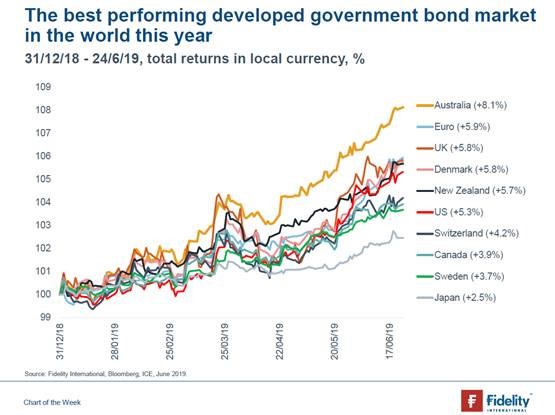

While Ash Barty has risen to the top of the tennis rankings in 2019, the Australian Government Bond market has also been beating all comers this year. The ICE BofAML Australia Government Index has outperformed a sample of the world’s largest developed government bond markets, including Euro, US, and Japanese government bond market indices. The rally in Australian government bonds reflects the reduction in the RBA cash rate in June, the expectation that the RBA will cut again in July or August, and a further expectation that the RBA cash rate will be cut again to 0.75% by the end of the year. In addition, Australia remains one of the few remaining AAA-rated government bond markets in the globe, a group of eleven countries that includes Canada, Denmark, Germany and Switzerland. Australia’s AAA-rating is attractive to large international investors seeking a risk-free asset that still has a positive yield, especially in a world where almost USD13 trillion of debt now has a negative yield (including a Swiss government bond maturing in 2049 which has a current yield to maturity of -0.01%).