Australian equities recaptured pre-crisis highs this week after an excellent year thus far for share market returns. This has led some to question whether they should retain their equity market exposure and stay invested with the market at an all-time high. Although it was over a decade ago, the financial crisis remains fresh in many investors’ minds. An investor that had bought at the 2007 peak suffered a 53% drawdown by the time the S&P/ASX 200 finally troughed in 2009. Many are obviously keen to avoid this experience.

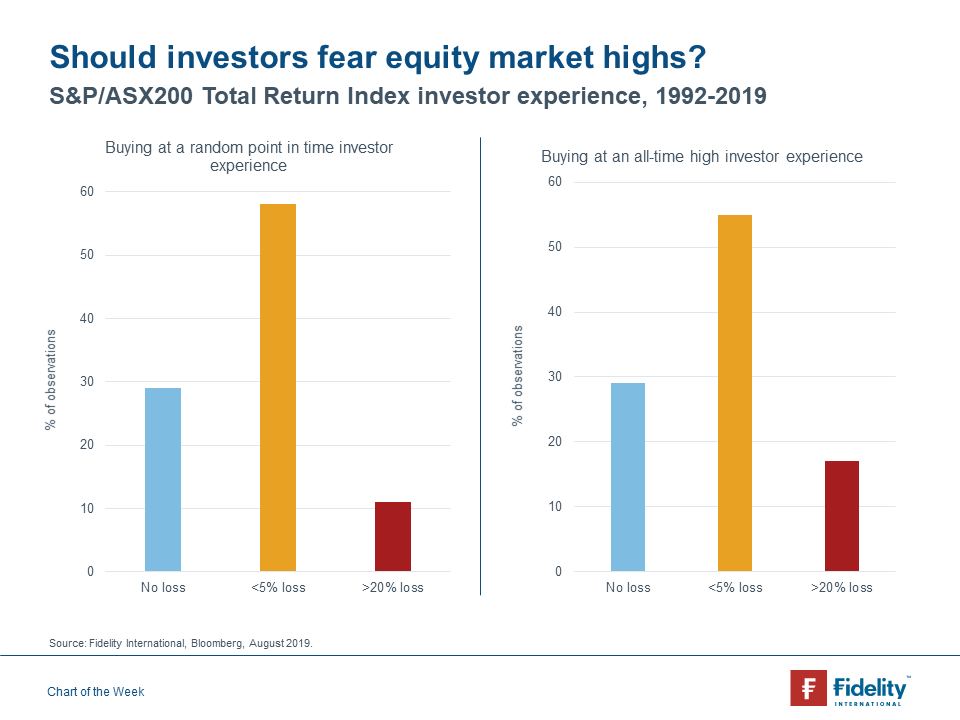

However, an analysis of S&P/ASX 200 monthly total return data since 1992 suggests that the chances of an investor experiencing a bear market are probably smaller than many think. Assuming that an investor bought at a random point in time:

- In 29% of cases, an investor did not see their initial investment (including dividends) turn negative at any point in the future;

- In 58% of cases, an investor did not see their initial investment (including dividends) suffer a drawdown of more than 5%;

- In just 11% of cases an investor experienced a “bear market” of a fall in value of their initial investment (including dividends) of more than 20%.

Out of 325 monthly observations since 1992, 108 were market highs, like today. What was the investor experience if an investor had bought at one of these all-time high points in the S&P/ASX 200 Total Return Index? The statistics are similar:

- In 29% of cases, an investor did not see their initial investment (including dividends) turn negative at any point in the future;

- In 55% of cases, an investor did not see their initial investment (including dividends) suffer a drawdown of more than 5%;

- In 17% of cases an investor experienced a “bear market” of a fall in value of their initial investment (including dividends) of more than 20%.

Investing at an equity market high suggests there is a greater chance that an investor may experience a bear market. But the inverse is also true: 83% of investors did not experience a bear market after investing at an all-time market high. This makes sense, as for every Asian Crisis, Tech Boom, or GFC, there are far more years where investors are rewarded with good total returns from the Australian equity market.