The outbreak of the coronavirus has changed the lives and consumer behaviours of the people in China - from working from home for an extended period of self-quarantine after Chinese New Year, to entertainment, shopping, and healthcare consultation.

The new trend, dubbed ‘cloud working’ or ‘cloud shopping’, is supported by the country’s cloud technology, as local and international technology companies roll out new cloud products and services to Chinese consumers.

While the coronavirus has dominated the headlines and will have a short-term impact on investor sentiment, here we review the impact of this global health event on China’s technology sector.

What challenges does the coronavirus outbreak present for China’s technology sector?

The coronavirus can impact the technology sector in two ways - one is production shortfalls and the other one is a reduction in demand.

The production impact has been limited thus far. The vast majority are expecting to resume production on 10 February after the extended Chinese New Year break. Most of the production is on the coastal regions and labour supply is not an issue at present.

The impact is also lessened by the fact that Q1 is the low season for most technology products. However, if the coronavirus drags on for another 2-3 months, production issues could start to arise, mainly from the logistics impact on supply chains, and the availability of labour, given a larger proportion of the labour supply is migrant workers.

There may also be some impact on planned capacity expansions for technology companies relying on foreign equipment, like the memory sector. There is likely to be a delay in the equipment installation, given that US vendors are unlikely to be sending their engineers to China in the foreseeable future.

In comparison with SARS, how do you see the sector performing?

Technology demand is growing structurally in China, driven by the increase in data creation, consumption, storage and interpretation. The coronavirus event will not change this, with this health event more likely being a delay in, rather than a destruction of, demand. In the short-term, smartphone demand will likely be affected most, followed by personal computers, with servers potentially seeing a positive impact.

Smartphones are still largely an offline product and while there has been some migration to online sources since the coronavirus began, this has not been enough to offset the offline decline. However, given that replacement cycle has been lengthening for the last few years, there is a lot of pent up demand - coupled with the commencement of 5G, this is demand that has merely been delayed. The question is whether this can be made up in the second half of 2020 or roll into 2021.

Server demand can increase as a result of the coronavirus. Consumer behaviour has changed since the virus took hold, with many people going online for entertainment, shopping and communication. This is evident in the ‘Game for Peace’ servers crashing last week due to a lack of capacity. Essentially what has occurred is that Chinese data use has been transferred from mobile networks to the cloud. Some of these changes in behaviour will prove permanent and the cloud providers now need greater computing power to cater for these surges in use.

What are the prospects of investing in IT in China?

We believe that the long-term prospects for the Chinese technology sector are very positive. China is a huge market with the largest population of smartphone users in the world, most of which are digital natives accustomed to living their life online. While semiconductor imports have overtaken oil as the largest import item for China, there is massive potential for China to localise production for many of these products.

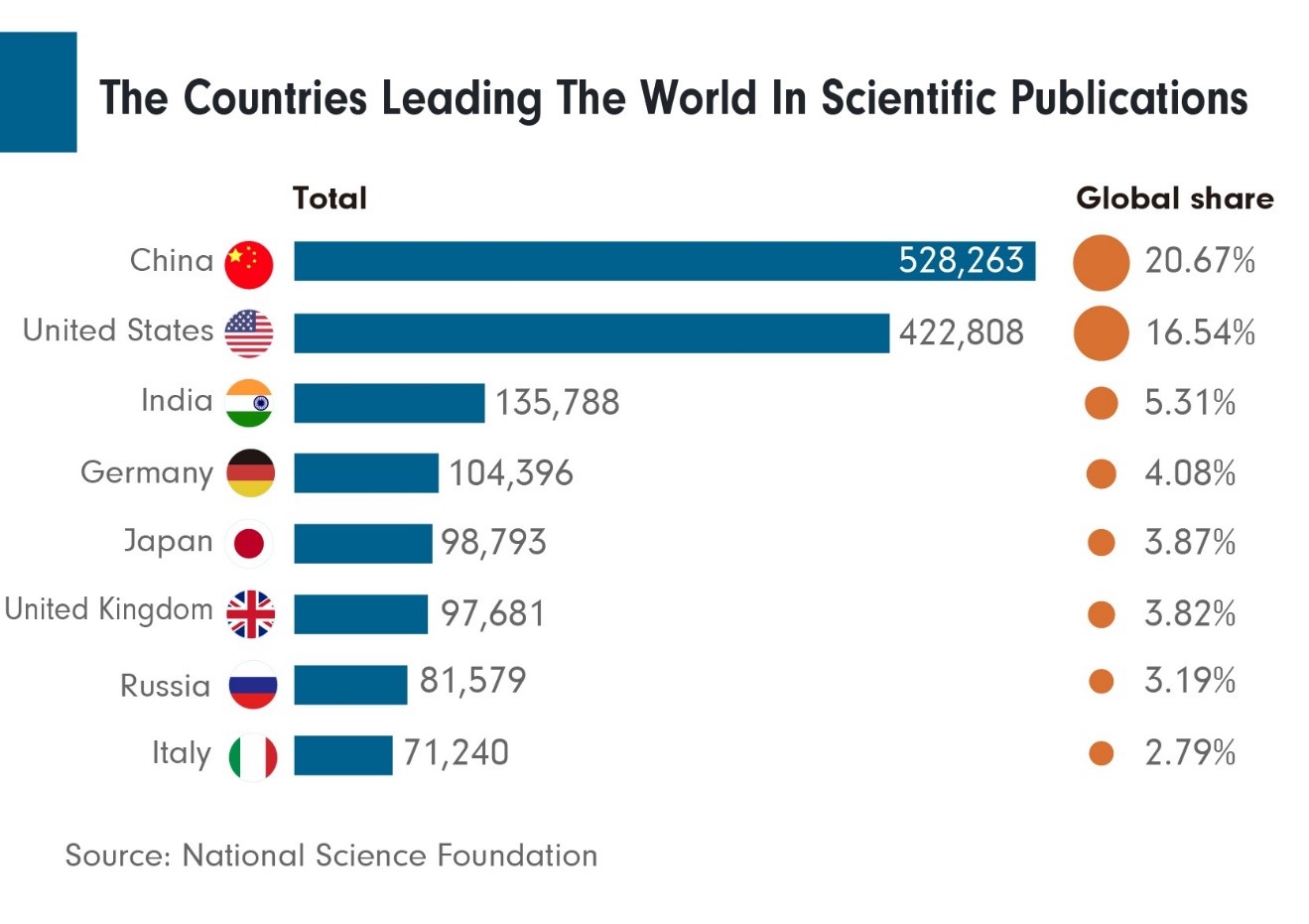

In addition to supportive government policy and regulation, China now has the tools to develop these products. China has 8.3 times more STEM graduates than the US1, were granted more patents than any other country last year (1.54 million, half of the world’s total patent grants)2 , and have overtaken the US to become the largest producer of global research papers in 20183.

While China will continue to lead the way in internet technology, and increasingly export its services to other countries, the areas most in focus for investors are the semiconductor and artificial intelligence fields, where China is fast becoming a global force.