacts

- Strategy: the specific nature-related impacts on a company’s business model, operations and supply chain

- Risk and impact management: the processes a company uses to identify and monitor nature-related impacts

- Metrics and targets: specific quantitative and qualitative measures used to assess nature-related impacts.

All the pillars will support biodiversity investment, but it is the last pillar of metrics and targets that will be the most instructive for day-to-day investment decision making. These metrics cover a range of parameters from spatial footprints to the volume of plastic consumed and water discharged, and they will increase the transparency and accountability of companies. As companies adopt the recommendations of the TNFD, there will be more information and data available to evaluate those companies most exposed to nature related risks and opportunities whether via impacts or dependencies. It will mean that equity markets can more readily make judgements about biodiversity compliance and risks, and incorporate those into stock prices much quicker.

The TNFD emulates the climate focussed TCFD (Task Force on Climate Related Financial Disclosures), but it is likely to have a much faster take up. The TCFD, first established in 2015, is mandatory in various jurisdictions including the EU, Hong Kong, Japan and Singapore, and will become mandatory in the UK in 2025. The TNFD, while recommended rather than mandatory at this stage (although both the UK and EU have hinted at mandatory adoption), will take effect just one year later in 2026 having first launched in 2021.

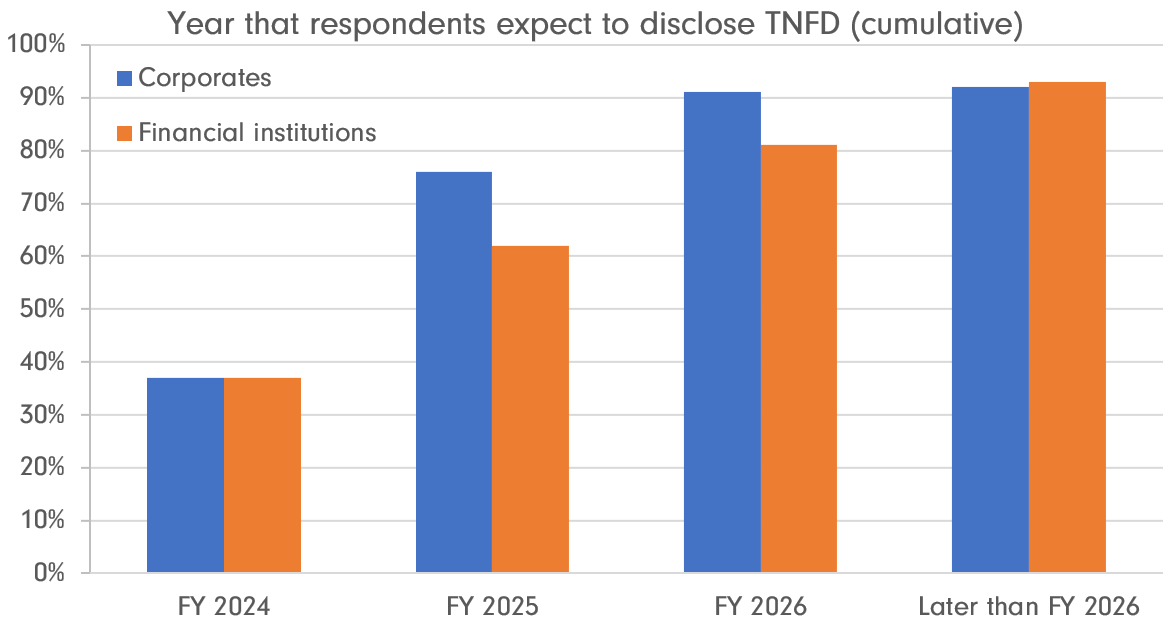

The TNFD should also be seen as additive and complementary to the TCFD. Adoption of TCFD will therefore pave the way for the TNFD and lubricate its acceptance and implementation. Given these characteristics and the momentum behind TNFD, we believe that it will be adopted faster than the TCFD. Indications already show that most companies will adopt the framework by 2025 and over 90% by 2026.

Overwhelming majority of companies expect to disclose TNFD recommendations

Source: TNFD, Barclays, October 2023. Survey conducted July-August 2023. 239 respondents.

TNFD already feeding though to accounting standards

We are already seeing the TNFD starting to flow through to the major accounting frameworks. The fact that the TNFD has been designed with accounting structures in mind, has helped this. For example, the TNFD recommendations are aligned with the same four pillars of the TCFD, which facilitates its integration into accounting standards given that the TCFD is already being assimilated.

The International Sustainability Standards Board (ISSB), which is part of the International Financial Reporting Standards Foundation (IFRS), has announced it has started to work on Nature, and may have a finalised guidance by the end of 2024. The UK, Singapore, Hong Kong and Canada have already indicated they will integrate ISSB recommendations, and Australia is currently reviewing it.

In July, the European Union announced it is adopting the European Sustainability Reporting Standards (ESRS), subject to the Corporate Sustainability Reporting Directive (CSRD), which entered into force in January 2023. The CSRD will considerably expand the scope of sustainability reporting requirements from 2024 for tens of thousands of companies, comprising over 75% of corporate turnover in the UK. This means companies and financial institutions with substantial activity in the EU must make nature-related disclosures. The CSRD builds on the ISSB baseline, offering enhanced disclosure.

Investors should prepare for biodiversity risks

Investors should get ready for TNFD implementation and have the right investment strategies, analytical tools and portfolio management systems in place to benefit from the added disclosure. Being prepared for further changes in governmental and regulatory policy, initiatives to standardise and measure biodiversity risks, evolving auditing and disclosures is vital.

There will be new approaches to critically evaluating companies and increasing awareness of supply chain weaknesses where issues such as water use, deforestation and threats to species are acute. As we saw with the earlier examples of Constellation Brands and Ence, biodiversity factors can make a difference of millions and even billions of dollars to company profits and market values, making it essential for investors to manage biodiversity risks.

At Fidelity International, we believe it is crucial to invest in the entire value chain of solutions to biodiversity loss to ensure a comprehensive, effective, and enduring response. While many causes of biodiversity loss can be addressed through solutions available today, there are some with no clear answers. Therefore, we can also invest in industry leaders that have the right policies or products and services in place; by supporting them, we can contribute to the development of commercial frameworks required to tackle the causes of biodiversity loss. This mix of solutions providers and transitioning companies across the value chain helps build a diversified portfolio.