Key points

- Bitcoin's traditional four-year cycle, driven by the halving mechanism, may be evolving into a more mature phase, as evidenced by growing market size, reduced volatility, and increased institutional participation.

- The rise in institutional involvement and the expansion of financial products like ETFs and derivatives are contributing to a more sophisticated market environment.

- Despite its volatility, Bitcoin's low correlation with traditional assets offers a differentiated risk-return profile, making it an appealing option in a landscape marked by geopolitical uncertainty and rising inflation.

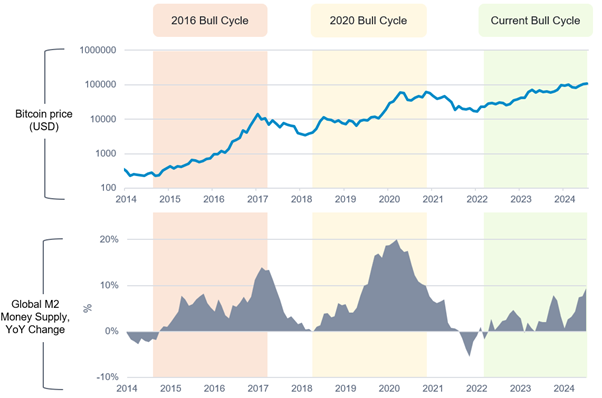

Approximately every four years (after every 210,000 blocks mined), Bitcoin halves the reward for new mining formally in a moment that has historically been followed first by a period of rapid price appreciation, and then a sharp correction and, eventually, consolidation.

The peak in each of those last three rallies came 12-18 months after the halving event and we are now 16 months into a rise following the latest event in April 2024. So, are we headed toward another steep correction, or is the four-year pattern beginning to shift?

Bitcoin price and the past halving cycles

Source: Fidelity International, Bloomberg, as of 14 July 2025.

Several market trends hint at a more complex and mature phase in Bitcoin’s price discovery journey, suggesting the market may no longer adhere as rigidly to cyclical patterns. This evolution could mark the early stages of a broader paradigm shift in how Bitcoin behaves.

1. Growing market size with declining volatility

Bitcoin’s market capitalisation has surged from billions to over US$2 trillion in the past five years, surpassing silver and positioning itself among the top 10 single assets globally today. As the scale of the market grows, the capital required to meaningfully move its price becomes substantially larger. This growth has coincided with declining volatility and for investors fewer of the exponential returns seen in earlier cycles. As the market becomes more liquid and mature, the asset volatility is likely to decline further.

BTC price 360-day volatility

Source: Fidelity International, Bloomberg, as of 14 July 2025.

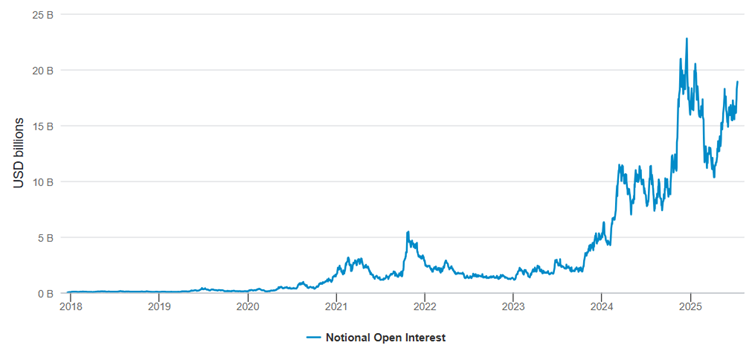

2. Expansion of hedging instruments

Each successive cycle has seen Bitcoin's volatility and drawdowns diminish, reflecting a maturing market supported by the broader availability of institutional-grade financial products, including ETFs and advanced derivatives. Derivative markets have seen significant growth in both futures and options open interest. For example, CME open interest in Bitcoin futures rose fourfold from US$5 billion in December 2023 to over US$20 billion at the time of Bitcoin’s breakout to US$100K. The expansion of the options market also highlights a more sophisticated investor base increasingly utilising hedging strategies and structured approaches to manage risk. These developments signal growing market depth and complexity, which may dampen the volatility delivered by speculative retail behaviour in earlier cycles.

Bitcoin CME futures open interest

Source: Fidelity International, Bloomberg, as of 14 July 2025.

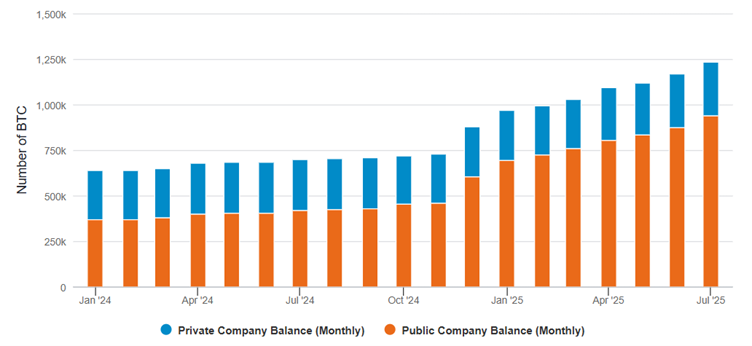

3. Rising institutional participation

Institutional investors, known for their longer-term investment horizons, are becoming increasingly prominent in Bitcoin allocation. Over the past year alone, corporate Bitcoin holdings have doubled to over 1.2 million BTC. Treasury allocations by corporations and growing ETF inflows enhance the resilience of the market and reduce its dependence on retail sentiment.

While lending and borrowing activities involving crypto assets, particularly Bitcoin, remain at an early stage for many institutions, these functions are poised to become more influential as the market infrastructure matures. The evolution of institutional involvement in these areas will likely shape future market behaviour, underscoring the importance of responsible risk management practices as adoption deepens.

Bitcoin balances in public and private companies

Source: Fidelity International, Bitcointreasures.net, as of 15 July 2025.

4. Reduced influence of “Altcoin Seasons’:

Previous Bitcoin cycles were typically accompanied by an "altcoin season", dominated by retail investors, who rotated speculative capital aggressively into a wide range of new and small cryptocurrencies, magnifying volatility and amplifying leverage-driven peaks and subsequent crashes. This cycle, dominated by institutions favouring BTC’s established value proposition, has seen significantly less speculative capital rotation and reduced retail leverage, further moderating price extremes. Bitcoin dominance of the overall cryptocurrency universe has continued to rise steadily and is at a multi-year high above 60%.

Bitcoin dominance

Source: Fidelity International, Coingecko, as of 14 July 2025.

5. Divergence from the past liquidity cycles

Bitcoin emerged during the aftermath of the 2008-2009 global financial crisis, with its 4-year halving schedule coinciding closely with periods of monetary expansion and contraction. The last 4-year cycle benefitted from the extraordinary monetary expansion of 2020-2021, before a steady rise in official interest rates after 2022 dampened the appeal of risk assets. By contrast, the current monetary cycle has not coincided in the same way with this halving, with interest rate cuts in the United States tentative so far and economic uncertainty growing. This asynchrony between Bitcoin’s 4-year cycle and the broader monetary environment may lead to a choppy or delayed cycle.

Bitcoin price versus Global M2 YoY change

Source: Fidelity International, Bloomberg, as of 30 June 2025; data for 30/06/2014 – 30/06/2025 based on monthly returns. Bitcoin (XBTUSD Currency), Global M2 (GLMOSUPP G Index).

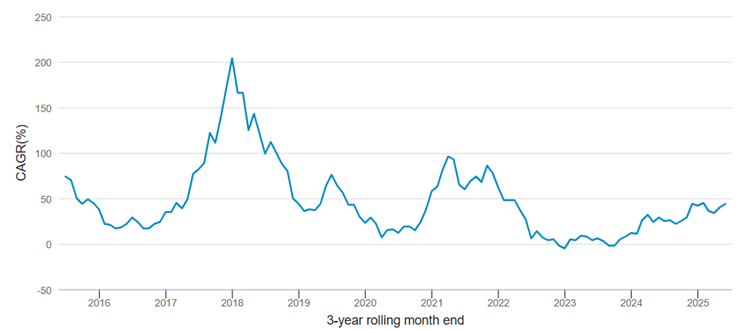

Think longer term

The historical data also now increasingly supports a longer-term approach. While volatility is still a well-documented element to the Bitcoin market, over the past decade, Bitcoin investors employing monthly dollar-cost averaging across rolling three-year periods have seen positive annualized returns approximately 97% of the time, independent of halving events. This underlines the potential of adopting a longer-term investment horizon rather than relying on timing entry and exit points to the market based on historical patterns, provided investors clearly understand Bitcoin’s unique characteristics and risk profile.

Rolling 3-year annualised return for a monthly dollar cost averaging Bitcoin investment over the past 10 years

Source: Fidelity International, as of June 2025. Compound annual growth rate (CAGR) is based on a rolling 3-year period using month-end Bitcoin (BTC) prices under a monthly dollar-cost averaging method. Past performance is not indicative of future results.

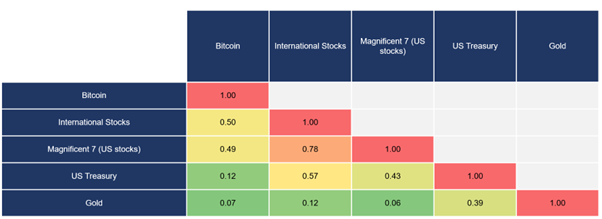

Meanwhile, Bitcoin's correlation with traditional assets remains low, near zero with gold, 0.1 with Treasuries, and 0.5 with global equities over the past five years, offering investors access to a differentiated risk-return profile.

Bitcoin correlation against traditional assets over the past 5 years

Source: Fidelity International, Bloomberg, as of 30 June 2025; data for 30/06/2020 – 30/06/2025 based on monthly returns. Bitcoin (XBTUSD BGN Curncy), US Stocks (SPX Index), International Stocks (WORLD Index), Magnificent 7 US tech stocks (UBXXMAG7 Index), US Treasury (G0Q0 Index), Gold (GOLDLNPM Index).

As a non-sovereign, liquid, and 24/7 traded asset with a capped supply, the market is one alternative for investors allocating in an environment shaped by persistent inflation, geopolitical uncertainty, and rising correlations among traditional asset classes.

Is the paradigm shifting?

Bitcoin has performed well in a decade marked mostly by strong appetite for risk across global markets. But in a year that has seen significant tremors on the US stock market in particular, it is worth remembering that it remains a volatile asset, and significant price swings and sharp corrections do occur. Investors need to remain mindful of these risks and ensure that any exposure to Bitcoin aligns with their risk tolerance and investment goals.

What all of these factors point to, however, is that the world’s biggest cryptocurrency may not now be the asset it was in the past. As the market continues to mature, its cycles may become elongated and less predictable, shaped increasingly by structural influences rather than historical patterns alone.

It’s dominance in the cryptocurrency space is likely to persist, driven by increasing institutional interest. The rise of Bitcoin ETFs and the prospect of government-level adoption are powerful structural forces distinguishing this cycle from previous ones. And the result, overall, could prove to be a lasting shift.