April was a good month for Australian investors, with major asset classes like global equities (7.7% in AUD terms) and global fixed income (1.4% in AUD terms) producing positive returns over the month. Additionally, the local S&P ASX200 rose by 5.0%. The rally in risk assets like equities has surprised many, especially in the U.S, where the S&P 500 rose 18.0% while the Nasdaq rose by 20.3%. However, the rally in US risk assets appears disconnected with the economic reality of the recession that the US economy is now in, with over 30 million Americans applying for jobless claims in the last 6 weeks and large swathes of the economy still on lock-down.

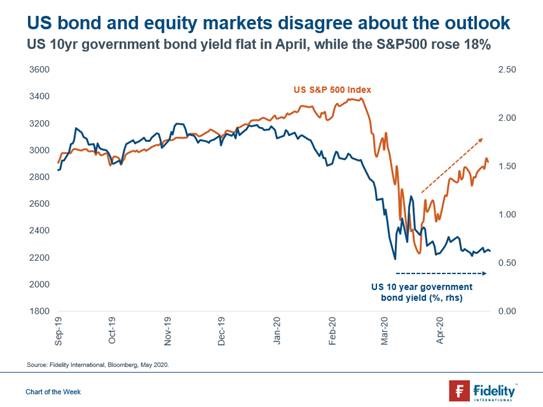

A large reason for the U.S equity market rally has been the monetary response of the US Federal Reserve. The mantra of April was “Don’t fight the Fed”, with US equity markets now pricing in a V-shaped economic recovery. Interestingly, the bond market is a little more sceptical, with bond yields and equity markets disconnecting in April.

If the bond market believed in a rapid US recovery, we would expect yields to rise as it began to factor in higher inflation and stronger economic growth. But that is not the case currently, with the US 10 year breakeven rate rising by only 0.16% in April to 1.07%. The 10 year breakeven rate is derived from inflation-protected securities, and measures what investors think inflation will be in 10 years’ time. If inflation erodes the value of an investment, then investors should want to be paid more now to account for that. The 10 year breakeven rate in Australia is currently only 0.70%, well below the Reserve Bank of Australia’s inflation target of 2-3%, suggesting a stagnating economy, a 0.25% cash rate for the foreseeable future, and more quantitative easing to come.

Looking ahead, I’d expect that the usual relationship between bond yields and equity market returns will reassert itself. But does this occur because equity markets fall or because bond yields rise? In my view, there may be short term pain for equity investors in 2020, but long-term gains as eventually investors rebalance portfolios to riskier assets due to stimulatory central bank action.