The yen is one of several currencies coming under fire from a strengthening US dollar. However, a commitment to yield curve control and ultralow interest rates puts Japan in a difficult position amid rising inflation. Were the Bank of Japan (BoJ) to abandon yield curve control (YCC), the knock-on effects could be severe.

Last week the yen passed ¥150 against the dollar for the first time since 1990. The strong dollar is part of the story. But Japan’s exchange rate is also undermined by the BoJ continued commitment to YCC and the fact that Japan is an energy importer (which has served to erode its trade balance as energy costs have soared). Over the past month, the Ministry of Finance has sought to stem the decline in the currency through launching a series of yen-buying interventions, their first since 1998.

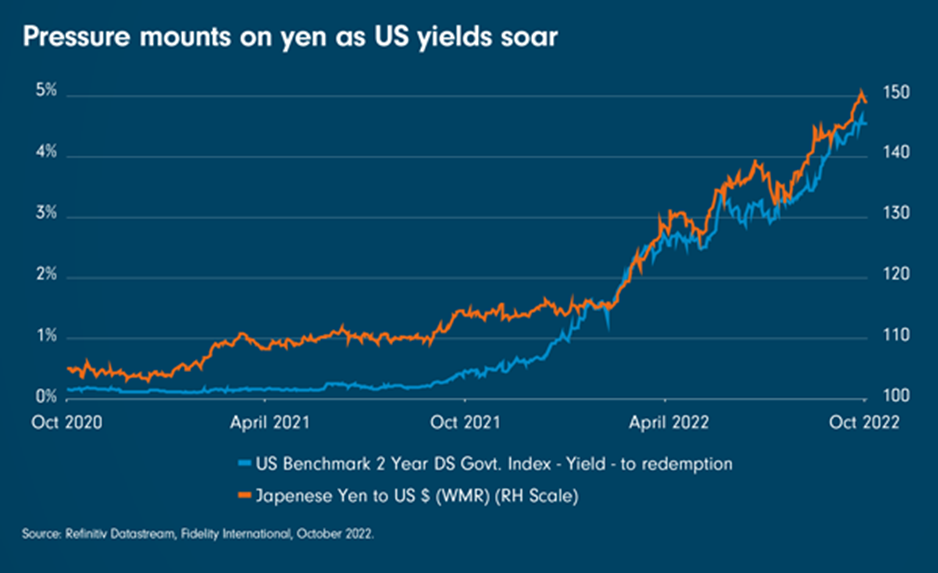

Japan faces the classic trilemma, which says you can’t have exchange rate stability, independent monetary policy, and free international capital flows all at the same time. Up to now the BoJ has prioritised monetary policy through YCC which acts to keep the 10-year Japanese government bond yield below 0.25 per cent. This policy was set when the backdrop was deflationary. But one consequence of higher inflation, which this week’s Chart Room highlights, is that rising US bond yields have widened the gap between US and Japanese interest rates, hence weakening the currency.

Higher import costs resulting from the weaker yen have put pressure on the BoJ to abandon YCC, which is increasingly an outlier compared to the hiking policies of other central banks in 2022. Were YCC to be abandoned, we would expect a sharp rally in the yen. There could also be knock-on effects in the form of higher US Treasury yields, which would not be constructive for risk assets.

The other variable here is the Federal Reserve (Fed). Were the Fed to pivot in its hiking path, that could relieve some of the pressure on global currencies, including the yen. We think it is likely the Fed will want to pause at some point to ascertain the impact of its prior tightening on the real economy. Furthermore, we believe it is well positioned to do so - labour market fragility and the possibility of inflation rolling over should allow them space to breath.

As it stands, the yen is one of several currencies coming under extreme pressure from diverging rate differentials - meaning the odds of both central banks changing tack are rising.