Sentiment towards the materials space turned quite decisively in September with China announcing coordinated monetary and fiscal stimulus. The market then sold off when major stimulus measures were not announced at the follow up National Development and Reform Commission (NDRC) press conference on 8th October.

With time horizons limited in the market, there is a risk that investors miss the bigger picture from the sequence of recent policy events in China. We think the implications of this are important for the commodities space.

In our opinion, the out-of-cycle nature of the announcements, and the coordination of monetary and fiscal stimulus, resembles a “whatever it takes” kind of moment from the central government. However, we think this is unlikely to take the form of bazooka stimulus given the need to manage risks and reserve some firepower if the external environment becomes more adverse. The NDRC announcement was never likely to be the forum for significant stimulus announcements - we will likely have to be patient and look to the State Council and the Ministry of Finance for more detail.

What exactly stimulus means for commodity demand has been subject to some scepticism in the market - both in terms of whether it will be enough to overcome stubborn structural issues in the Chinese economy, particularly around property and demographics, and the commodity intensity of what is perceived as more consumer-driven stimulus than the property reflation of the past.

We agree with aspects of this scepticism - it’s not entirely clear from the aggressive rally in iron ore whether it was well-understood that the measures to underpin property explicitly target lower supply structurally. What we think is more likely is that the Chinese government will intensify existing measures to upgrade Chinese machinery stock, upgrade appliances and, most importantly, double down on the parts of the existing stimulus package that are working - the transition economy.

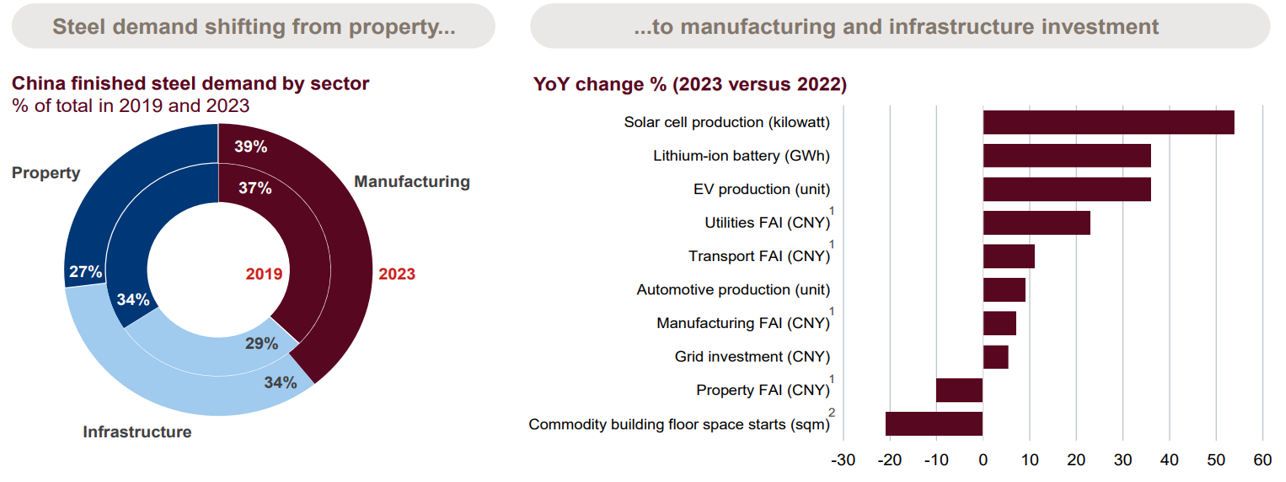

China’s policy announcements are essentially likely to intensify a trend that we have seen developing over the past 2-3 years, where Chinese commodity demand drivers have been changing and the winners and losers have been shifting as a result. This is illustrated neatly in metal and mining company Rio Tinto’s FY23 results presentation.

Figure 1: China’s steel demand drivers are reshaping

Source: Rio Tinto, 21 February 2024. Rio Tinto Market Analysis, CEIC, Wind, China NBS | 1FAI = Fixed Asset Investment | 2Commodity building refers to all building structures that can be transacted in the open market, including residential homes, office buildings, factories, and warehouses.

Steel has been the big loser in this second transition, but base metals have been material beneficiaries. Even with domestic property issues impacting demand in 2024, Chinese copper and aluminium demand are likely to grow 1-2% and 3-4% respectively this year driven by the requirements of the transition economy. Chinese aluminium demand from solar alone is now larger than total Japanese demand!

Appliance and machinery upgrades should also benefit commodity demand - while this may not be a game-changer it certainly contributes, particularly for commodities with tight existing micro conditions. And this is a crucial point – we expect China stimulus to be less commodity intensive than in the past, but for some commodities it is more relevant and arrives when these commodities were already in limited supply, setting up powerful but divergent tailwinds for commodities.

There have been some remarkable announcements in the last few months, which have received little attention but show the scale of the ambition of China’s policymakers. The proposal to co-fire 10% of coal-fired power plants with green ammonia and biomass implies a build out of green ammonia capacity significantly larger than the entire global ammonia production in our assumptions. The infrastructure challenges of this are also likely to be commodity intensive. This returns us to the fact that the markets impacted in the transition are very different to previous cycles and wider than commonly thought.

Steel: mixed picture but there are better ways to be exposed to Chinese stimulus

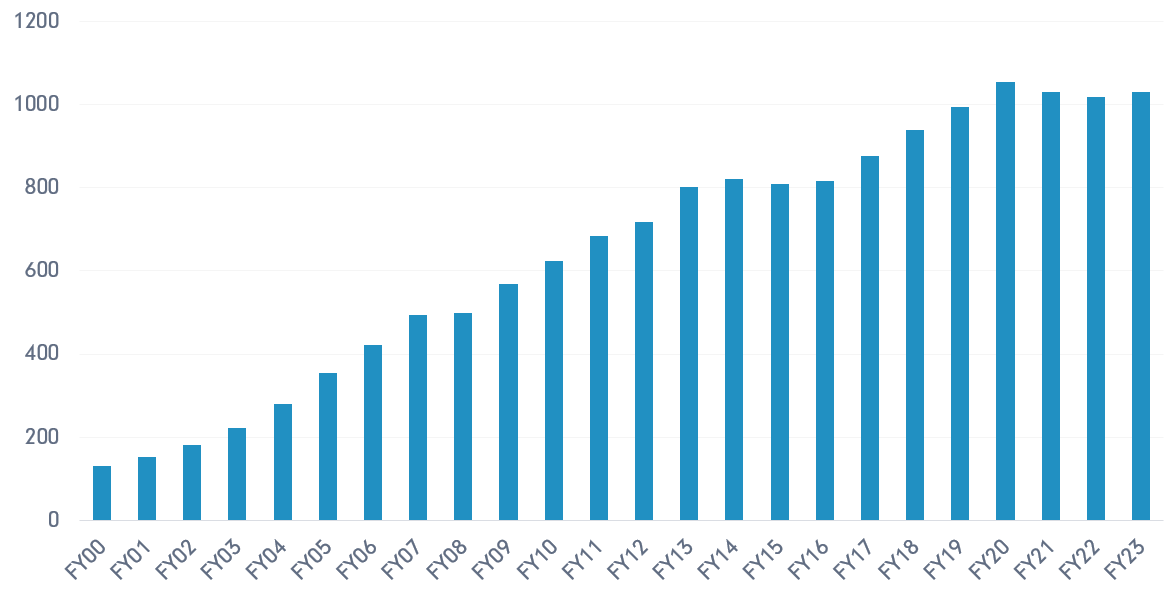

These demand-side measures are also likely to benefit steel demand. It’s not clear at this stage what measures will be implemented around property, but stabilising the market should at the very least place a floor under steel demand from the construction sector and possibly be a small tailwind over the medium term. In addition, the policies around machinery/appliances and the transition economy will benefit steel demand. However, we think steel is the wrong way to play the Chinese stimulus because significant excess capacity has been built up in China’s steel industry. Despite the drop in property demand, Chinese crude steel production has been resilient.

Chart 1: Chinese crude steel production

Source: BMO Global Commodities Research, 20 August 2024.

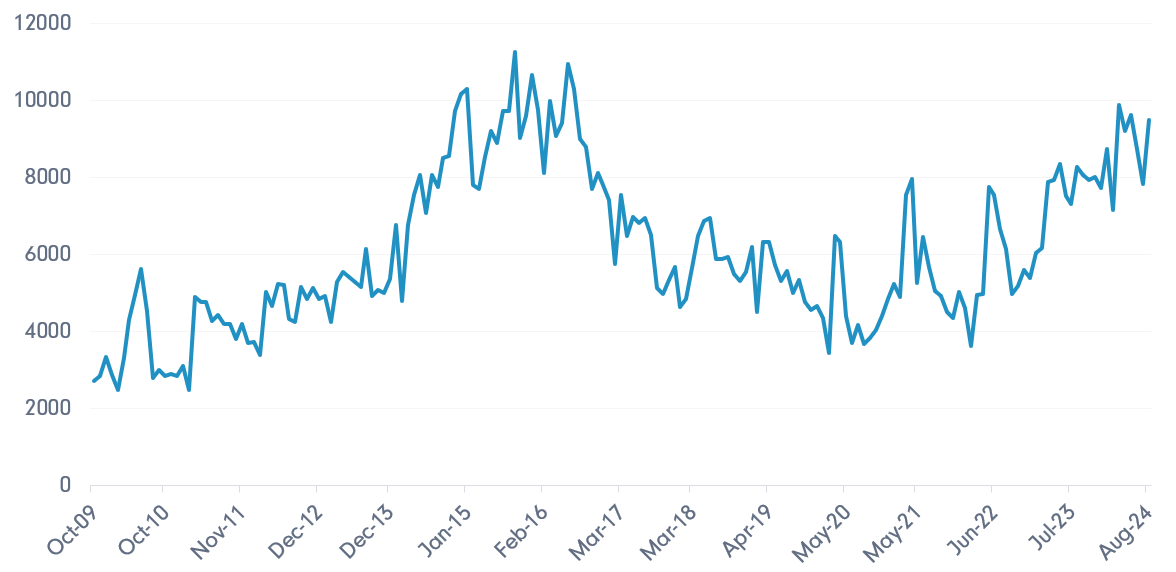

The reason for this resilience is that excess steel tonnes are being exported and causing contagion in other markets. As Chart 2 shows, exports have risen significantly over the past 18-24 months. And this has led to the situation today where the chair of the world’s largest steelmaker, Baowu, recently talked of a “harsh winter” for the Chinese steel industry that will be “longer, colder and more difficult to endure than expected”.

Chart 2: China steel export (mt per month)

Source: Fidelity International, 31 August 2024.

We think that steel demand will improve, reducing the volume of tonnes entering the export market, but not needing China to grow output. We believe that it’s likely that the Chinese steel industry will face structural over-capacity until, or unless, they embrace a second round of supply side reform. This would be positive for steel and allow steelmakers to generate profits; but clearly supply-side reform and a structurally smaller Chinese steelmaking industry is mixed news for its suppliers, the iron ore and steelmaking chain.

China consumes about 75% of seaborne iron ore - to the extent that exports fall, this may create more demand in other geographies and should help global steel pricing to a degree. Moving demand from China to countries with a different steelmaking mix would potentially restrict the benefits for aggregate iron ore demand. And that’s not including the supply side effects where there is plenty of elastic iron ore supply between US$90 and US$100 on the cost curve, which limits upside for steel investors. The reactive muscle memory of investors may reach to “buy steel, buy iron ore”, but we think the real beneficiaries of Chinese stimulus are base metals and other transition materials.

Commodity index exposure unlikely to yield the best investment outcomes

Unfortunately, many of the most obvious ways to play a stimulus-led recovery in Chinese commodity demand do not reflect these structural changes. In fact, many are skewed to the “old world” winners and not to the areas that are likely to be the primary beneficiaries in future. For example, the top 10 constituents of the MSCI ACWI Metals & Mining Index comprise over 50% of the Index, however, only three of these (12% of the Index) are aligned with the transition that we believe will drive commodity demand over the long term.

Figure 2: MSCI ACWI Metals & Mining Index Top 10 constituents

Source: Fidelity International, 08 October 2024. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only.

Investing in the transition economy is a long-term opportunity but requires deep familiarity with the nuances of the commodity markets and the specific profiles of the companies that operate in them. In practice, this means that simply making bets on which commodities will win big eventually is almost certainly likely to frustrate investors and not deliver expected outcomes. Both sides of the market price equation require thorough research; demand is important to gauge accurately and dynamically, but the ability of new supply to meet that demand is often neglected and just as integral.

To benefit from the long-term macro trends underway in commodity markets, it is essential to grasp the micro details and understand each producer’s business as it is today, rather than an outdated version in this evolving market. Investors should keep a close eye on the near term, clearly understanding commodity market and corporate fundamentals to avoid being overly influenced by a persuasive growth story that could lead to costly investment decisions. Demand is important but the ability of new supply to meet that demand is often neglected and is just as important - if not more so.