Our latest monthly survey shows analysts are not worried about company valuations - yet.

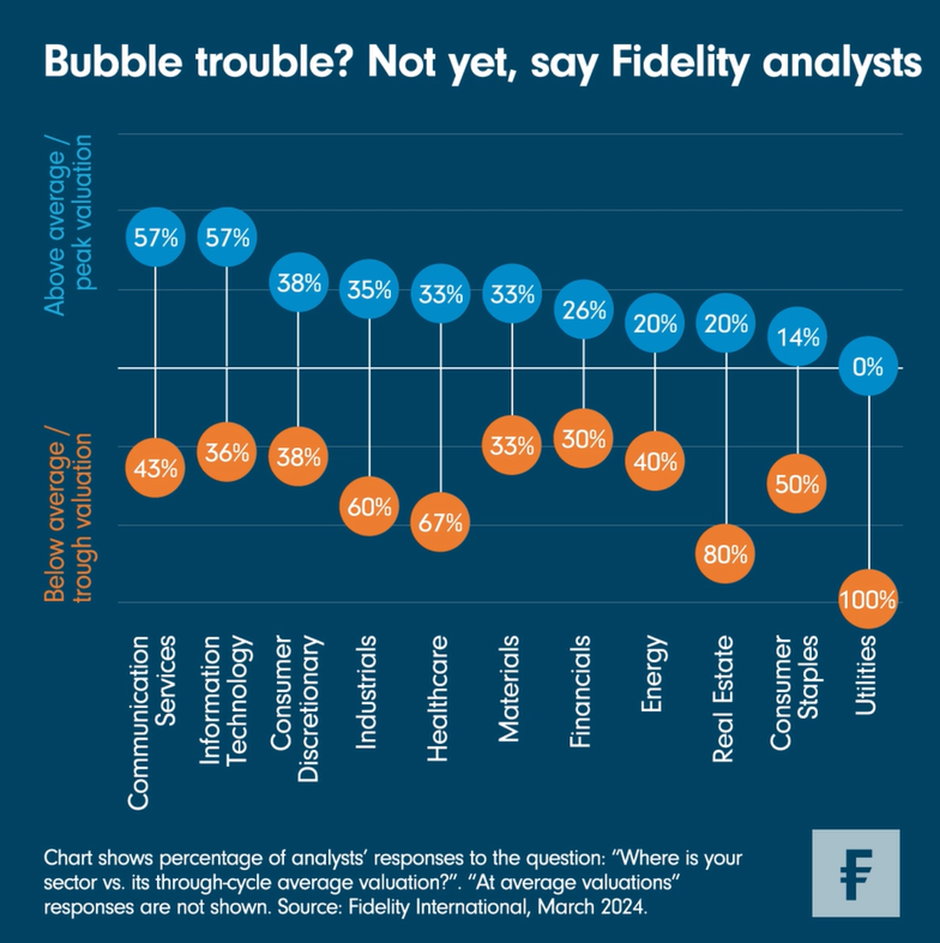

Information technology (IT) and communication services are the two sectors in which valuations currently appear most stretched, according to Fidelity International analysts and as shown in this week's Chart Room. However, this does not necessarily mean those sectors are in bubble territory.

“We’ve had multiple expansions, which precede earnings growth,” explains one analyst who covers European IT services companies. “Earnings growth now will come through and multiple contractions will partly offset that growth to return to more normal valuations.”

Another analyst, who covers European software firms, says that while company valuations may be at a peak, “businesses are getting better with recurring revenues. Higher margins mean a higher valuation compared to history.”

Utilities stands out as the only sector in which every analyst believes valuations are lower than average. That’s due to a combination of concerns about rate rises hitting share prices (in the US in particular), even as earnings have soared off the back of high power costs.

Strikingly, our analysts have identified value in parts of the market which may look overblown. Japanese stocks, for instance, have soared to decades highs off the back of positive inflation data. Yet none of Fidelity’s analysts who focus on the country believe their companies are at peak valuations; almost 40 per cent think they are still at or below average levels.

That’s not to say that there’s no froth bubbling around markets today. Twelve-month forward price-to-earnings ratios in the US, for instance, currently sit nearly 30 per cent higher than average. But the overall view of the US-focused analysts remains sanguine - only a quarter of them believe valuations are higher than normal (the lowest regional percentage after China).

That discrepancy can be explained by those handful of names - the so-called Magnificent Seven - that dominate the S&P 500. They constitute nearly 30 per cent of the index’s total market capitalisation. Were you to give all 500 companies an equal weighting, the S&P 500 would trade now around 18 times earnings - a figure much closer to the historical median.

Although this is by no means the consensus opinion, some of our analysts are looking at these companies with trepidation. One put it bluntly: “Yes, [my stocks are approaching] a bubble. Multiples are elevated.” Nvidia, for example, is starting to look exposed at the top of an AI-driven rally. Other members of the Magnificent Seven have struggled to replicate last year’s growth in the opening months of 2024, with Alphabet and Apple earnings coming in cooly, and Tesla continuing to lose momentum.

These results draw attention to risks we’re monitoring, but they also support our current risk-on stance. Our analysts are telling us that valuations have further to go. In areas that warrant caution, we are being selective - we prefer US mid-caps to the frothy magnificent seven stocks. For now, fear not: there’s still plenty of value in today’s market.