Updated 1 May 2023

A diverse set of investment opportunities

There are many ways investors can capture growth by investing internationally. The COVID pandemic has accelerated growth across existing themes and sectors such as digital transformation, online retail and cloud technology. There are also underlying structural growth themes globally, such as demographics and environmental, social and governance (ESG) obligations, underpinning the success of select companies and the countries and regions where they operate and supply markets.

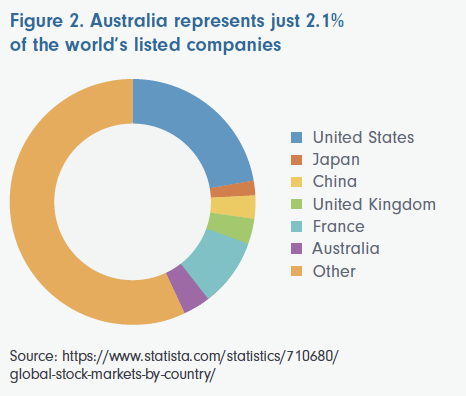

Global shares also offer diversification across sectors and market capitalisation that would not be possible to achieve by investing in Australian equities alone. With more than 41,0001 listed companies on stock exchanges worldwide, investing globally can feel too big, or too risky and complicated. But it doesn’t have to be; in fact, access to international markets may be easier than you think.

As with investing in Australia, there are two options to investing overseas: direct and indirect. Direct investing is where you purchase an asset under your own name, such as shares, but the shares are located in another country. While this gives you freedom and control to manage your investment, you will also need to be aware of the regulations and taxes that apply in the country in which you’re invested, as well as in Australia when you collect your returns. Different jurisdictions have different legal systems which may be difficult to navigate if you haven’t done your research first.

The other option is indirect investing – where you purchase assets through another party such as managed funds or ETFs. This is a simpler way of gaining foreign exposure, as you are investing in a fund that has a portfolio manager responsible for picking and choosing assets as well as the overall management of the fund. This style of global investment can sit alongside your Australian investments and may be worth considering if you’re in search of growth sectors or themes not available in Australia.

“ Asset allocation matters. In less volatile times, there’s less to be gained by picking your fights. Just taking part is all that matters. The last year has shown the importance of being in the right place at the right time.” Tom Stevenson, Investment Director Fidelity International

The rapid rise of digital

Few investment themes have been as prevalent in recent times as the digital transformation of how we work and shop, socialise and access entertainment. The COVID-19 pandemic has accelerated this transition, with higher levels of adoption for streaming and video call services during lockdown, and distributed networks and applications to support remote working.

There are already clear winners from this rapid rise of digital among the household names for retail and entertainment. The cloud businesses of Google, Amazon and Microsoft also reaped the benefits with double-digit rises in their revenue in the first half of 2020. With new consumer and business habits and behaviours expected to outlast the pandemic, the boom in these industries is set to continue.

Not only is there opportunity for global equity investors to be part of the continuing success of established giants like Amazon and Netflix, there are also likely to be gains among smaller players, as they position to compete through merger and acquisition activity. Suppliers that support these companies will also be expanding their capacity for delivery, payment and analytics services, offering another option for exposure to returns from digital demand.

The demographic factor

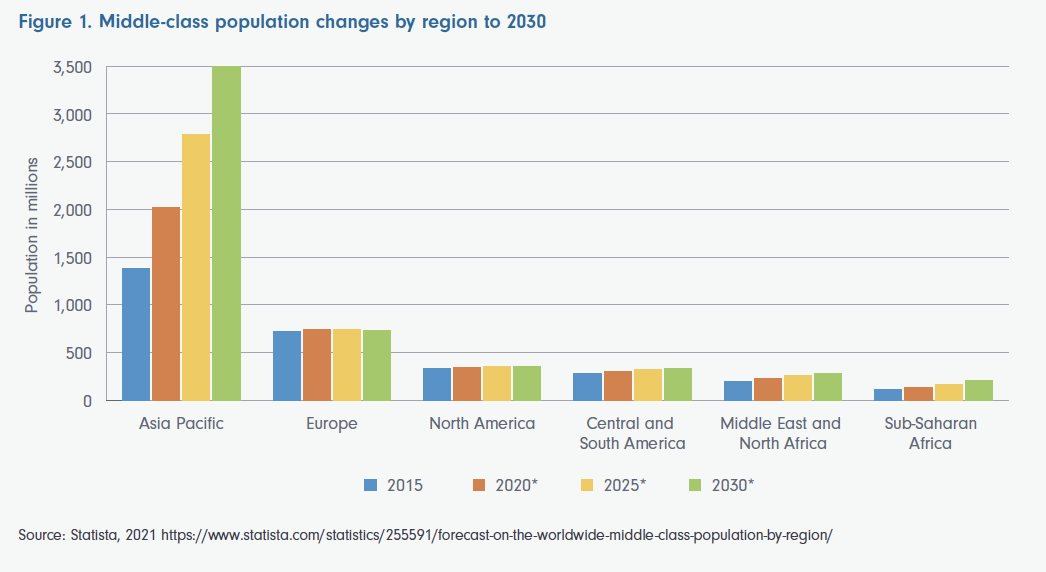

A macroeconomic growth factor unchecked by COVID-19 is the changing demographics of our world as a whole and regions within it. As Figure 1 below shows, the middle class in Asia has been growing rapidly over the past six years and is expected to grow well over three times the size of any other region by 2030. A skew towards ageing populations will drive expansion of the healthcare sector in some countries, while rising demand for retail and leisure from a growing middle class and greater urbanisation can be expected in others.

Investment opportunities arising from these transitions can be captured very effectively in a portfolio targeting companies with products and services that address these shifts in income, labour markets, consumption and more.

Demographics point to an age of prosperity for Asia

Policies supporting sustainability

Another significant growth trend with a long tail, but a less predictable trajectory, is the transition to more sustainable and environmentally responsible economies and business models. Pressure on companies to better manage emissions and waste is coming from both consumers and governments.

In the European Union (EU), for example, legislation was introduced in 2018 aiming to recycle 70% of municipal waste and 80% of packaging waste by 2030. Australia is lagging behind the rest of the world on biomethane use, but it does have a bio-gas sector, which is used to produce electricity and heat.

While a sustainable approach to production and service delivery is mandated in some countries and sectors, in others it is market forces driving this transition. Following the slump in energy consumption seen during 2020 due to lockdowns and a degree of hibernation across many industries, demand has rebounded.

In 2021, renewables are expected to take the lead as the fastest growing source of energy during this early recovery period. With the Biden administration in the White House putting climate change back on the agenda, a greater alignment with EU targets for a net-zero greenhouse gas economy by 2050 is likely to be seen in US energy policy.

The big three in Australian shares

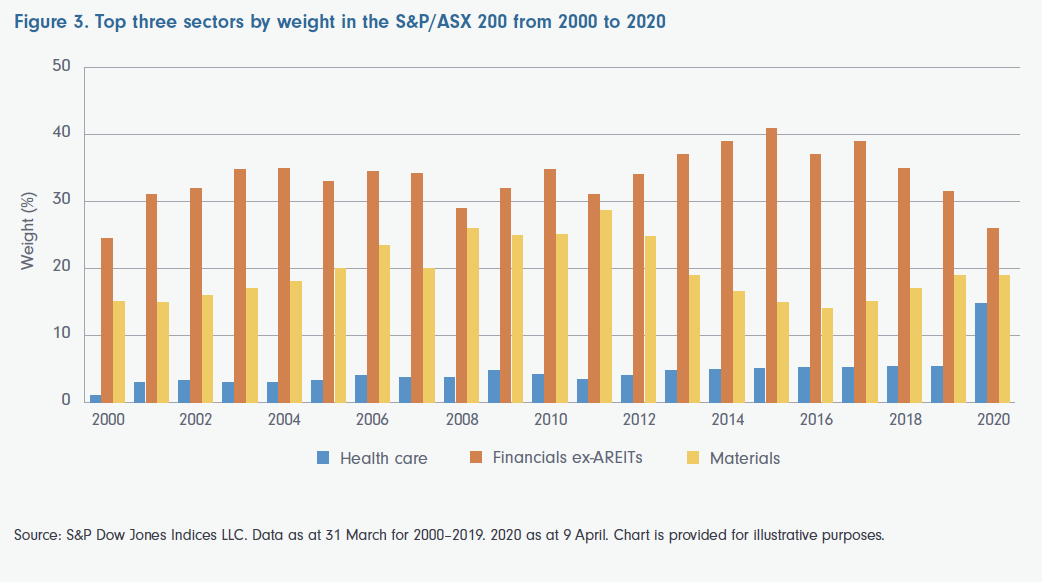

The ASX 200 was traditionally dominated by two industries and, for the last twenty years, financials and materials (refer to Figure 3, below) accounted for roughly half of the ASX by market capitalisation.

More recently, health care has become a stronger presence, and following a bumper year in 2020, the sector rose to 14.2% of the ASX and a total market cap of AU$210 billion.

While this relatively recent change in sector composition has helped to reduce concentration risk, if you only invest in Australian shares you will miss out on meaningful exposure to sectors such as telecommunications, media and technology (TMT) and consumer discretionary.

Staying domestic may also mean missing out on opportunities to be found among small to mid-cap global companies. By focusing on bottom-up research to find companies in their earlier stages of growth offers investors a way to gain exposure to the diverse small and mid-cap (SMID) category.

Materials, financials and healthcare dominate in Australian equities

Fidelity – the active advantage for risk and return

Fidelity offers investors a range of different ways to access global equities – all actively managed. These include:

Fidelity Global Equities Fund holds 80 to 120 companies, including household names and growth sector leaders from across the world. The portfolio is carefully weighted for diversification across countries, sectors and companies, further supporting our goal of delivering sustained returns and managing downside risk for investors. Recommended as a long-term core holding, we aim to outperform the benchmark over a five- to seven-year timeframe.

Fidelity Global Emerging Markets Fund gives investors access to companies in the world’s fastest-growing economies, underpinned by strong underlying structural growth. A concentrated portfolio of 30 to 50 companies, the Fund focuses on finding quality companies with strong balance sheets and robust corporate governance.

Fidelity Global Demographics Fund invests across three main demographic factors: ageing population, growth of the middle class, and population growth. The portfolio of typically 50 to 70 companies is positioned to benefit from slow-moving, long-in-duration and highly predictable demographic trends.

Fidelity Global Future Leaders Fund offers a diversified portfolio of 40 to 70 small- to mid-cap global companies. The Fund gives Australian investors access to a global universe of small- to mid-cap companies too large for many investors to contemplate. Using our global reach and research capabilities, we identify the best opportunities and build a portfolio designed to deliver consistent returns through market cycles.

Fidelity also offers Asian equities as a region, or countries within Asia such as India and China Funds.