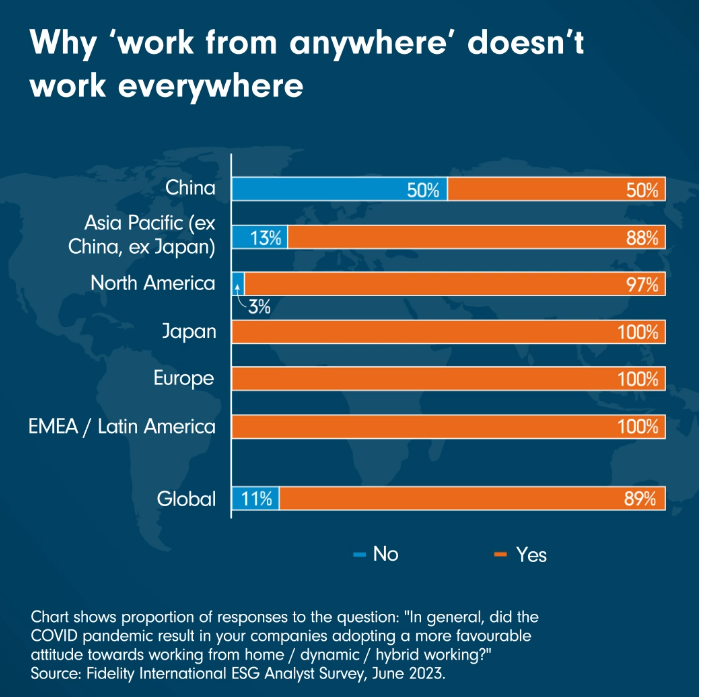

Our ESG Analyst Survey indicates that working from home (or WFH as it is now known) is viewed favourably by most companies around the world, even as the pandemic that brought it to prominence fades in the rearview mirror. But there is one very big exception to the WFH trend: China.

Love it or loathe it, WFH is here to stay. That is the message in our latest ESG analyst survey of companies looking at progress in environmental, social and governance (ESG) globally. Our analysts report that a vast majority (89 per cent) of the companies they cover are more favourable towards remote work -- including hybrid, dynamic or full WFH models -- after Covid. Managements say these flexible approaches help retain staff, save costs, and improve employee welfare. Almost every region in the survey is warming to remote work. Almost.

The standout exception is China, where companies are split right down the middle on the issue. China is the only region where over half of the companies (55 per cent) covered by our analysts do not facilitate remote work. In Japan, for example, all companies in the survey offer remote work either for some or all their employees, while in the rest of Asia-Pacific (excluding these two markets), only a quarter of companies do not have any remote work arrangements.

This may have more to do with the structure of the Chinese economy than corporate attitudes. “China is the manufacturing hub for the world,” said Sherry Qin, Hong Kong-based equity portfolio manager and analyst. “There is no such thing as ‘work from home’ for workers in manufacturing.” The country is home to about 400 million blue collar workers, compared with roughly 150 to 120 million white collar workers.

Adding to that push for being present in-person are many service sector companies, which China hopes to depend on for future growth. In healthcare, for instance, workers whose roles involve everything from research and development to hospital visits can only perform their duties on-site. “In most cases, online working doesn’t work for these companies,” said Yuanlin Lang, Hong Kong-based senior industry analyst covering the healthcare sector.

Even those who can work remotely may opt not to. Many white collar workers had no choice but to WFH until recently because of China’s prolonged Covid restrictions, said Eric Zhu, research associate in Shanghai who covers consumer discretionary companies.

This is also a function of corporate cultures where the emphasis on work ethic and ‘presenteeism’ (e.g. the ‘996’ culture at internet companies - where workers commonly follow a routine of 9 a.m. to 9 p.m., six days a week) can blur the boundary between work life and home life. “Basically, there was no ‘off-duty’ anymore. That’s the problem with WFH in China,” Zhu added.

The implications for investors are many, not least of which in the property sector. Our observations on the ground show that commercial real estate occupancy across Beijing, Shanghai and Hong Kong is back above 90 per cent -- higher than the top end of estimates for the US market and about 20 to 30 percentage points above current occupancy rates in Europe, according to Shanghai-based real estate analyst Fiona Shou. “The preference for offline working in China has clearly contributed to higher office occupancy rates, and this is beneficial for commercial real estate developers struggling in a weak economy,” she said.

Unlike many parts of the world where the prevalence of WFH is seen as a win for workers over bosses, the dynamic isn’t the same in China. Indeed, many Chinese companies have no need to push employees to return to the workplace; they never left.