This Chart Room shows how technological advances could be set to hypercharge adoption rates of electric vehicles (EVs) in China, according to the results of a recent survey commissioned by Fidelity International.

When it comes to purchasing intent, around 60 per cent of current car owners in China and 84 per cent of non-owners responding to the survey said they would prefer an EV to an internal combustion engine (ICE) model for their next purchase. Only 25 per cent of owners and 10 per cent of non-owners opted for ICE vehicles, while smaller proportions selected “hybrid” as their top choice.

China is already the world’s biggest market for EVs bases on annual sales volumes, but the results of this study suggest that the penetration rate for EVs in the world’s most populous country could be set to accelerate significantly, gaining a much bigger share of mainstream auto sales going forward. The survey, which was conducted in May for Fidelity by a third-party firm, received responses from around 2,000 participants from 49 Chinese cities, including Beijing, Shanghai and Shenzhen.

Respondents either already owned a car or said they planned to buy one in the next 12 months.

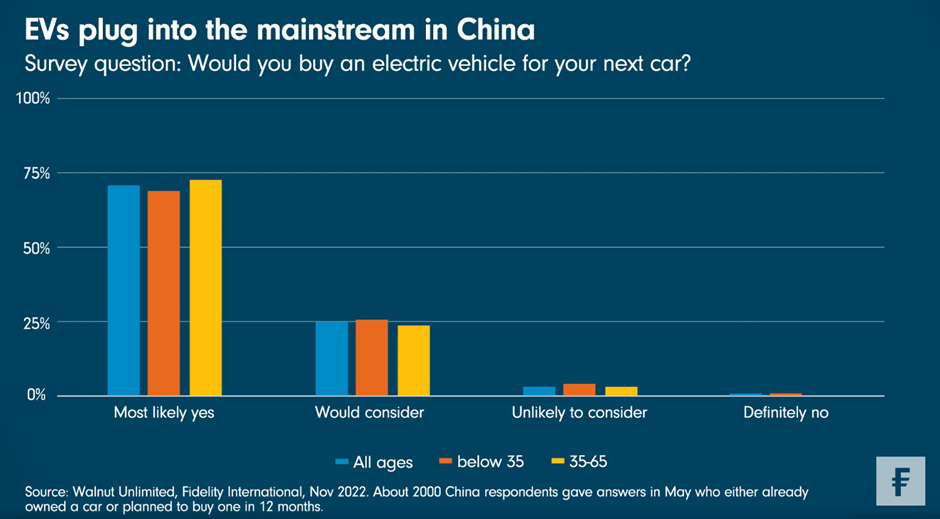

Perhaps surprisingly, young people in China do not appear to be any more interested in EVs than older groups, based on the survey results. Some 69 per cent of respondents below the age of 35 indicated they were “most likely to buy” an electric model, compared to 73 per cent of those aged 35 to 65. Overall, we have seen a relatively high acceptance of EVs across age groups in China.

Besides environmental benefits, respondents listed car performance and technology as their top reasons for buying EVs. An improved driving experience brought by technological progress in EV design and development also emerged as a key factor for the rising popularity of electric models. Other popular reasons included trendiness, high fuel prices and government policies favouring EVs.

Interestingly, performance and technology were also listed by those who are not ready to embrace EVs as top reasons for their aversion. Their answers revealed worries about technological limits affecting battery life, charging, driving range and mileage.

The survey responses also suggested a lack of brand loyalty in the Chinese car market. Brand itself ranked poorly as a purchase driver. Moreover, some respondents said they specifically rejected a brand If they had previously bought it, as they would prefer to explore new brands instead.