The expansion of China’s top hotel brands may look foolhardy given the economic backdrop, but the sector is entering a consolidation phase that none of the big players can afford to miss out on.

It may seem a bad time for a business in China to pursue a radical growth strategy. From weak consumption to sluggish corporate activity, the country is dealing with a barrage of poor economic signals.

But China’s hotel giants nevertheless are aggressively expanding their networks across the country, with a focus on adding new franchisees. At least two of the top-four players are planning for double-digit growth in the number of their hotels in 2024, with one aiming to expand by about a third.

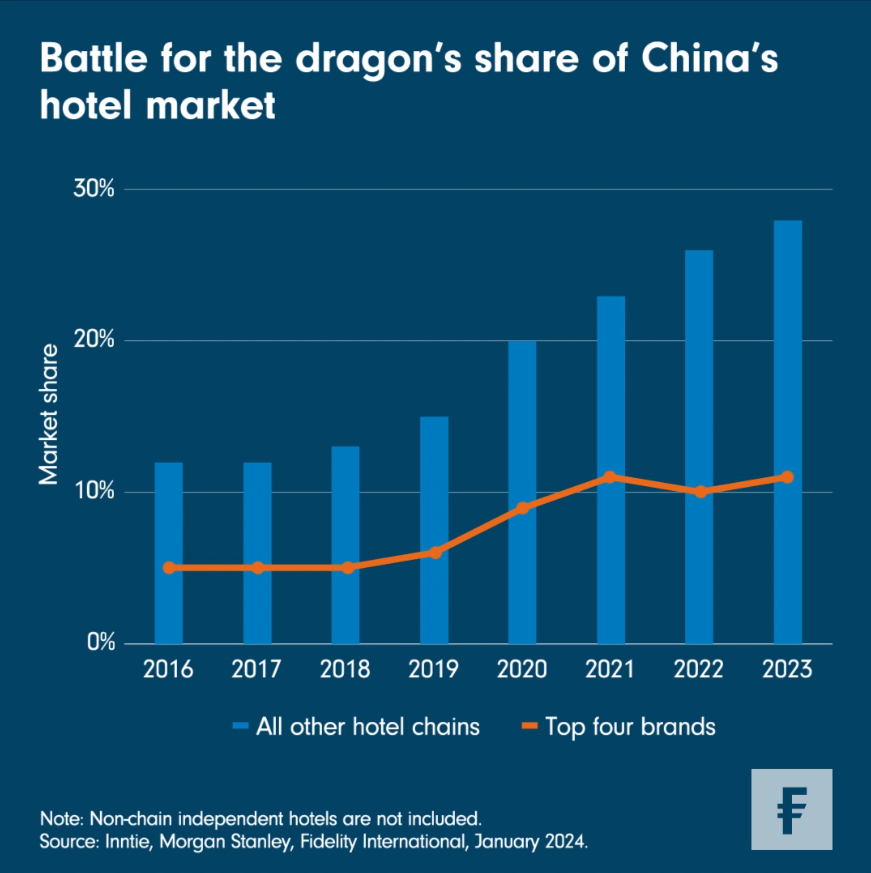

This week’s Chart Room looks at changes in the combined market share of China’s top-four operators by number of rooms over the years. They are entering a consolidation phase in which Fidelity expects faster growth among the biggest names from 2024 onwards.

Currently, the top-four players account for just over a tenth of China’s hotel rooms, more than double their share in 2018. Based on their pipelines of potential franchisees, we think these giants could further double their combined market share over the next five years.

A rise in brand awareness among Chinese consumers is accelerating the consolidation. As the chart shows, the combined share of all other brands has also jumped over the last few years, mainly at the expense of small, independent operators. Since 2020, thousands of these smaller hoteliers have gone out of business due to lockdowns, weaker demand, or tougher competition.

In recent field trips, we have observed a rise in demand for hotel assets among Chinese investors. They view franchised hotels as a relatively safe investment in a flagging economy, and are increasingly keen to join the networks of top brands. Some see franchised hotels as a reliable way of passing their wealth on to their children.

The long lifecycle of a hotel project, typically 12 to 15 years, allows investors to lock in their rental costs while enjoying room-rate inflation. This strategy has become all the more attractive thanks to China’s real estate downturn which has made it cheaper to rent property for hotel use.

Expanding in a weak economy may put pressure on the profit margins and credit quality of hotel operators, but the long-term payoff for any winners (watch for strong brands and healthy balance sheets) could be huge.